Valuentum: Now Bearish, We’ve Been Here Every Step of the Way

Valuentum Has Been Here Every Step of the Way

From the COVID-19 top in February 2020 to the COVID-19 bottom to the massive bull run through the end of 2021, we've been here for you.

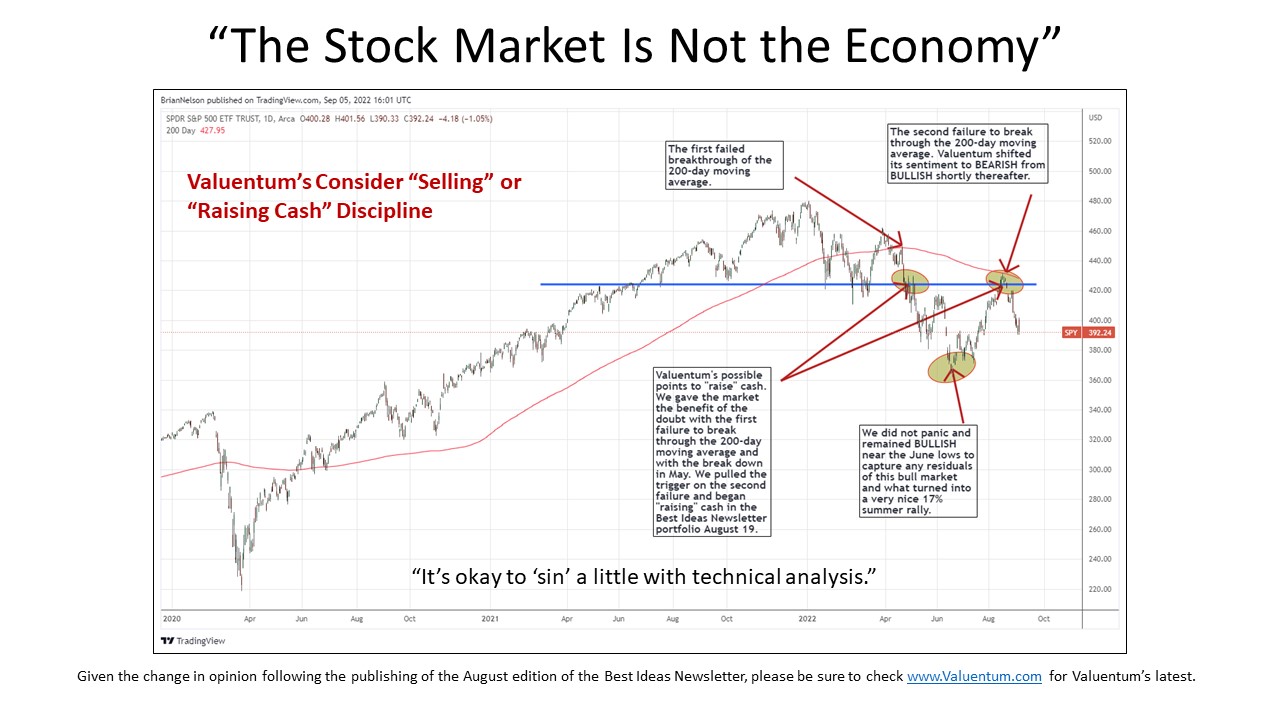

2022 started out to be a rough year, catching many by surprise.

But Valuentum stayed positive. When the markets headed south in June, Valuentum stood its ground. On June 14, Valuentum said that "we still believe stocks could make a "huge rebound" in the near term.

We reiterated our views a few days later and on June 19, we said that "investors shouldn't panic during this bear market" and that "stocks remain an attractive proposition at the moment and a very attractive consideration over the long haul."

Some, however, did panic, unfortunately, and missed out on a huge summer rally. From June 17 to August 16, the SPY rallied 17%+.

After the SPY failed to break through its 200-day moving average, on August 19, we then went bearish on the markets, "raising" cash.

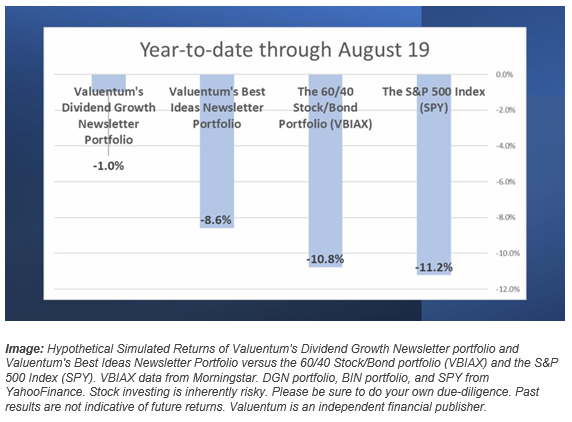

At the time, the simulated Best Ideas Newsletter portfolio was down just 8.6% year-to-date, beating the SPY by 2.6 percentage points. The simulated returns in the Best Ideas Newsletter portfolio included those of Meta Platforms (META) and PayPal (PYPL).

The simulated Dividend Growth Newsletter portfolio was down just 1% year-to-date through August 19.

Since we went bearish August 19, the SPY has dropped more than 7%. Valuentum's simulated newsletter portfolios continue to deliver for members during good and bad times, and our research continues to be as timely as ever through thick and thin.

Right now, we’re bearish. We think consumers and investors are tapped out in the U.S. (video), and we’ve grown very cautious on Europe and China, more recently (video). Here’s an excerpt from our latest video on the global economy:

---

Global economic growth is slowing down sharply as Europe is teetering on a recession. European energy bills for most households have shot through the roof in 2022, sharply reducing disposable incomes across the continent. Industrial firms in Europe may be unable to source enough natural gas (a key feedstock in certain manufacturing activities) and electricity to meet their operating needs this winter as gas supplies could get diverted to keep households warm. The economies of Germany, Italy, and the UK have all been hit quite hard and that pain will likely spread throughout the European continent.

Before the winter hits, European industrial enterprises are contending with cost structures that are far less economical than they were before the Russian invasion of Ukraine in February 2022. Surging natural gas and electricity prices combined with rising labor costs have made Europe’s industrial giants far less competitive on the global stage. A sharp reduction in industrial activity and subdued consumer spending power paints a bleak picture for Europe’s economic trajectory in the near term. There is not much that key European economies can do in the near term to reverse their bleak economic outlook, and it will take a long time for Europe to develop new supply chains for natural gas supplies and new power generation facilities (wind, solar, nuclear, etc.).

China also has limited tools to revive its major growth engines, with the World Bank forecasting that its GDP will grow by just 4.3% in 2022, far below historical levels. The country’s housing market is in crisis and there are reports of widespread mortgage boycotts as Chinese households are no longer willing to give embattled developers the benefit of the doubt as those households grow increasingly concerned that the home they purchased won’t get built. Effectively, households that purchased homes before they were built in China and took on a mortgage to do so are indicating they won’t make good on a mortgage for the home until they are confident the developer will be able to fulfill their obligations.

Many Chinese property developers are heavily indebted and are facing liquidity crunches, and these issues are beginning to spread to once financial healthy developers. Activities relating to real estate, from property developers to steel makers to asset management firms to suppliers of building materials, represent a major chunk of the Chinese economy and so far, support from the central government has been limited.

COVID-related lockdowns in China have led to sharp reductions in economic activity in recent months while exacerbating supply chain hurdles and ultimately inflationary pressures (given how dependent the world is on China’s vast manufacturing base). However, unlike in the past, China will be unable to rely on strong overseas demand for goods to revive its growth trajectory after a period of COVID-related lockdowns as economic activity is slowing sharply worldwide.

Furthermore, attempts to stimulate fixed asset investment in real estate will also run into a wall due to the myriad problems facing China’s developers big and small. Large debt loads at government entities (from municipalities to state-run enterprises) and slowing economic growth will make it difficult for China to lean on deficit funding to prop up growth, a problem many other governments elsewhere are also contending with. China’s economy is beginning to experience a structural shift to slower growth, especially as the country’s population is set to decline over the coming decades.

During the first half of 2022, the US experienced a “technical recession,” meaning two consecutive quarters of negative GDP growth.The US economy will likely post positive GDP growth going forward as activities in the realm of resource extraction (with an eye towards oil & gas) and exports of raw energy resources (especially LNG), infrastructure (aided by increased federal investments in domestic infrastructure), and professional services help pick up the slack while unemployment rates remain near record lows, though domestic economic growth will likely be muted until the global economic growth outlook improves.

Value Trap Continues to Offer Valuable Insights

---

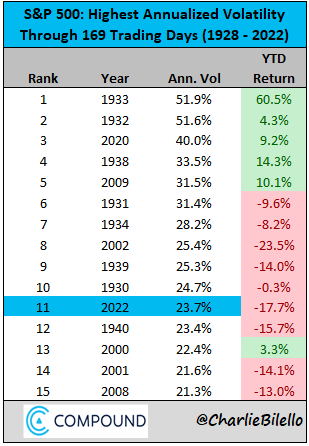

Following huge volatility in 2020, the year 2022 has been one of the worst years in terms of annualized equity (S&P 500) volatility, with only the Great Depression, dot-com crash, GFC, and COVID-19 meltdown worse.

Originally published in 2018, in its “Call to Action,” Axiom Business Book medalist, the book Value Trap warns that price-agnostic trading will cause sustained elevated volatility in the equity markets and that, without reform, we will eventually reach a tipping point.

Image Source: @CharlieBilello

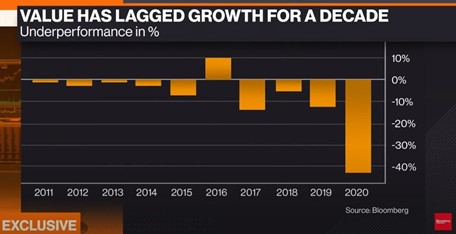

1. The first edition of Value Trap, released in 2018, warned about the impending collapse of the value factor, and during 2020, the value factor registered its worst performance in history.

Image Shown: Bloomberg

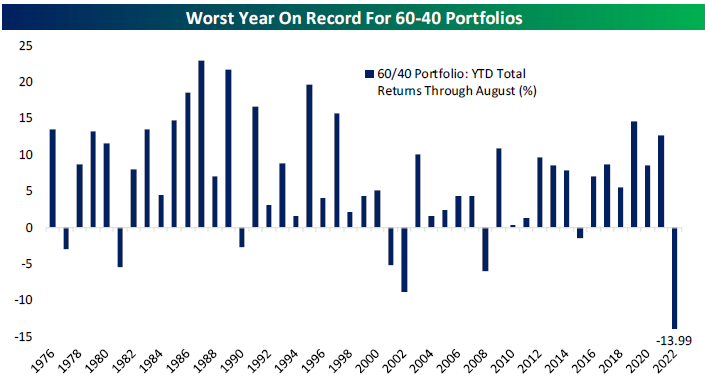

2. The second edition of Value Trap, released in 2020, warned heavily about the spurious nature of backward-looking correlations and the deficiencies of the 60/40 stock/bond portfolio, in particular. 2022, thus far, has been the worst year for the 60/40 stock/bond portfolio on record.

Image Source: Bespoke Investments

The case for forward-looking analysis and a third edition of the book Value Trap continues to build. We sincerely hope you have enjoyed the first two editions, and we look forward to crafting the third edition in the future.

Concluding Thoughts

It’s easy to lose sight of the tremendous value that a Valuentum subscription provides during down markets, but we’ve been here for you every step of the way. 2019, 2020, and 2021 were fantastic years, and the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio have delivered in 2022.

The simulated High Yield Dividend Newsletter portfolio is holding up nicely, and ideas within the Exclusive publication continue to boast impressive success rates. Members continue to receive options ideas to bet directionally on the stock market, and the book Value Trap has been true to its efforts, showcasing the ongoing benefits of forward-looking analysis.

Thank you for reading!

Video: Valuentum's President Brian Nelson, CFA, explains why he's turned bearish on the equity markets after a great bull run. In this 8-minute video, learn about the fantastic returns of the stock market the past three years, and how the Valuentum way has cushioned the market decline in 2022. Watch now to learn about the textbook execution of the Valuentum strategy and more!

----------

Tickerized for holdings in the SPY.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment