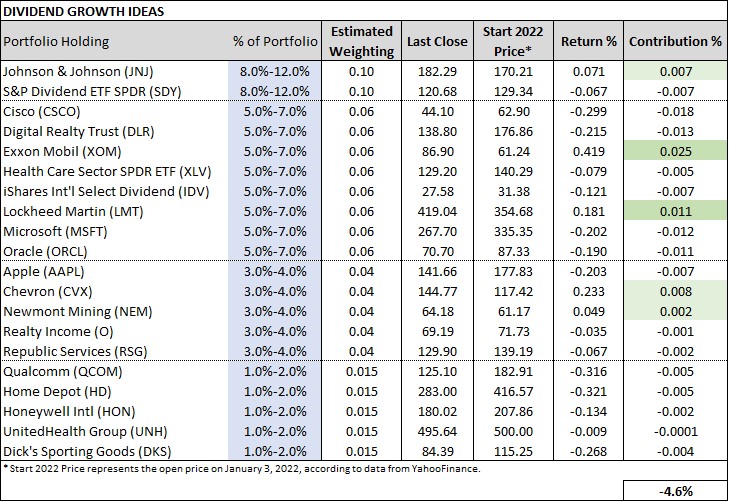

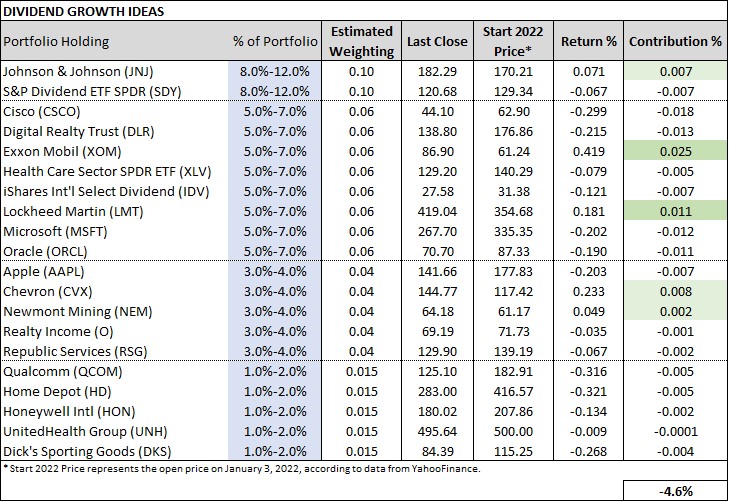

Image: The Valuentum Dividend Growth strategy has delivered thus far in 2022. With the S&P 500, as measured by the SPY, down 18.1% (negative 18.1%) thus far in 2022 and the S&P Dividend ETF (SDY) down 6.7% (negative 6.7%), the Valuentum dividend growth strategy, as measured by the hypothetical performance of the Dividend Growth Newsletter portfolio (as shown above), is down an estimated 4.6% (negative 4.6%) so far in 2022, all on a price-only basis. Though two percentage points better than the S&P High Yield Dividend Dividend Aristocrats Index doesn't seem like much, the large cap tilt of the simulated Dividend Growth Newsletter portfolio makes such "outperformance" significant and material. The benefits of a dividend growth strategy, in general, have also been on display so far in 2022, with the simulated Dividend Growth Newsletter portfolio "outperforming" the SPY by an estimated ~13.5 percentage points, on a price-only basis.

Data and returns are hypothetical and provided only for informational and educational purposes. No investor may have achieved such hypothetical "performance" because the simulated Dividend Growth Newsletter portfolio is not an investable product. Valuentum is a financial publisher. Data as of June 26.

By Brian Nelson, CFA

---

Hi everyone -- trust you all are doing great!

---

With the half year mark of 2022 nearing, we wanted to continue to provide updates on the "performance" tracking across a variety of our publications. In case you missed them, please find the year-to-date evaluations of the simulated Best Ideas Newsletter portfolio, the Exclusive capital appreciation and short idea considerations, the simulated High Yield Dividend Newsletter portfolio, as well as our additional options commentary for your convenience. The links are provided as follows. In this article, we'll talk about the "performance" of the simulated Dividend Growth Newsletter portfolio relative to traditional benchmarks and in the context of modern portfolio theory, though we stress that our dividend growth focus is on long-term income expansion not short-term relative price performance, per se.

---

---

---

---

---

First of all, for new members, welcome to Valuentum! We provide stock and dividend reports on hundreds of companies, publish five monthly newsletters--the Best Ideas Newsletter (which houses a simulated portfolio of our best ideas for capital appreciation), the Dividend Growth Newsletter (which houses a simulated portfolio of our best ideas for dividend growth), the Exclusive publication (which offers one income idea, one capital appreciation idea, and one short idea consideration each month), the High Yield Dividend Newsletter portfolio (which houses a simulated portfolio of our best high yield dividend ideas), and the ESG Newsletter (which houses a simulated portfolio of our best ESG-related ideas). We also provide an add-on service with respect to additional options commentary, generate quarterly publications and provide a periodic screener, which can be downloaded here (xls) -- login required, among other bespoke work.

---

With that said, the simulated Dividend Growth Newsletter portfolio has done remarkably well given the swoon that markets have experienced thus far in 2022. Thanks in part to the most recent additions of Exxon Mobil (XOM) and Chevron (CVX) in June of last year, the simulated Dividend Growth Newsletter portfolio is generating "alpha" against traditional benchmarks such as the S&P High Yield Dividend Dividend Aristocrats Index ETF (SDY) as well as the S&P 500, as measured by the S&P 500 SPDR ETF (SPY), the former by an estimated 2+ percentage points and the latter by an estimated ~13.5 percentage points. The simulated Best Ideas Newsletter portfolio, which is updated on the 15th of the month every month, is also generating "alpha" for members, to the tune of roughly 4-5 percentage points relative to the SPY thus far in 2022, by our estimates. We are also pleased with the "outperformance" of the simulated High Yield Dividend Newsletter portfolio relative to traditional benchmarks, the elevated success rates for capital appreciation ideas and short idea considerations in the Exclusive publication, as well as the idea generation behind our additional options commentary.

---

The tumultuous start to 2022 has tested many of the Valuentum strategies and methodologies, and while none of the strategies, as measured by the newsletter portfolios, have positive simulated returns thus far in 2022, they have done well against a number of their traditional benchmarks. Please don't misinterpret what we're saying, however. We're definitely not tooting our own horn for having strong "relative performance" across the board so far in 2022 with our simulated newsletter portfolios, but rather we wanted to explain how the strategies and methodologies are "performing" during difficult times following the fantastic "returns" of years past. Though each member uses our services in different ways (see here), we are pleased with how things have progressed during this difficult 2022 across the board, but especially as it relates to the simulated Dividend Growth Newsletter portfolio, which is down only 4.6% (negative 4.6%) so far this year, on a price-only basis (see image above for the details), by our estimates.

---

As we look ahead to the back half of 2022, we remain optimistic about the stock market and continue to question the merits of modern portfolio theory. So far in 2022, for example, the iShares Core U.S. Aggregate Bond ETF (AGG) has fallen nearly 11%, while the Vanguard Long-Term Treasury ETF (VGLT) has fallen by more than 21%, according to data from Seeking Alpha. It's difficult to see the merits of modern portfolio theory when major asset classes applied within the framework such as stocks, investment-grade bonds and long-term Treasury bonds have all fallen aggressively in unison by double-digit percentages so far in 2022. Correlations across asset classes tend to approach one during sell-offs, often breaking down at the precise time they are needed to hold up to smooth returns for investors. On the other hand, however, a broadly diversified simulated Dividend Growth Newsletter portfolio, as that found in the Dividend Growth Newsletter, is down by a mere fraction of a portfolio that pursued modern portfolio theory by equal-weighting the SPY, AGG, and VGLT together, for example.

---

We can't know for sure whether equity returns will be strong during the back half of 2022, but we still are believers in stocks for the long haul and think the market is carving out a bottom. To a large degree, our discounted cash flow valuations are already factoring in any economic malaise through forward estimates and the application of a margin of safety (our fair value estimate ranges), so we remain steadfast in our bullishness. Paying close attention to the intrinsic values of companies has paid for itself many times over, and we applaud members. As we gear up for next week, readers should expect the July editions of the Dividend Growth Newsletter and High Yield Dividend Newsletter to be released on the first of July, and an update on the healthcare industry models during the week. Our latest industry refresh came on May 23 with a refresh of oil and gas reports. Our valuation models for top-weighted considerations in the simulated Best Ideas Newsletter portfolio, Meta Platforms, Inc. (download report here, pdf -- login required) and Alphabet Inc. (download report here, pdf -- login required), have also been fine-tuned.

---

We appreciate your interest very much, and we hope that you continue to enjoy our work for many more years to come!

---

Thank you,

---

Brian Nelson, CFA

President, Investment Research

Valuentum Securities, Inc.

brian@valuentum.com

---

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment