Amgen’s Pipeline Continues to Disappoint

Image Source: Amgen

The ability to generate commercially-viable products via the clinical pipeline is crucial to grow profits and offset revenue declines from the loss of patent protection. We remain unimpressed with the progress shown thus far by biotech stalwart Amgen. Let’s review the clinical pipeline along with a consideration of the recently-released earnings report.

By Alexander J. Poulos

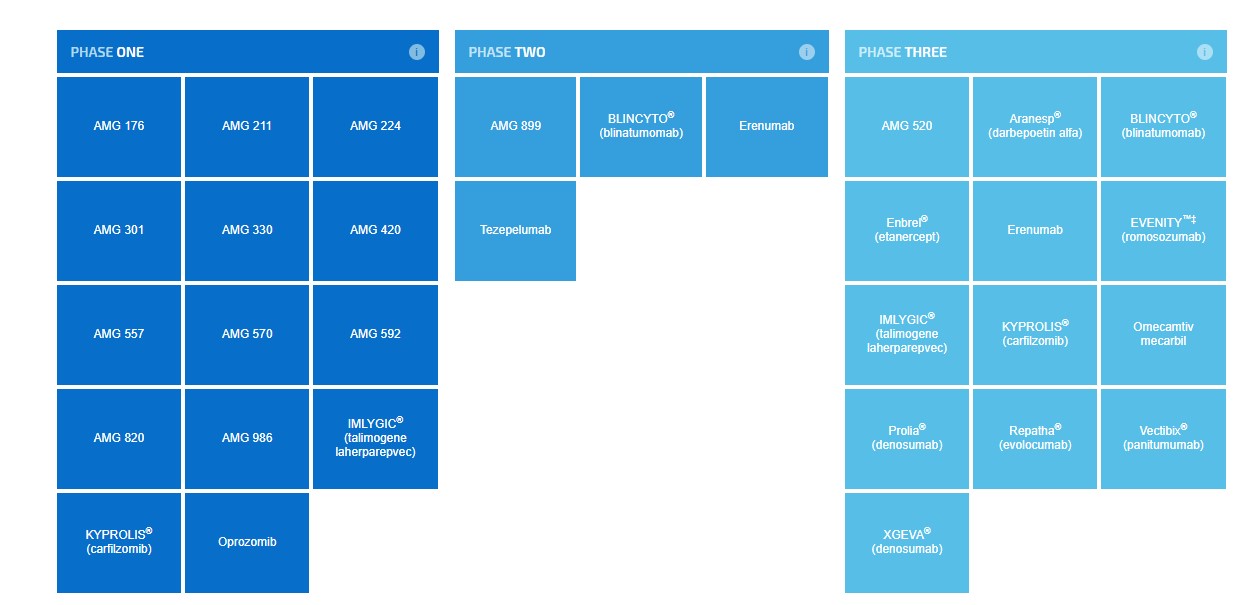

Clinical Pipeline

We believe the three most promising molecules in Amgen’s (AMGN) pipeline in order of importance are Repatha, Evenity, and Erenumab. Amgen’s ability to develop and market these products will go a long way to shore up the top-line revenue as older products begin to face biosimilar challenges that continue to sap revenue and profits. Let’s examine each in further detail to determine the path forward for each.

Repatha

Repatha is the first commercially-available product in the uber-hyped PCSK9 Inhibitors, the group widely expected to bring forth a new way to treat elevated cholesterol. The marketplace was initially projected to be quite large, but the challenge remains the therapy’s roughly $1,000 per month price tag. Payers remain wary of broader access--thus they have instituted a prior authorization process to limit access to those patients with the greatest need for the med.

Amgen’s best opportunity to expand market share is the recently-completed Fourier outcomes trial. We detailed the results in a recent post titled “Analyzing Amgen's Sudden Fall.” The following excerpt from the article neatly sums up the disappointment with the therapy.

Repatha registered a 15% decrease in MACE, its primary endpoint, with a 20% drop in MACE to meet its secondary endpoints. The key portion of the secondary outcome is the inclusion of a statin therapy in addition to Repatha. The unfortunate outcome is the use of Repatha did not have a positive impact in lowering cardiac death versus statin alone, in our view a negative for the future prospects of the entire class.

The lowering of LDL-C, as shown by the Fourier trial does have a positive impact, but the goal of reducing cardiac death remains elusive. The ability to drop LDL-C is a significant step in lowering the overall risk but remains just part of the process. Additional work will need to be conducted with other mechanisms to produce the desired outcome.

The disappointment from the trial continues to reverberate in the quarterly sales figures from Repatha. Amgen posted total worldwide revenue for Repatha of $83 million, hardly an inspiring sales performance. We remain highly skeptical that the PCSK9 class will ever achieve the blockbuster status most are expecting. The failure of the PCSK9 class to meaningfully grow revenues may be especially painful for Amgen as Repatha was projected to become the star of Amgen’s burgeoning cardiovascular franchise and overall product lineup.

Evenity

Amgen is attempting to broaden its osteoporosis product lineup with a new product dubbed Evenity (Romosozumab), a monoclonal antibody for the treatment of postmenopausal women with osteoporosis. Evenity met its primary and secondary endpoints in the recently-completed phase 3 ARCH study which upon initial glance seemed like a clear victory for Amgen. Unfortunately, the commercial viability of the product suffered a sharp setback as a cardiovascular safety signal was detected, dampening the overall use of the product.

The FDA cited the cardiac risk in the complete response letter issued to Amgen which will require the inclusion of additional safety considerations in the New Drug Application (NDA). The amended NDA will delay the arrival of Evenity, and we will wait for the FDA’s final decision before offering our opinion on the overall commercial viability of the product.

Erenumab

The third product worth highlighting is Erenumab, a novel approach for the treatment of migraine headaches. Erenumab is an anti-CGRP monoclonal antibody that selectively binds to the CGRP receptor. In studies, the product shows the ability to reduce or prevent the pain of a migraine headache. The product is developed in partnership with Novartis (NVS) with Novartis retaining the exclusive rights to market the product in Japan, Canada and the rest of the World. Amgen and Novartis will co-promote the product in the US, which in our view will limit the overall impact on Amgen’s balance sheet.

We feel the price tag of Erenumab will become a challenge with payers initially balking at the cost. We envision a similar scenario as the Repatha product ramp, a slow grind at first. Further complicating matters is the presence of a similar product from Eli Lilly (LLY) dubbed Galcanezumab. At the moment, we expect payers to limit formulary coverage to one product from the product class, but we view the anti-CGRP class as an important medical advance. It may not be significant enough of an innovation, however, to meaningfully move the revenue needle of biotech behemoth Amgen.

Quarterly Results Underscore the Need for Enhanced Pipeline Productivity

The decision to highlight the near-term pipeline was deliberately done to highlight the continued shortcomings of Amgen and hence our tepid stance. We realize Amgen is still viewed as a biotech bellwether, but we feel the company is currently miscategorized. Amgen should be lumped together with other traditional pharma companies such as Merck (MRK) and Pfizer (PFE)—(i.e. slow growth large cap behemoths with tepid top-line growth). The main appeal of such entities is the dividend, which continues to grow at a rate well above the rate of inflation. Headline numbers posted by Amgen in its second-quarter results upon a cursory glance appear more appealing than they are, in our view.

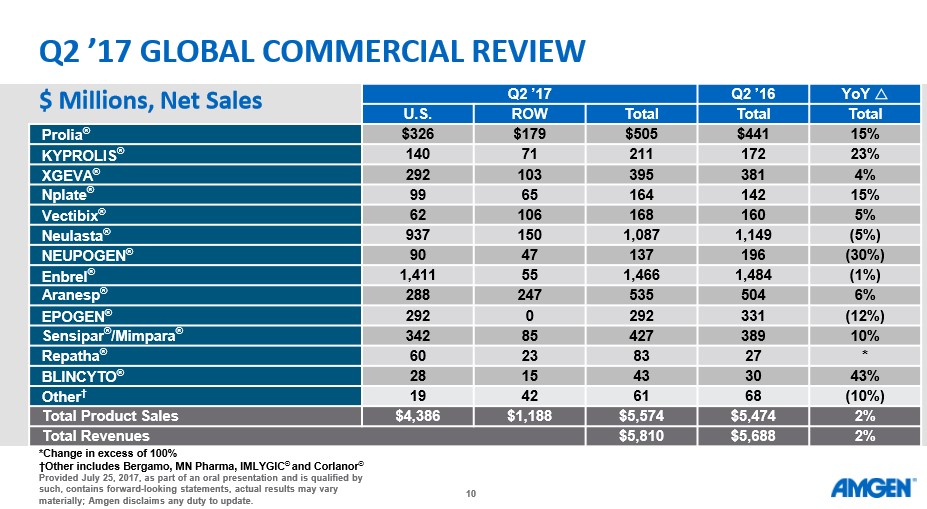

- Total revenues increased 2 percent versus the second quarter of 2016 to $5.8 billion.

- Product sales grew 2 percent driven by Prolia® (denosumab), Repatha® (evolocumab) and KYPROLIS® (carfilzomib).

- GAAP earnings per share (EPS) increased 18 percent to $2.91 driven by higher operating margins.

- GAAP operating income increased 13 percent to $2.7 billion, and GAAP operating margin increased 4.9 percentage points to 48.4 percent.

- Non-GAAP EPS increased 15 percent to $3.27 driven by higher operating margins.

- Non-GAAP operating income increased 9 percent to $3.1 billion and non-GAAP operating margin increased 3.8 percentage points to 55.2 percent.

- 2017 EPS guidance increased to $10.79-$11.37 on a GAAP basis and $12.15-$12.65 on a non-GAAP basis; total revenues guidance revised to $22.5-$23.0 billion.

- The Company generated $2.1 billion of free cash flow.

Source: Amgen

The overall market reaction to the news was generally negative as Amgen traded down sharply the next trading day following the results. We feel the main culprit behind the selling pressure is the rather uninspiring revenue growth of 2%. Amgen is faced with the rather unpleasant task of having to replace sales of aging blockbuster products such as Enbrel at precisely the time where the well of clinical innovation continues to run dry.

Image Source: Amgen Q2 Earnings Conference Call

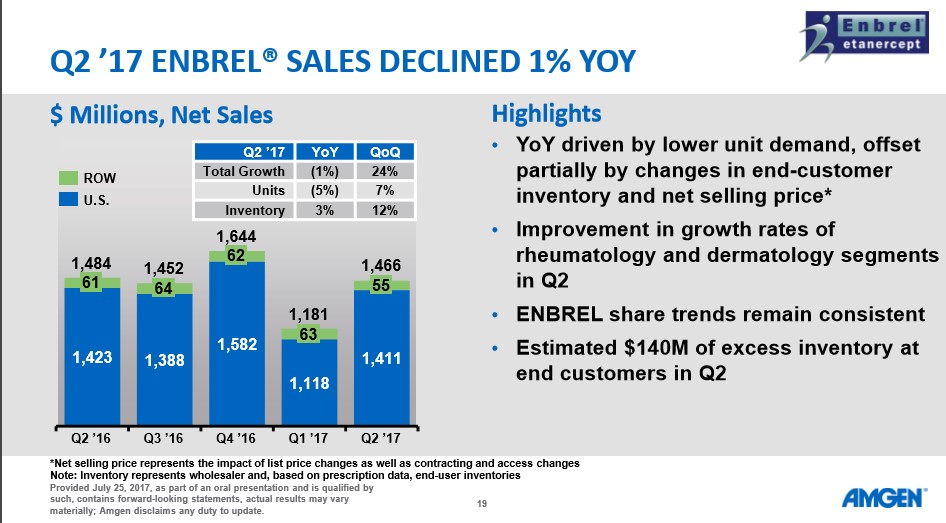

Enbrel posted a net 1% worldwide decline which may not sound particularly ominous, but the sales drop is masked by a clever bit of marketing on Amgen’s part. Amgen is utilizing the term “net selling price” which the company defines as: “Net selling price represents the impact of list price changes as well as contracting and access changes.” In essence, Amgen raised the price of therapy to help offset the 5% drop in units sold, in our view and as detailed in the slide below.

Image Source: Amgen Q2 Earnings Conference Call

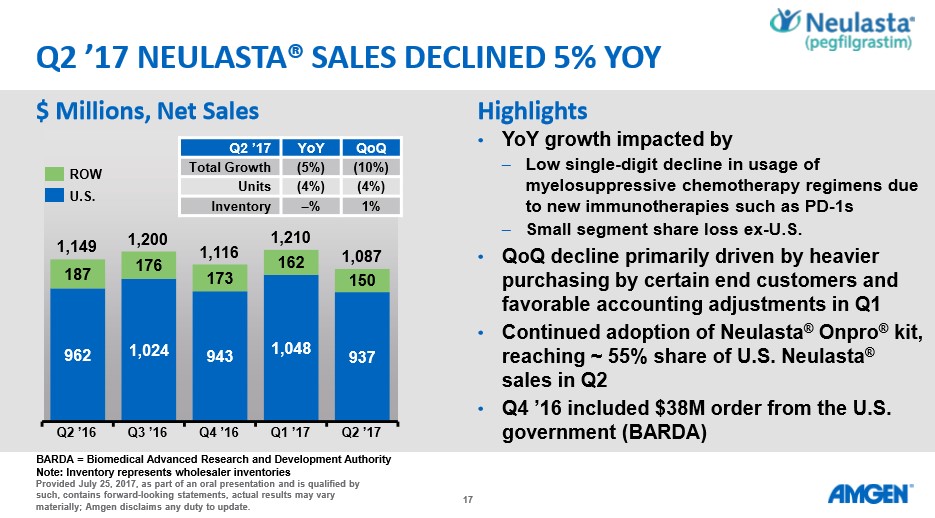

Similar phenomena can be witnessed with the performance of Neulasta. We feel the sales of Neulasta are holding up better than expected due to the FDA’s continued reluctance to approve a biosimilar version. It may only be a matter of time before a biosimilar version enters the US market--the European market remains more enlightened than the US with a cost-saving biosimilar version in active use.

Image Source: Amgen Q2 Earnings Conference Call

Concluding Thoughts

Once we peel off the label of biotech pioneer and replace it with mature pharma with little growth, the focus then shifts to the dividend. In this regard, Amgen fails to stack up to what is offered by other mature, established entities in the field. From our perspective, we prefer industry titan Johnson and Johnson (JNJ) for its bulletproof balance sheet and depth of the product line-up. We are recently impressed with the progress at Novartis, a European powerhouse with a broad product lineup backed with a more robust dividend that what is currently available in US pharmaceutical companies.

Healthcare and biotech contributor Alexander J. Poulos has no disclosures to report.