UnitedHealth Group’s Dividend Growth Potential is Impressive

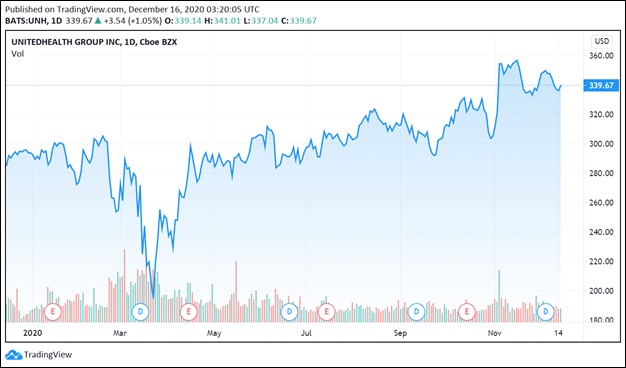

Image Shown: UnitedHealth Group Inc has a tremendous dividend growth runway, one that is supported by its high-quality cash flow profile, pristine balance sheet, and improving near-term outlook. Shares of UNH have staged an impressive recovery over the past several months since crashing in March 2020 due to headwinds arising from the ongoing COVID-19 pandemic. We added UnitedHealth Group to our Dividend Growth Newsletter portfolio on November 27, 2020.

By Callum Turcan

On November 27, we added UnitedHealth Group Inc (UNH) to the Dividend Growth Newsletter portfolio (link here). The company has an “EXCELLENT” Dividend Growth rating as the firm is well-positioned to push through meaningful dividend increases in the coming years. Additionally, UnitedHealth Group earns an “EXCELLENT” Dividend Safety rating as its Dividend Cushion ratio sits at 3.1, and please keep in mind these metrics factor in our expectations that the company will meaningfully grow its payout going forward. As of this writing, shares of UNH yield ~1.5%. We like UnitedHealth Group’s stellar cash flow profile, pristine balance sheet, improving near-term outlook and resilient business model. During the ongoing coronavirus (‘COVID-19’) pandemic, the company’s financial performance has remained rock-solid, too.

Before covering UnitedHealth Group’s historical financials and future expected financial performance, let us first provide a brief overview of its business profile. UnitedHealth Group has two main business platforms: UnitedHealthcare (focuses on providing health insurance plans to individuals, enterprises, and governments) and Optum (a health services business that seeks to use technology to improve care delivery, generate insights that can improve various health care operations, and provide a comprehensive array of pharmacy care services).

Its four main business reporting segments are as follows: UnitedHealthcare (provides health insurance plans), OptumHealth (includes its local ambulatory care services business and a health care provider business), OptumInsight (provides a slate of services to drive efficiencies and improve quality of care including health information and electronic data exchange, revenue cycle management, administrative and clinical technology for claims editing, and risk analytics services), and OptumRx (provides diversified pharmacy care services through a vast network of retail and community health pharmacies while also helping provide home delivery services, specialized pharmacy services, and more).

Stable Historical Financial Performance

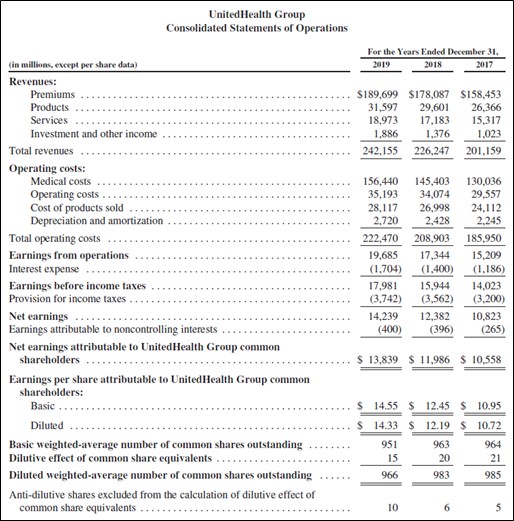

From 2017 to 2019, UnitedHealth Group saw its GAAP revenues climb higher 20% with growth experienced across the board (here we will note that UnitedHealth Group includes ‘investment and other income’ in its GAAP revenues figure). Rising premium payments from its health insurance business led the way and was responsible for the lion’s share of its revenue growth during this period. UnitedHealth Group’s GAAP operating income rose 29% from 2017 to 2019, aided by economies of scale and well-managed operating expense growth.

We appreciate the steady improvement in UnitedHealth Group’s financial performance during the past few years as that speaks favorably towards its expected future financial performance. From 2017 to 2019, UnitedHealth Group generated ~$13.9 billion in annual free cash flow on average, which significantly exceeded its annual dividend obligations of ~$3.9 billion in 2019. Though UnitedHealth Group’s share repurchases have become much more significant in recent years (growing from $1.5 billion in 2017 to $5.5 billion in 2019), its shareholder return strategy remains well-funded by its organic free cash flow generating abilities.

Image Shown: UnitedHealth Group’s revenues and operating income have steadily climbed higher in recent years, which we appreciate as that speaks favorably towards its outlook. Image Source: UnitedHealth Group – 2019 Annual Report

During the first nine months of 2020, UnitedHealth Group’s financials have held up incredibly well in the face of the COVID-19 pandemic. Its GAAP revenues advanced 6% year-over-year, once again led by strength at its health insurance business, while its GAAP operating income surged higher 29% year-over-year as management continues to keep a lid on the firm’s operating expense growth. UnitedHealth Group generated $14.6 billion in free cash flow during the first nine months of 2020 while spending $2.5 billion on share buybacks and $3.4 billion covering its dividend obligations.

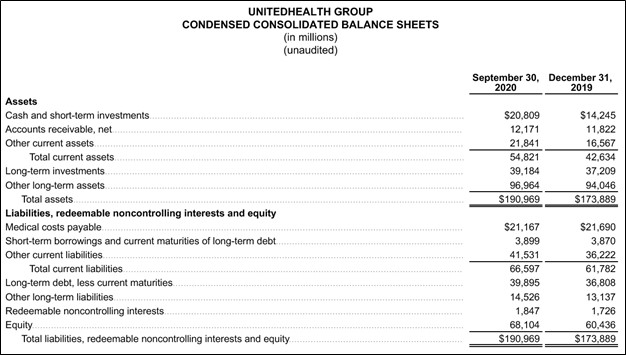

At the end of September 2020, UnitedHealth Group’s balance sheet remained pristine. The firm had $20.8 billion in cash and short-term investments on hand as well as $39.2 billion in long-term investments on the books. Stacked up against $3.9 billion in short-term debt and $39.9 billion in long-term debt, UnitedHealth Group’s net cash position of ~$16.2 billion at the end of September 2020 is an immense source of strength during these turbulent times. The combination of its high-quality cash flow profile, pristine balance sheet, and strong outlook supports UnitedHealth Group’s Dividend Cushion ratio.

Image Shown: We are big fans of UnitedHealth Group’s pristine balance sheet. Image Source: UnitedHealth Group – Third Quarter of 2020 Earnings Press Release

Promising Outlook

During UnitedHealth Group’s third quarter of 2020 earnings report, management increased the firm’s full-year adjusted non-GAAP EPS guidance to $16.50-$16.75 for 2020 (versus $16.25-$16.50 previously), which is significantly above the $15.11 in non-GAAP adjusted EPS the company posted in 2019. We appreciate the company’s growing optimism as it has seen “strong underlying performance across [its] business segments” of late, though increased costs (some of which are voluntary) due to the COVID-19 pandemic are a concern. Considering that the distribution of a COVID-19 vaccine has recently begun in the US and elsewhere, it appears UnitedHealth Group’s outlook continues to get brighter and brighter.

Over the long haul, management is targeting significant earnings growth at UnitedHealth Group, which in turn should drive its cash flows higher over time. Here is what the firm had to say during its third quarter of 2020 earnings call in response to an analyst’s question (emphasis added, moderately edited):

“We approach the future with continued conviction on our long-term 13% to 16% earnings growth objective. Some of the factors giving us confidence include our rapidly expanding care delivery services now benefiting from over a decade of building and investing in local value-based care systems and extension into market leading post-acute home and modern behavioral health intervention services.

Our ability to support seniors across multiple channels and markets [involves] increasingly innovative high-value offerings. The way we meet the growing needs of people with highly complex conditions [is] with comprehensive personalized care, including people across commercial, federal and state-based programs. [This] innovative and consumer [suite] of products is now being offered through the employer and individual market channels.

Our unmatched ability to support a more interoperable and intelligent health system [is] a result of significant investments over many years to improve performance, [from] integrating data analytics and clinical information to provide essential insights to evidence-based next best care actions and our restless drive to allocate capital in line with other innovative companies as we lead in the development of the next generation health system in a socially conscious way.” --- David Wichmann, CEO of UnitedHealth Group

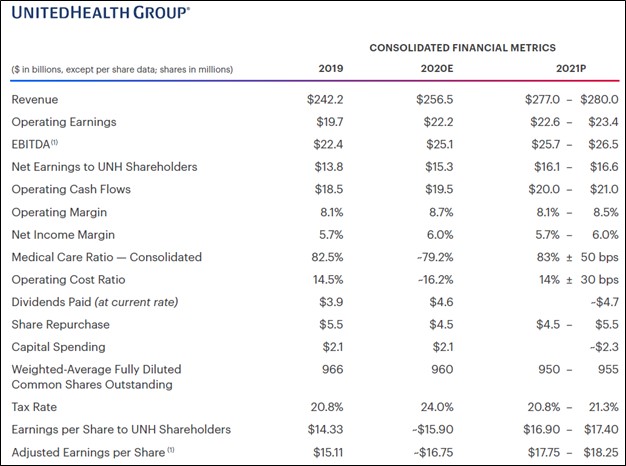

In early December, UnitedHealth Group released guidance for 2021. Though significant headwinds remain due to the ongoing COVID-19 pandemic, management appears confident that UnitedHealth Group would still be able to post solid revenue income, and cash flow growth in 2021 versus forecasted 2020 levels as one can see in the upcoming graphic down below. Please note this solid expected performance comes on top of the company’s expectations that its revenues, income, and cash flows will grow materially in 2020 over 2019 levels.

Image Shown: UnitedHealth Group expects its financials will continue moving in the right direction in 2021. Image Source: UnitedHealth Group – 2020 Investor Conference

Some of the key strategic initiatives UnitedHealth Group is currently working on includes investing in its telehealth capabilities, which involves connecting patients with physicians via online platforms. In theory, this makes it significantly easier for patients to complete their routine check-ups and frees up time for physicians, resulting in greater efficiencies across the board. Management noted during UnitedHealth Group’s third quarter of 2020 earnings call that “OptumCare physicians have facilitated 1 million digital clinical visits directly with their patients” as mid-October. Going forward, the company plans to continue bulking up its digital capabilities.

Pivoting to UnitedHealth Group’s health insurance business, management noted that “the number of people (it) serves with individual health coverage has grown by 15%” in 2020 during the firm’s third quarter of 2020 earnings call. The company also noted it has significantly grown the reach of its Medicare Advantage plans and expects 2021 to be a good year for this part of its business. Combined, these two dynamics are expected to help improve UnitedHealth Group’s financial performance going forward.

New Partnership

On December 4, UnitedHealth Group announced it had partnered up with Eli Lilly & Co (LLY) to help deal with the COVID-19 pandemic. The venture aims to study Eli Lilly’s “new monoclonal antibody treatment, bamlanivimab, for non-hospitalized people recently diagnosed with COVID-19” which will involve leveraging UnitedHealth Group’s digital capabilities to provide the study’s volunteers with a “seamless observational study experience” and to improve care delivery. For reference, the US Food and Drug Administration (‘FDA’) has approved bamlanivimab for emergency authorization use to treat mild-to-moderate cases of COVID-19 in adult and pediatric patients.

The study's volunteers that begin experiencing COVID-19 symptoms can use an app, ProtectWell, which UnitedHealth Group developed in collaboration with Microsoft Corporation (MSFT) to indicate that they need to take a COVID-19 test. At that point, UnitedHealth Group will help arrange for the patient to take a COVID-19 test, and should that test turn up positive, the company would then help put the patient in contact with “an Optum infusion nurse to schedule a home infusion treatment of the therapy.” We are intrigued by this study and wish UnitedHealth Group and Eli Lilly the best in their endeavors.

Concluding Thoughts

UnitedHealth Group is a tremendous company with a promising growth outlook, stellar cash flow profile, and pristine balance sheet. We view the company’s dividend growth trajectory quite favorably, and the strength of its dividend coverage on a forward-looking basis is impressive. Additionally, the high end of our fair value estimate range sits at $401 per share of UNH, indicating UnitedHealth Group has decent capital appreciation upside, too, as of this writing. We emphasize, however, that its dividend growth potential is the paramount reason why we include shares of UNH in the Dividend Growth Newsletter portfolio.

-----

Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Tickerized for UNH, MOH, ANTM, CNC, CI, HUM, THC, UHS, CYH, HCA, ABC, CAH, LLY, CVS, WBA, EHTH, GTS, TDOC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Health Care Select Sector SPDR ETF (XLV), Johnson & Johnson (JNJ) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment