UnitedHealth Group’s Long-Term Story Intact

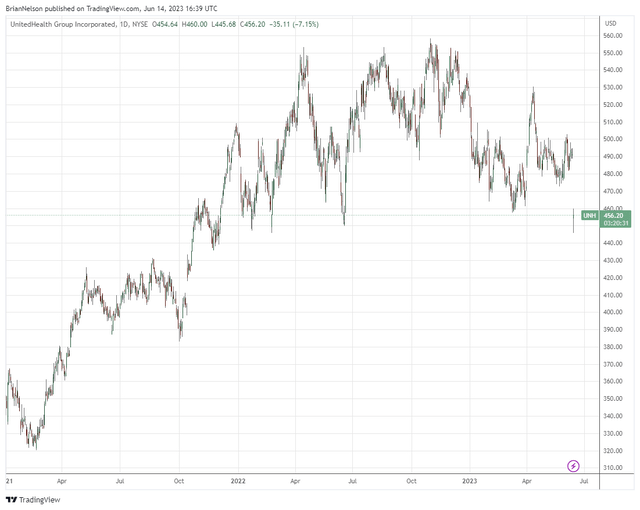

Image: UnitedHealth Group’s shares are facing pressure as the pace of medical procedures normalizes following COVID-19. We still like shares.

By Brian Nelson, CFA

On June 7, UnitedHealth Group (UNH) raised its quarterly dividend nearly 14%, to $1.88 per share, which reflects a forward estimated dividend yield of 1.65%. The company remains a staple in the Dividend Growth Newsletter portfolio and is a new add in the Best Ideas Newsletter portfolio. Recent comments by UNH’s John Rex on June 14 regarding the firm’s healthcare costs during the second quarter have put shares under pressure during the trading session. Discretionary surgeries have picked back up following a lull during most of the COVID-19 pandemic as hospital capacity was largely constrained during that time.

We’re viewing the expectations for higher medical costs in the near term for UNH as a reflection of pent-up demand (e.g. hip, knee replacements) and therefore largely a one-time step up that will weigh on its financials during 2023, but not in the longer run as premiums are eventually reset (repriced) to better cover the cost pressures. We think the market is overreacting to the news and likely reallocating to more aggressive areas within big cap tech as defensive stocks within healthcare weaken in 2023. UNH’s shares are now trading in the lower bound of our fair value estimate range, and we still like this large cap growth idea in the long run.

NOW READ -- ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

----------

Tickerized for UNH, HUM, ALHC, CLOV, ELV, CNC, MOH, CVS, SGRY, THC, HCA, XLV

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.