Roblox Goes Public; Strong Balance Sheet and Expected Free Cash Flow

Image Source: Roblox Corporation – S-1/A SEC Filing

Executive Summary: Roblox Corporation recently went public through a direct listing on March 10, 2021. The video game platform company has an extensive growth runway with multiple avenues to further expand its business. We are impressed with its free cash flow generating abilities, pristine balance sheet, and strong growth rates of late. Roblox’s outlook for 2021 indicates its growth story is expected to continue this year in earnest. Capital appreciation seeking investors should take a deeper look at Roblox, though we caution that its co-founder, CEO, and chairman controls most of the company’s voting power.

By Callum Turcan

2021 is already shaping up to be a huge year for initial public offerings and direct listings. The video game platform company Roblox Corporation (RBLX) went public on the NYSE through a direct listing on March 10 and shares of RBLX closed that day well above the reference price of $45 per share. Roblox offers a free online platform that allows “developers” to make their own video games using the tools provided by the firm (including the tools provided by Roblox Studio), with users of Roblox able to play those games online (usually by having the user control an avatar, with the avatar engaging with the various aspects of the video game created on Roblox’s platform). Most of Roblox’s daily active users (‘DAUs’) are under the age of 13 according to the company. According to Roblox’s amended S-1 SEC filing:

An average of 37.1 million people from around the world come to Roblox every day to connect with friends. Together they play, learn, communicate, explore, and expand their friendships, all in 3D digital worlds that are entirely user-generated, built by our community of over 8 million active developers. We call this emerging category “human co-experience,” which we consider to be the new form of social interaction we envisioned back in 2004. Our platform is powered by user-generated content and draws inspiration from gaming, entertainment, social media, and even toys.

Some refer to our category as the metaverse, a term often used to describe the concept of persistent, shared, 3D virtual spaces in a virtual universe. The idea of a metaverse has been written about by futurists and science fiction authors for over 30 years. With the advent of increasingly powerful consumer computing devices, cloud computing, and high bandwidth internet connections, the concept of the metaverse is materializing.

Games developed through the Roblox platform can be played on mobile devices, consoles, and PCs. That includes the new PlayStation 5 console by Sony Corp (SNE) and the new Xbox Series X console by Microsoft Corporation (MSFT). Roblox also supports gaming on virtual reality (‘VR’) offerings, such as Facebook (FB) Oculus headset. Roblox is an interesting company, and its growth runway is extensive for reasons we will get into shortly.

Operational Overview and Growth Ambitions

Roblox benefits from the network effect as a greater user base encourages developers to build more content on its platform, and that in turn encourages existing users to stay within Roblox’s universe and new users to join in on the fun. A digital currency called “Robux” allows users to upgrade their digital avatar and acquire special in-game abilities, and most importantly, creates an avenue for Roblox and its developers to monetize content on the Roblox platform.

When someone develops a game via the Roblox platform, that developer has the option to monetize that effort via microtransactions, with revenue split between Roblox and the developer. In 2020, ‘developer exchange fees’ totaled $329 million, up sharply from $72 million in 2018. This encourages users to develop new content for Roblox’s users and helps build out the community side of the Roblox platform. Throughout Roblox’s amended S-1 SEC filing, management stresses that Roblox is much more than a video game platform company given its ability to create digital communities, which could be viewed in the realm of social media.

Roblox generates revenue by enabling microtransactions on its platform and through a subscription service called Roblox Premium (the global launch of the service was announced in September 2019). The goal of Roblox Premium goes beyond simply trying to build up recurring revenue, but to also boost user engagement of those paying users. Members of Roblox Premium get a monthly allowance of Robux, a 10% bonus when buying Robux (meaning members purchasing the digital currency as a standalone item get more of the digital currency than if they were not members), increased revenue share in the games the member developed (if relevant), and access to all the Roblox platform’s economy (buying, selling, trading in-game items).

According to its amended S-1 SEC filing, roughly 68% of Roblox’s DAUs at the end of 2020 were not in the US and Canada, though its DAUs in these two markets represented over two thirds of its bookings last year. Going forward, Roblox aims to better monetize its international user base as this part of its business is growing faster (in terms of DAU growth) than its business in the US and Canada.

Roblox sees a long growth runway in Europe, the Middle East and Africa. In particular, the firm noted it has experienced strong growth of late in Germany, France, and South Korea. Additionally, through a strategic partnership with Tencent Holdings Co (TCEHY), Roblox sees itself being well-positioned to grow the Roblox platform in China (FXI, MCHI) as well. We appreciate the geographical reach of Roblox, which has DAUs in over 180 countries.

Beyond growing its business in key geographical markets, Roblox aims to increase its user base of those who are aged 13 and older. Roblox notes that “this demographic has a higher propensity to spend on content, and our ability to increase penetration in, and user contribution from, this demographic will affect our ability to grow revenue” in its amended S-1 SEC filing and we are intrigued by the upside the firm has on this front, though it is not a given that Roblox will be successful in its endeavors. In 2020, growth in Roblox’s DAUs aged 17-24 outpaced growth seen at its DAUs who are less than 13 years old.

Roblox is also considering expanding into the realm of “entertainment, learning and business markets” as its “developers will be able to build and host virtual concerts, classrooms, meetings and conferences on Roblox” as new updates are pushed out. Expanding its geographical presence outside of North America, appealing to a wider user base, and potentially launching into new digital realms (such as telecommunications and live event hosting) underpin Roblox’s promising long-term growth runway.

Impressive Free Cash Flow Generating Abilities

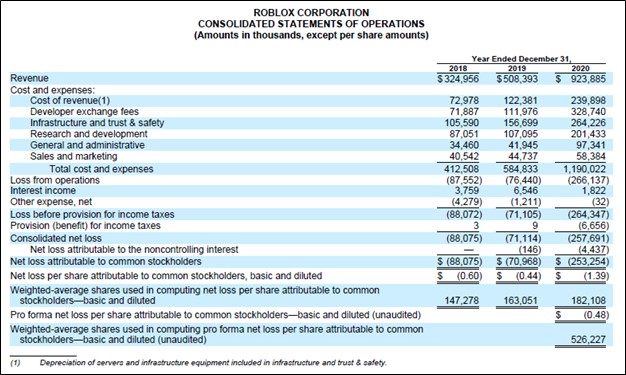

As with many tech companies that have recently gone public, Roblox continues to operate at a GAAP operating loss but its ability to generate free cash flow continues to impress. From 2018 to 2019, Roblox’s GAAP revenues grew by 56% while its operating expenses surged by 42%, resulting in only a minor reduction in its GAAP operating loss during this period.

Roblox’s strong revenue growth continued into 2020, when its GAAP revenues jumped higher by 82% year-over-year, though its operating loss swelled during this period due to expenses related to its direct listing and other factors. At the end of 2019, Roblox had about 360 full-time employees which surged to roughly 960 full-time employees at the end of last year (alongside over 2,300 “trust & safety agents” around the world).

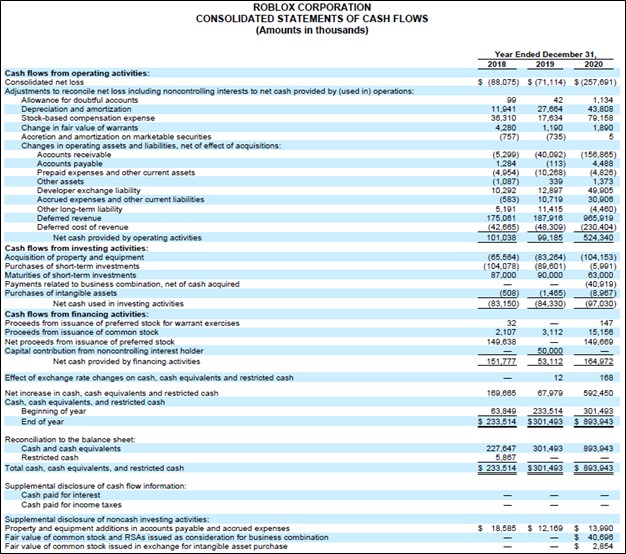

While Roblox has been running at a GAAP operating loss, the company remains comfortably free cash flow positive. Roblox generated positive annual free cash flow each year from 2018 to 2020, generating over $0.4 billion in free cash flow in 2020 (up many-fold from 2019 levels). The company’s cash flow profile is impressive.

Image Shown: Roblox posted positive annual free cash flows every year from 2018 to 2020. Image Source: Roblox – S-1/A SEC Filing

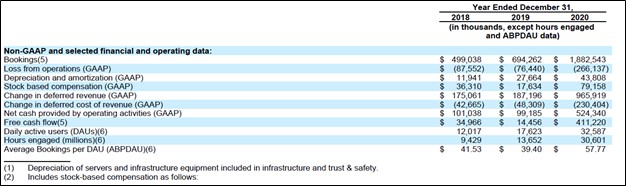

Roblox provided guidance for 2021 on March 2 that called for the firm to post $1.44-$1.515 billion in revenue this year, representing 56%-64% year-over-year growth. Roblox aims to grow its daily active user (‘DAUs’) base by 6%-12% this year versus 2020 levels, indicating a significant part of its revenue growth story involves better monetizing its existing user base. The company expects to record $2.0-$2.125 billion in bookings in 2021, representing 6%-13% year-over-year growth.

Due in part to the surge in demand for video games during the coronavirus (‘COVID-19’) pandemic, with many primary school-aged children forced to seek indoor entertainment, Roblox expects its ‘hours engaged’ to be broadly flat (+/- 3% year-over-year) in 2021, though that is impressive performance given that its hours engaged metric more than doubled in 2020 (after growing by 45% annually in 2019).

Image Shown: Roblox’s user base is growing, seen through sharp increases in its DAUs over the past couple of years, and is becoming increasingly engaged, seen through the sharp increases in hours engaged over the past few years. Image Source: Roblox – S-1/A SEC Filing

Roblox’s GAAP margins are impressive, standing at 74.0% in 2020, though its ‘developer exchange fees’ and ‘infrastructure and trust & safety’ line-item operating expenses represent essential aspects of its business as well. Please note that the depreciation expense associated with servers and infrastructure equipment is included within the infrastructure and trust & safety line-item and not the ‘cost of revenue’ line-item located on Roblox’s income statements.

Image Shown: Roblox’s gross margins are rock-solid. Image Source: Roblox – S-1/A SEC Filing

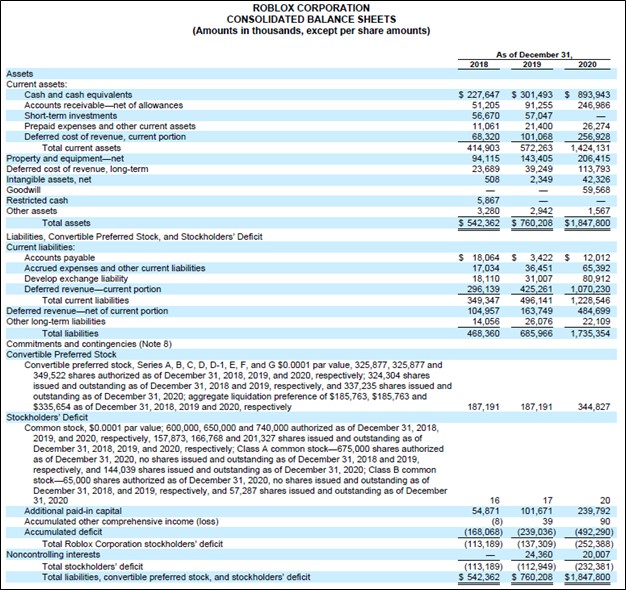

Sometime in the future, Roblox will need to lift its foot off the gas pedal as it concerns its operating expense growth, specifically growth related to its growing headcount (some of Roblox’s operating expense growth is a direct product of its revenue growth). However, Roblox exited 2020 with a pristine balance sheet and remains comfortably free cash flow positive, giving the firm ample financial firepower to continue growing its business. At the end of last year, Roblox had $0.9 billion in cash and cash equivalents on hand with no debt on the books.

Image Shown: Roblox had a pristine balance sheet at the end of 2020. Image Source: Roblox – S-1/A SEC Filing

Roblox expects to post $0.32-$0.34 billion in net operating cash flow this year, down from 2020 levels though its 2021 guidance factors in special items related to its direct listing. The company’s cash flow generating abilities are impressive. There is a level of seasonality, as Roblox generated 34% of its annual revenues in the fourth quarter of 2020 (up from 29% in the fourth quarter of 2018). Please note this means Roblox’s financial performance is dependent in part on the firm doing a solid job capitalizing on elevated consumer spending during the holiday shopping season primarily in Western countries.

Valuation Analysis

Roblox is one difficult company to value, but we believe that the universal framework for calculating the value of an entity is the discounted cash-flow process (enterprise valuation). The framework rests in calculating the net cash position on the balance sheet and adds that to the present value of the future free cash flows one expects the company to deliver to investors over the long run. You can read about how to value a stock with respect to enterprise valuation in the book Value Trap: Theory of Universal Valuation.

The first place to start with respect to Roblox's valuation is to subtract the company's convertible preferred stock balance from its net cash position. This results in a valuation foundation of ~$550 million in equity, but we still have to value the company's future expected free cash flow stream, which is by far the most important part of the equation.

Roblox's free cash flow has just started to explode, with the firm hauling in $411 million during fiscal 2020 alone. In light of the company's strong expected revenue growth and bookings growth expectations, deferred revenue should be expected to swell meaningfully on the cash flow statement, driving operating cash flow significantly higher in coming years, while capital spending may grow more modestly, driving huge expected increases in free cash flow generation.

Though Roblox may experience some cash flow pressure in 2021 based on management guidance, on a mid-cycle normalized basis (about 5-7 years out), $1.5-$3 billion in free cash flow seems achievable. After all, Roblox is already generating north of $400 million in free cash flow on an annualized basis (as it did in 2020)--but it's still expecting to grow its top line at a breakneck 56%-64% pace for 2021! We would expect some earnings leverage to eventually kick in and capital spending requirements seem less intensive than the average firm.

Putting its valuation together, using a conservative 10% cost of capital (which may be high in today's environment), we could see Roblox fetch a valuation of ~$43 billion {[$3 billion/[.1-.03] + $550 million} on the basis of a growing perpetuity with a 3% growth rate and in light of its healthy cash position on the books. The company's market capitalization is just shy of $40 billion at the moment, and our scenario may approximate what the market is anticipating, but investors should remain cautious. Our valuation of Roblox is very sensitive to normalized free cash flow expectations as well as the discount rate we apply.

For example, if we were to use a 8% cost of capital, which some may argue is more appropriate in light of all-time low (but rising) interest rates, an equity valuation north of $60 billion may be more appropriate, revealing meaningful upside potential. However, if we were to use a 10% cost of capital and $1.5 billion as our mid-cycle free-cash-flow assumption, then its equity value would come in at ~$22 billion, well below where shares are trading today. In any case, the future direction of interest rates and Roblox's free cash flow trajectory will play a big role in the future direction of its equity price.

Management and Ownership Analysis

Back in 2004, David Baszucki and the late Erik Cassel founded Roblox. As CEO, chairman and co-founder of Roblox, Mr. Baszucki has an outsize say over the decisions of the company as he had control over 70% of Roblox’s voting power as of January 15, 2021, due to his ownership of all Roblox’s Class B stock. Shares of Roblox’s Class A stock trade on the NYSE.

Dual class structures are common for companies run by their founders and are not inherently terrible (they may not be good for outside investors but are not necessarily detrimental to the success of the company), though investors need to have a significant amount of faith in the firm’s founder(s) to make the right decisions.

Concluding Thoughts

We appreciate Roblox’s pristine balance sheet, ability to generate sizable free cash flows, and its promising growth trajectory. The company should be able to put itself in a position to generate positive GAAP operating income in the medium term, though Roblox will likely continue to scale up its business for the time being given its long growth runway.

In its amended S-1 SEC filing, Roblox notes that “to support and grow (its) business, (it) intend(s) to increase (its) headcount for the foreseeable future” which is a reasonable move, in our view. Roblox’s growth story is intriguing, though we caution that the fair value estimate range for RBLX is enormous. Shares of Roblox will likely experience volatile trading activity going forward as investors await the firm’s first quarterly earnings report as a publicly-traded enterprise.

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for RBLX, TCEHY, SNE, GNUS, EA, ATVI, TTWO, ZNGA, PLTK, NTDOY, SGAMY, GME, NCBDY, UBSFY, HEAR

Other: ARKW, GAMR, ESPO, NERD, FXI, MCHI, EWJ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment