US Congress Is Getting Ready to Pass a Massive ~$2.2 Trillion Fiscal Stimulus Bill

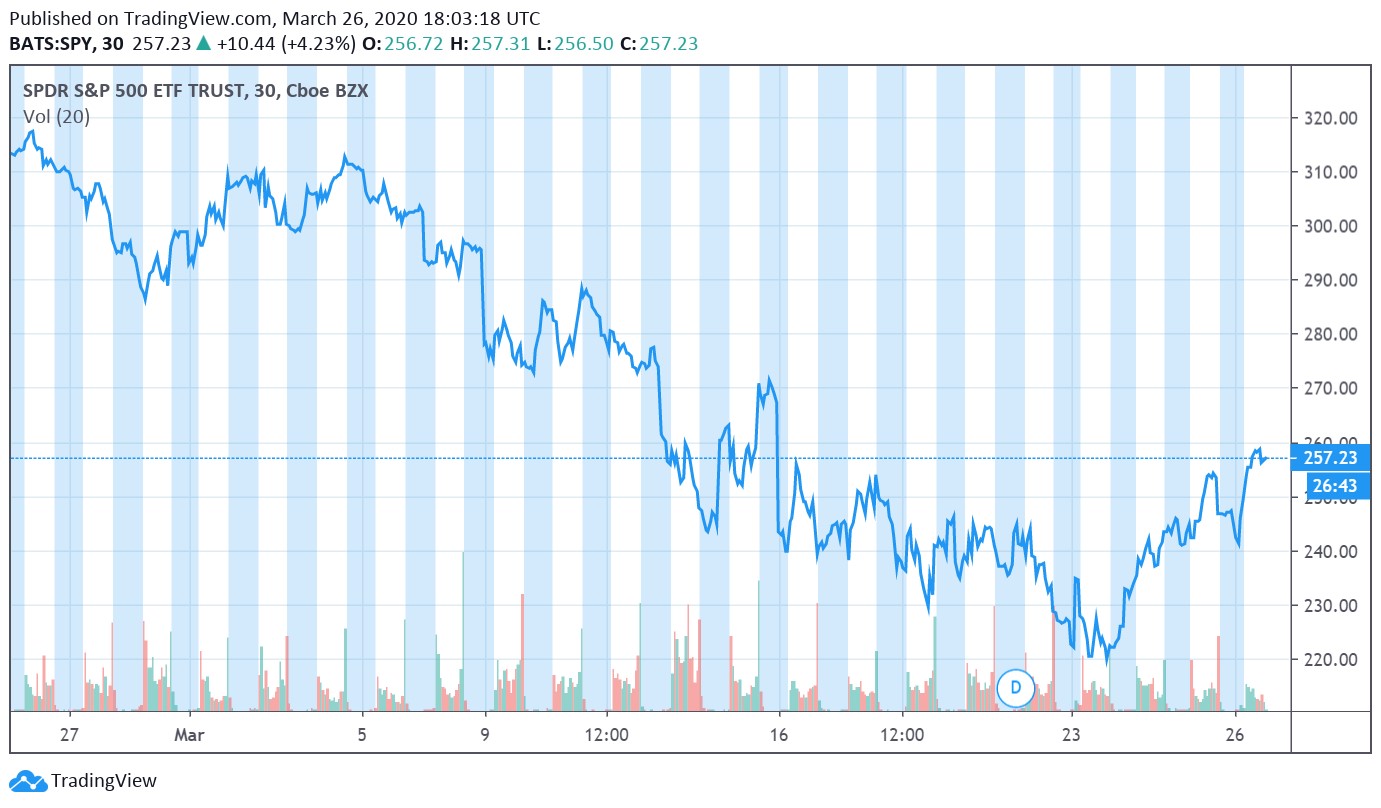

Image Shown: US equities have started to recover some of their lost ground as the likelihood that the US Congress will pass a massive ~$2.2 trillion fiscal stimulus and emergency spending package, dubbed the CARES Act, has increased significantly over the past week as seen through the bounce in the SPDR S&P 500 ETF Trust (SPY). President Trump has clearly indicated that he intends to sign such a bill into law as soon as possible, with the US House of Representatives expected to take up the legislation this upcoming Friday morning on March 27.

By Callum Turcan

On March 25, the US Senate worked late into the night to secure a bipartisan compromise on a massive ~$2.2 trillion fiscal stimulus and emergency spending bill to offset the negative impact of the ongoing novel coronavirus (‘COVID-19’) pandemic. The bill passed 96-0 after several senators forced a vote on an amendment on that bill that would have changed the nature of the “beefed up” unemployment benefits (that amendment failed 48-48, and would have needed 60 votes to pass). As of this writing, there are over 65,000 confirmed cases of COVID-19 in the US according to Johns Hopkins University, and we sincerely hope everyone, their families, and their loved ones stay safe during this pandemic.

A vote in the US House of Representatives is expected this upcoming Friday morning on March 27. The House is expected to convene at 9AM EST and the goal of each party’s leadership is to secure passage of the bill via a voice vote (please note that this differs from unanimous consent, which requires every member of the House to agree to such a legislative process in order to pass a bill without having the majority of lawmakers return to Washington DC, but this is easier/faster to achieve than a recorded roll call vote that would force every member of the House to return). Assuming the House swiftly passes the bill that was approved in the Senate, President Trump has clearly communicated he would sign the bill into law right away. Please note this bill is formally known as the Coronavirus Aid, Relief, and Economic Security (‘CARES’) Act.

Direct Cash Payments

There’s a lot within this mammoth agreement. For starters, at an estimated cost of approximately $250 billion, the bill allows for direct cash payments (via direct deposit if possible, using information from 2019 tax returns or 2018 tax returns if the individual/household has yet to file their 2019 taxes; however physical checks are also a possibility) to US individuals and households that would phase out past certain income thresholds (the phase-in part of this program has since been removed); $75,000 for individuals, $112,500 for heads of household, and $150,000 for married couples (the phase-out portion starts after that threshold has been hit, with the cash payment reduced by $5 for each $100 earned over those thresholds). Furthermore, each household with children receives an additional $500 per qualifying child (under the age of 17). Treasury Secretary Mnuchin has communicated that Americans should expect those checks to be sent out within the next three weeks if all goes according to plan (meaning the CARES Act swiftly passes the House and is quickly signed into law, we’ll soon see if that’s the case).

Beefed Up Unemployment Benefits

Another roughly $250 billion is being allocated towards an enhanced unemployment benefits system which includes offering relief to workers in the informal economy such as Uber (UBER) and Lyft (LYFT) drivers, for example. In a previous note (link here), we covered how weekly US employment claims (on an adjusted basis) spiked to over 3 million for the week ended March 21, and the pain is unlikely to stop there. On top of existing state unemployment benefits (which usually last for about 26 weeks, depending on the state), the fiscal stimulus bill includes a provision that allows for those on unemployment benefits (keeping in mind the rules are loosened to obtain these benefits) to receive an additional $600 per week for four months. That, when combined with other provisions such as the direct cash infusion to US individuals and households, is supposed to tide Americans over during the worse of the ongoing economic slowdown.

As an aside, other measures to help US households include suspending federal student loan payments through September 30, with interest not accruing on those loans during this period.

Direct cash payments and the enhanced unemployment benefits package will go a long way to bolstering US consumer confidence and potentially consumer spending. That being said, the “cocooning” of US households makes it hard to gauge when and where those funds will be spent. Consumer staples (XLP, VDC, KXI) firms, grocery stores such as Walmart (WMT) and Kroger (KR), and e-commerce firms, including Amazon (AMZN), are likely the biggest winners as consumers continue to “panic buy” consumer staples and food products in physical stores, and households have been utilizing e-commerce services more of late as well (there’s enough US consumer spending power for both US grocers and e-commerce firms to gain, relatively speaking, from the pending fiscal stimulus bill as US households put off other expenditures toward things like vacation and travel).

Boost to Governments and Healthcare Providers

Among other things, this bill includes over $140 billion in funding for the Department of Health and Human Services. That department will deliver $127 billion in funding towards the Public Health and Social Services Emergency Fund, which in turn will provide $100 billion in grants for various healthcare providers (XLV) including hospitals, public entities, suppliers enrolled in Medicare and Medicaid programs, not-for-profit entities, and institutional providers. $16 billion will be allocated towards creating a strategic national stockpile of pharmaceuticals and medical equipment, and another $11 billion will go towards helping various entities develop a vaccine for COVID-19. Outside of the funding that’s going towards the Public Health and Social Services Emergency Fund, over $4 billion is going towards the Centers for Disease Control and Prevention, along with numerous other funding measures.

Pivoting to the boost to various government entities that have spent enormous sums dealing with COVID-19, $150 billion has been allocated to states, territories, local and tribal governments based on population size, and the minimum for each state stands at $1.25 billion. Tribal governments have been allocated $8 billion, $3 billion is going towards District of Columbia, Puerto Rico, Virgin Islands, Guam, Northern Mariana Islands and American Samoa, and please note 45% of the $150 billion is allocated towards local governments with populations that exceed 500,000 people. These funds are supposed to provide various governmental and other entities with the ability to continue combating COVID-19 and the various expenditures that arise when doing so (i.e. emergency response-related expenses).

These funds will have a very powerful impact on the municipal bond market as it becomes much easier for these entities to service their debt burdens. Relevant funds include the Vanguard Tax-Exempt Bond ETF (VTEB), iShares National Muni Bond ETF (MUB), and First Trust Managed Municipal ETF (FMB). All three of these funds, which invest in municipal bonds, have spiked on the news that the US fiscal stimulus and emergency spending bill is increasingly likely to get signed into law.

Business Provisions

Some of the biggest parts of the enormous CARES Act comes down to the support that will be provided to small, medium, and larger businesses (and thus the vast majority of American employers). Around $350 billion is going towards supporting small- and medium-sized enterprises which will be delivered in the form of loans worth up to 250% of an employer’s monthly payroll. Under this program, the size of those loans is capped at $10 million per firm. A key part of this program (and the bill at-large) includes creating a tax credit where firms that have seen gross receipts fall by over 50% due to COVID-19 can claim up to 50% of the wages paid during this crisis as a future tax credit. The payroll tax for employers has been delayed, with half of those payments (for 2020) now due by the end of 2021 and the other half due by the end of 2022.

Arguably the most controversial part of this bill comes down to the creation of a massive lending/cash infusion program for large corporations, and that program involves a cash infusion of ~$500 billion. Part of that entails the creation of a $62 billion program involving federal loans and cash assistance for firms so they can continue to meet their payroll obligations. That includes $25 billion in grants to airliners, another $4 billion in grants to cargo carriers (the grants are supposed to be exclusively used to cover payroll expenses), and an equivalent amount for loans and loan guarantees to those entities. Additionally, $17 billion has been set aside to provide loans and loan guarantees for “businesses critical to maintaining national security” which will very likely include Boeing (BA). We want to stress that airliners (JETS) such as Delta Air Lines (DAL), United Airlines (UAL), American Airlines (AAL), Spirit Airlines (SAVE), and JetBlue Airways (JBLU) are the big winners, as it Boeing, and also all of the suppliers to those industries as well. $3 billion has been allocated towards grants for airline contractors, including caterers, to cover their payroll needs.

Firms that utilize this lending program will have to agree to salary freezes for those that make over $425,000 per year, bans on share repurchases until a year after the loans have been repaid, and those firms can’t count President Trump, Vice President Pence, heads of executive departments, members of Congress, or the relatives of those individuals as major shareholders (those individuals can’t own 20% or more of the equity of the company being “bailed out” as per the rules within the CARES Act).

Here we would like the stress that this bill does create moral hazards. Firms, like airliners, which utilized the vast majority of their free cash flows to buy back stock over the past decade, now know that even if poor capital allocation decisions are made (such as having firms in highly cyclical industries not building up large net cash balances on the books), they can receive a “bailout” which creates long-term problems. Companies aren’t being properly incentivized to maintain fortress-like balance sheets, far from it. For Boeing, while the company is of national importance and of tremendous strategic value to America (we wrote here why we can understand the need to bailout Boeing), the bailout signals to other firms of similar importance [defense contractors (XAR), aerospace suppliers (ITA), etc.] that Uncle Sam will have your back even if poor operational, financial, and/or capital allocation decisions are made.

Finally, we want to stress that the ballooning of the federal debt and federal deficit has serious long-term implications for the intrinsic value of equities, as US federal corporate income taxes will likely need to be raised in the future to meet those debt obligations. Higher federal corporate income taxes reduces the estimated future free cash flows to firms, which in turn reduces their estimated fair values materially.

Concluding Thoughts

There are other considerations within the massive CARES Act that’s not covered in this article, but we’ve highlighted all of the key programs that will likely have the biggest impact on equity and credit markets, along with the US and global economies as well, going forward. While equity markets are rallying on the news (as of March 26), we will caution once again that we still see the chance of the US economy (and global economy at-large) slipping into a deep recession as quite likely given the sharp slowdown in economic activity that is the result of the containment efforts relating to COVID-19.

It won’t be until a vaccine is created that the cocooning of households will start to abate, in our view, and we are still 12-18 months away from one being commercially available (at the earliest, medical breakthroughs are not a certainty). Various treatments have been floated around as possibly effective, and Best Ideas Newsletter and Dividend Growth Newsletter portfolio holding Johnson & Johnson (JNJ) is working on creating a vaccine with its partner Beth Israel Deaconess Medical Center (the partnership aims to select a handful of potential candidates by the end of this month). We’ll have more to say once the CARES Act passes the House and gets signed into law, or in the event that it doesn’t.

Aerospace & Defense (Prime): BA, FLIR, GD, LMT, NOC, RTN

Aerospace Suppliers: ATRO, HEI, HXL, SPR, TDY, TXT

Conglomerates: DHR, GE, HON, MMM, UTX

Dollar Store and Department Store Industries: KSS M JWN BIG DG DLTR PSMT

Food Products (Small/Mid-Cap): CALM FLO FDP HAIN HRL JJSF LANC MKC SJM THS TSN

Food Products (Large/Mid-Cap): ADM BG CPB CAG GIS HSY K KHC MDLZ NSRGY UL UN

Food Retailing Industry: CASY COST CVS KR SYY TGT WBA WMT

Restaurants (Fast Food & Coffee/Snack): ARCO, DPZ, DNKN, JACK, MCD, PZZA, SBUX, WEN, YUM

Staffing Services: ADP, DLX, EFX, KFY, MAN, NSP, PAYX, RHI

Related Airline: AAL, ALK, DAL, HA, JBLU, LUV, SAVE, UAL

Related ETFs: XLV, SPY, XLP, VDC, KXI, XAR, ITA, JETS, VTEB, MUD, FMB

Related Hotel: H, IHG, WH, CHH, RLH, STAY, BEL, WYN, EXPE, BKNG, TRIP, TZOO, TCOM, HTZ, CAR

Related: AMZN, UBER, LYFT, JNJ

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG), the Health Care Select Sector SPDR ETF (XLV), Johnson & Johnson (JNJ), and the S&P Aerospace and Defense ETF (XAR) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Cracker Barrel Old Country Store Inc (CBRL), Johnson & Johnson, Lockheed Martin Corporation (LMT), and the Health Care Select Sector SPDR ETF are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

2 Comments Posted Leave a comment