Dividend Growth: Capital Preservation Remains Key

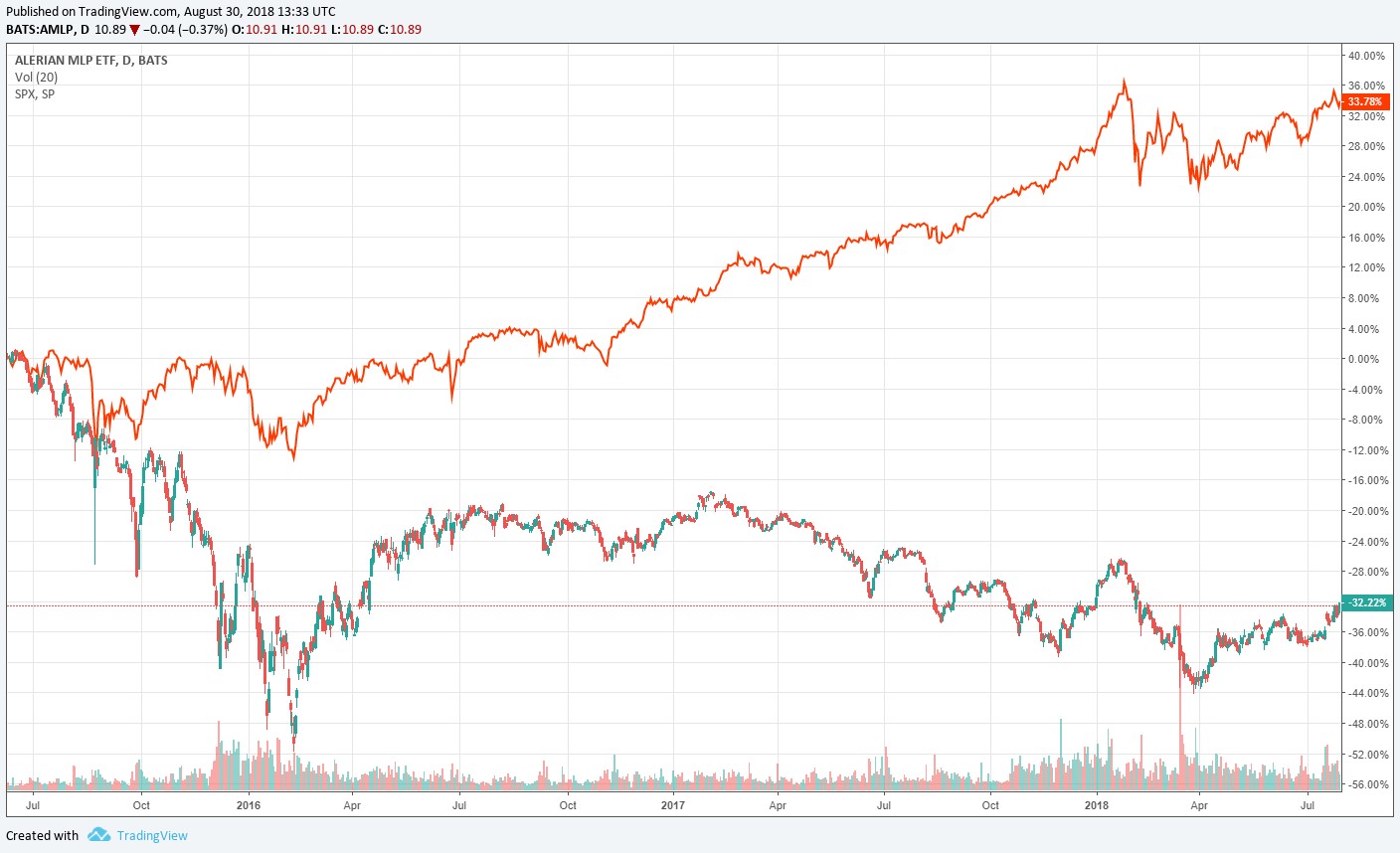

Image Shown: Since mid-June 2015, the performance of an ETF tracking the midstream MLP industry (AMLP) has collapsed while the performance of an ETF tracking the S&P 500 (SPY) industry has surged.

By The Valuentum Team

We think one of the things we do better than most is in our work supporting capital preservation.

We have a knack for parsing out risk and explaining that risk clearly in advance to our members. A lot of investors tend to be buy-and-hold as they reinvest dividends and capture compounding over time, and this is wonderful. But it is okay to change your mind, too. It is okay to factor in new information and to be somewhat active in your equity portfolio construction, even if you don’t want to be overactive given the difficulties in timing the market as well as the costs of commissions, though brokerage fees have come down quite a bit in recent decades.

Our team undoubtedly made one of the best calls ever when we warned our members of the impending collapse of the shares of Kinder Morgan (KMI) and the master limited partnership space (AMLP), when we were prominently featured in Barron’s June 11, 2015, “The Bear Case Against Kinder Morgan.” Since the publishing of that piece—and the warning to our members, “5 Reasons Why We Think Kinder Morgan’s Shares Will Collapse (June 11, 2015),” an ETF tracking the MLP space *has fallen* in price by more than 30%, while the S&P 500 *has advanced* more than 30%.

Why is this a significant comparison? For one, it takes a 100% gain to offset a 50% loss, meaning that it is far more important to preserve your capital than to take on outsize risk for gains. Said differently, it would take roughly a 50%-60% leap just for the MLP index to get back to where it was at the time of our call, and that gain would still put the index 30+ percentage points behind that of the broader market’s performance since then. This isn’t a total return comparison, as both the compounding of dividends in the S&P 500 and the compounding of distributions in the MLP index have been excluded from the analysis for simplicity, but total return adjustments don’t change the takeaway: preserve your capital. Warren Buffett’s first rule is so important: Never Lose Money.

You wouldn’t believe what we are encountering out there in the blogosphere. There are still widely-read authors that are telling us that we were and are still wrong on MLPs, and that they made a “fortune” by not paying attention to our work. Certainly given the volatility, some traders moving in and out of MLPs may have done well since mid-2015, but it’s rather strange to suggest we were wrong. Others are saying that our call was lucky because energy resource prices collapsed. But they are forgetting that midstream MLPs were supposed to be immune to energy resource prices (remember!). We were sounding the alarm on the risks of midstream MLPs being tied fundamentally to energy resource pricing, while others were saying energy resource pricing didn’t matter. Since our call on MLPs in June 2015, roughly 60 MLPs have cut their distributions while many continue to roll up their convoluted organization structures.

We work hard every day with our members in mind. We’re not money managers, and we have editorial rules preventing Brian and Kris from owning stocks they write about to preserve independence and an unbiased view. This means that our reputation and track record of research and analysis is everything! Part of the Valuentum dividend methodology has been a laser focus on saving investors from dividend growth blowups, one of the most important components of long-term dividend investing. Since the development of the Dividend Cushion ratio, the measure has forewarned of the dividend cuts of approximately 50 companies (meaning Valuentum members were well aware of the significant risk to these stocks’ dividends before they slashed them). Among some of the high-profile dividend cuts were StoneMor (STON), Mattel (MAT), Exelon (EXC), BHP Billiton (BHP), ConocoPhillips (COP), General Electric (GE), Seadrill (SDRL), J.C. Penney (JCP), among many others. Read more here >>

Despite all of this, many unfairly continue to misrepresent our call on MLPs, and they are confusing just about everybody. We’re counting on you to know better, to know just how solid our research and analysis is -- and to understand just how important it is to preserve your capital. Others are chasing 10%+ yielders, and that may be foolish if you don’t know the tremendous risks involved in doing so. The simulated performance in the Dividend Growth Newsletter has advanced at a double-digit annualized pace since the beginning of 2012, well above the high-single-digit target. We’ve been incredibly prudent, and most importantly, there has never been a dividend cut in the simulated Dividend Growth Newsletter portfolio. We’ve included Kinder Morgan and General Electric as ideas in the simulated newsletter portfolios in the past, but we notified members far in advance of their dividend cuts and share-price collapses.

Some may not care, but we cannot let others take our tremendous call on MLPs and twist the truth, harming our reputation, which does have an impact on our business. It’s not fair, and we’re going to continue to stand up for our fantastic track record. We’d love to put our head down and continue to generate the fantastic work that we continue to do (and we will continue to do so), but if others are misrepresenting us, it is incredibly problematic to our brand, and we have to come out to defend ourselves. Others may have an agenda, but we’re going to continue to present things fairly, as we see them. Midstream MLPs were overpriced in mid-2015, their distributions were at risk, and the MLP business model was on its way out, and it continues to be. It’s time for the naysayers to stop twisting the facts.

What do we think about MLPs now? As in every investment, price matters. In mid-2015, we thought most midstream MLPs were overpriced, as the market, from our perspective, in pricing the industry as a function of distributable cash flow and therefore distributions, was completely ignoring that growth capital spending is still shareholder capital. Today, midstream MLP valuations are much more reasonable, as that bubble has already popped, and shares of the broader midstream MLP space have hovered around the lows for years. We identified a structural mispricing in the markets in mid-2015, as units would have already reverted to prior levels given the recent surge in crude oil prices. They haven’t.

What is happening, however, is ongoing implicit distribution cuts and simplification transactions, and while such simplification transactions may bring new capital to the industry, meaning a bounce in the midstream MLP index could be expected, this doesn’t change that we’ve been right in identifying tremendous downside risk for members prior to the collapse in mid-2015. We have a ton of fans on our website that know the correct story, but others that are out there in the blogosphere are doing us a huge disservice, and I believe it is hurting our business. We’re just not going to take it. We’ve worked way too hard to let this happen.

Related: MLPA, MLPX, USO, OIL, ETE, ETP

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

6 Comments Posted Leave a comment