UnitedHealth Group Still a Free-Cash-Flow Generating Machine

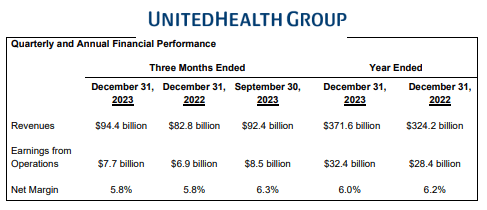

Image: UnitedHealth Group continues to drive strong revenue and operating earnings performance. Image Source: UnitedHealth Group.

By Brian Nelson, CFA

On January 12, healthcare benefits provider UnitedHealth Group (UNH) reported strong fourth-quarter 2023 results that showed revenue advancing 14% on a year-over-year basis thanks to strength at its UnitedHealthcare and Optum divisions, while earnings from operations advanced 11.6%. UnitedHealth is facing some temporary cost pressures in its business due to pent-up demand for discretionary procedures following the worst of the COVID-19 pandemic, but its net margin held up fine in the period, coming in at 5.8%, the same level a year ago. Management reaffirmed its previously-issued 2024 guidance, and we continue to like UnitedHealth Group as a key weighting in the Best Ideas Newsletter portfolio. Shares yield ~1.4% at the time of this writing.

For starters, we’re huge fans of UnitedHealth Group’s free cash flow generation, which remains robust. For 2023, cash flow from operations advanced to $29.07 billion from $26.2 billion in 2022, while purchases of property and equipment came in at $3.4 billion from $2.8 billion a year ago. Free cash flow for 2023 increased to $25.68 billion from $23.4 billion, up 9.7% on a year-over-year basis. UnitedHealth Group’s balance sheet is also in tip-top shape. The company ended the year with $77.2 billion in cash and long-term investments against a long-term debt load of $58.3 billion, good for a solid net cash position on the books. In the current market environment, we continue to be huge fans of strong free cash flow generators with pristine balance sheets.

Shares of UnitedHealth Group fell modestly following the quarterly report as healthcare costs are expected to be higher than previously expected as discretionary surgeries picked up following a slowdown during the COVID-19 pandemic. Its fourth-quarter medical care ratio came in at 85%, up from 83.2% in 2023 and 82% in 2022, and the operating margins at both its UnitedHealthcare and Optum divisions fell on a year-over-year basis in the fourth quarter. Many patients had delayed discretionary operations such as hip and knee replacements until after the worst of the pandemic, and we’re now seeing an uptick in these operations. Though it’s not great news that costs are on the rise, we think UnitedHealth Group will eventually be able to re-price premiums effectively in the longer run to recover the increased costs, and its 2024 outlook speaks to this.

In the quarterly press release, UnitedHealth Group reaffirmed the guidance it provided at its November 29 investor event. For 2024, the company expects revenue in the range of $400-$403 billion (was $371.6 billion in 2023) and adjusted earnings of $27.50-$28.00 per share (was $25.12 per share in 2023). The company’s cash flow from operations is targeted in the range of $30-$31 billion for 2024, up from $29.07 billion in 2023, showcasing continued strength where it counts. We continue to like the long-term momentum behind UnitedHealth Group’s business, and in light of the reaffirmed guidance for 2024, we’re maintaining our $582 per share fair value estimate (shares are trading at ~$519 at the time of this writing). The company's Dividend Cushion ratio stands at an impressive 3.7x, revealing considerable capacity for continued dividend growth.

----------

Tickerized for UNH, HUM, ALHC, CVS, CI, CNC, MOH, ELV

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment