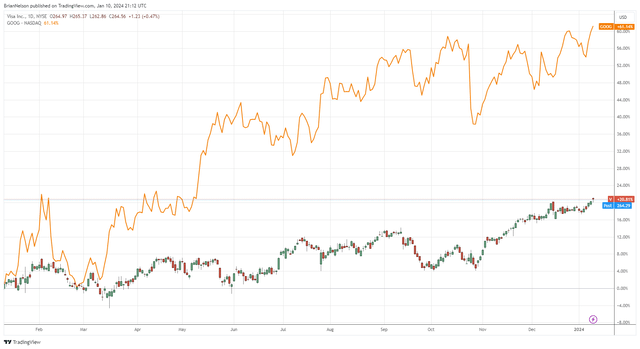

Best Ideas Visa, Alphabet Hit 52-Week Highs

Image: The top weightings in Valuentum’s Best Ideas Newsletter portfolio just hit 52-week highs.

By Brian Nelson, CFA

We’re reiterating our view that investors should stay aggressive with their allocations to equities, “12 Reasons to Stay Aggressive in 2024,” and our top two weightings in the Best Ideas Newsletter portfolio, Visa (V) and Alphabet (GOOG) just hit 52-week highs. These are two of our favorite names on the marketplace, with targeted weightings of 10%-12% of portfolio construction seeking long-term capital appreciation. During the past year, Visa’s shares are up nearly 20%, while Alphabet’s shares are up more than 60%. Position sizing, or the weighting ranges we assign to each company within a newsletter portfolio, is important as it is another way to gauge how much we like each of our best ideas relative to one another.

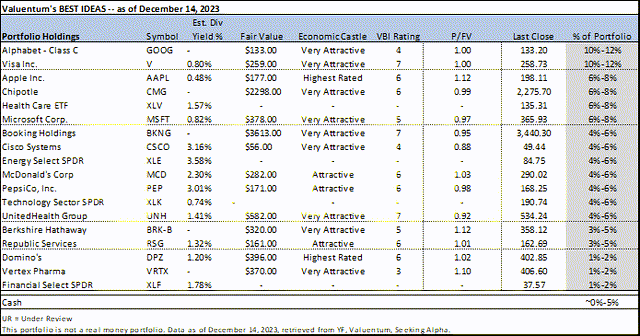

Image: Valuentum’s Best Ideas Newsletter portfolio. Portfolio information as of published date in top, left corner of table above. The Best Ideas Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments.

As long-time readers know, “Visa has been one of our favorite companies for a long time. It is levered to the secular growth trend toward a cashless society, and it benefits from e-commerce proliferation. The firm's operating margin is simply a sight to see, and its free cash flow margin is awesome. We expect Visa to generate a considerable amount of free cash flow in the coming years, and its dividend growth prospects to benefit as a result. Shares could have meaningful upside potential based on the high end of our cash-flow-derived fair value estimate range ($311 per share), too (Seeking Alpha).” Shares trade just shy of $265 at the time of this writing.

Alphabet is another one of our favorites. The company ended its most recently-reported third quarter of 2023 with total cash, cash equivalents and marketable securities of ~$119.9 billion versus long-term debt of just ~$13.8 billion, good enough for a huge net cash position. Alphabet probably has the best balance sheet out there given how much financial flexibility it has to defend its economic moat in search and other areas. The firm’s free cash flow during the first nine months of 2023 came in at a whopping ~$61.6 billion, up from $44 billion during the same period a year ago.

For the three months ended September 30, 2023, revenue growth at Alphabet was ~11%, and we expect advertising spending growth to remain strong in 2024. Shares are currently trading just shy of $144 at the time of this writing, and the high end of our fair value estimate stands at $182. We expect continued strength from Alphabet, and from our perspective, it has all of the makings of turning into one of the top performers of 2024.

All told, the first week of trading in 2024 gave investors some pause, as it was filled with profit taking from a strong 2023, but we think this bull market continues to have legs. We’ve outlined 12 reasons as to why we think investors should stay aggressive during 2024, and while key inflation data looms, we continue to like how the Best Ideas Newsletter portfolio is positioned heading into what could be another strong year in 2024. Visa and Alphabet remain two of our favorite ideas on the market today, and we point to the high end of their respective fair value estimate ranges as reasonable targets for optimistic, risk-seeking investors.

NOW READ: 12 Reasons to Stay Aggressive in 2024

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment