Report Updates -- Did You Throw the Baby Out with the Bathwater?

Hi everyone:

Brian here. I hope you are having a nice Labor Day holiday weekend.

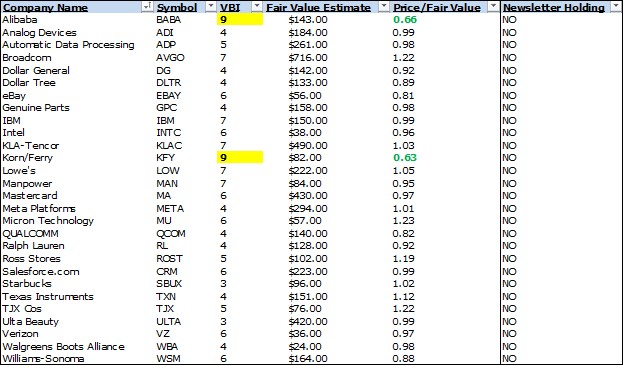

We wanted to bring your attention to a number of stock report updates. Both Alibaba (BABA) and Korn/Ferry (KFY) have registered one of the highest ratings (9) on the Valuentum Buying Index. To garner such a high rating, a company would have to be considered undervalued on a discounted cash-flow basis, undervalued on a relative value basis, as well as exhibiting strong technical/momentum indicators. Alibaba looks like it could pop quite a bit from current levels after technically basing for months, and while risks related to the name are tremendously high given rising U.S.-China tensions, shares sure look undervalued to us. Korn/Ferry’s shares also look quite cheap, but it lacks a fundamental catalyst for us to get really excited about the name, and we won’t be adding it or Alibaba to any newsletter portfolio.

Right now, we’re extremely happy with how the newsletter portfolios are positioned. Both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio “outperformed” the market-cap weighted S&P 500 (SPY) last year, and we not only “overweighted” one of the strongest sectors in energy last year but we emphasized in January of 2022 near the market peak NOT TO THROW THE BABY OUT WITH THE BATHWATER. We spelled it all out back in January 2022: “Junk tech should continue to collapse, but the stylistic area of large cap growth and big cap tech should remain resilient.” Resilient has turned out to be an understatement. We outlined some of the big winners in the September edition of the Dividend Growth Newsletter (pdf), but the winners in the Best Ideas Newsletter portfolio this year have been just as good, even better. Alphabet (GOOG), Visa (V), Apple (AAPL), Microsoft (MSFT), Cisco (CSCO)…after newsletter portfolio outperformance in 2022, this year has been great!

My read of the situation the past couple years is that it hasn’t been a great one for many investors. Based on my assessment, I think many sold out of big cap tech and the stylistic area of large cap growth during the June and October swoons just about the time the stock market was bottoming. Many may have rotated into high dividend paying stocks, which haven’t done much the past few years and ended up missing out on one of the biggest relative moves in big cap tech and the stylistic area of large cap growth that we’ve ever seen. Some of those high dividend paying stocks may have been REITs (VNQ), too, which are down more than 11% over the past 52 weeks, while the market-cap weighted S&P 500 is up nearly 14%. Others may have rotated into investment-grade bonds or the equal-weight S&P 500 (RSP) last year, and both of these moves weren’t great either. The iShares Core U.S. Aggregate Bond ETF (AGG) is down 4% on a price-basis during the past 52 weeks, while the equal-weight S&P 500 has trailed the market-cap weight S&P 500 by more than 7 percentage points.

The right move was to not throw the baby out with the bathwater and stick with big cap tech and the stylistic area of large cap growth. These entities have large net cash positions on the balance sheet and generate gobs of free cash flow--two of the primary cash-based drivers of intrinsic value. Stock prices and returns are in part a function of the net cash a company has on its balance sheet and changes in future expectations of enterprise free cash flow. All else equal, if changes in future expectations of enterprise free cash flow increase, so should the stock price. If changes in future expectations of enterprise free cash flow decrease, the stock price should fall. With most of big cap tech and the stylistic area of large cap growth overflowing with net cash on the books and the market building in ever-higher expectations of enterprise free cash flow due to the catalyst that artificial intelligence has become, it’s no wonder why these areas have been big winners.

Let’s discuss a few more changes from the table above. First, Walgreens (WBA) is in a world of hurt, and we’ve cut our fair value estimate on the company. Its free cash flow is subpar these days, and all the wheeling and dealing that it has done the past few years is finally catching up to it. We’d be extremely cautious on this one as it may be turning into a yield trap, despite holding the Dividend Aristocrat label. IBM (IBM) continues to pull capital out of its business as capital spending continues to fall short of depreciation, and we’d be cautious about getting lured into shares by its dividend yield, too. Verizon (VZ) is one that we’d be very careful with, too, given the company’s massive net debt position, capital-intensive business model, and potential liabilities associated with lead-sheathed telecom cables. All three of these dividend payers have large net debt positions, which is part of the reason behind their low price-to-earnings (P/E) ratios. A low P/E ratio does not mean shares are undervalued; it is sometimes explained by the company’s net debt position, which is a reduction to the present value of discounted future enterprise free cash flows in arriving at equity value.

Mastercard (MA) continues to be one of our favorite businesses, and its free cash flow margins are absolutely phenomenal. The company’s shares recently notched an all-time high. We would include the firm in the Best Ideas Newsletter portfolio, but we already have peer Visa (V) in there as one of the portfolio’s top weightings. To a large degree, it’s a toss up between whether we include Mastercard or Visa in the Best Ideas Newsletter portfolio, and we’ve opted for the latter, though both benefit from the same trends, namely the ongoing proliferation of e-commerce. Meta Platforms’ (META) future expected financials look great again, and the company fits right into the theme of big cap tech and the stylistic area of large cap growth, but we were burned on the stock last year. Though the social media giant is back on track, last year revealed vulnerabilities in the company’s business model that we weren’t aware of, namely with respect to the impact competition could have on its growth and profit trajectory. Meta’s economic moat is not as strong as we once thought.

As for the semiconductor space (SMH), several companies are facing free cash flow pressures as their capital spending levels skyrocket. Intel (INTC) is shelling out a considerable amount in capital spending such that its free cash flow is on target to be massively negative this year, by our estimates. Texas Instruments (TXN) is another entity that is engaging in a massive capital spending cycle, pressuring its free cash flow and impacting its future pace of dividend growth. Micron (MU), on the other hand, is retrenching as it is feeling a huge impact from the cyclical dynamics inherent to the storage business. The massive change in the outlook for Micron means that we won’t ever consider the firm for any newsletter portfolio. Free cash flow is looking about as ugly as it gets at Micron these days after two very good years. Some companies are just “uninvestable” no matter how seemingly cheap they may look.

Let’s talk about a couple “sleepers” in our coverage. eBay (EBAY) continues to throw off material free cash flow, and its digital advertising initiatives are bearing fruit. The company doesn’t quite reach undervalued levels based on our process, but we continue to be surprised at the sustainability of its business model. Manpower (MAN) has traditionally been a strong free cash flow generator, but its operating cash flow has faced material pressure the past few years. Manpower’s operations are under pressure, but shares should be relatively resilient, and its forward estimated dividend yield of ~3.7% looks well-covered on the basis of its Dividend Cushion ratio, at least for now. Ross Stores (ROST) and TJX Companies (TJX) are doing quite well, but we think their shares are starting to get pricey, likely because many investors seeking retail exposure have ditched the traditional department stores in favor of them.

We’ve cut our fair value estimate of Dollar General (DG) to incorporate its latest quarterly results and outlook, and we made a good move removing it from the Best Ideas Newsletter portfolio some time ago. Our channel checks a number of months ago showed an operation that failed to impress, and the firm continues to spend capital building new units while operating cash flow is being pressured due in part to shrink, which has become a big problem across the retail industry, more generally. Lowe’s (LOW), Starbucks (SBUX) and Ulta Beauty (ULTA) seem fairly priced after our latest valuation model updates, and while Williams-Sonoma (WSM) continues to generate impressive levels of free cash flow, it continues to experience a very difficult revenue environment in the midst of increased competition from Etsy (ETSY) and others. Ralph Lauren (RL) is holding up better than most, but the company just doesn’t fit the bill of what we’re looking for in the newsletter portfolios these days.

As a side note, the major weakness at Walgreens and Dollar General could make Realty Income (O) an interesting short idea candidate given that these two entities are among its top tenants. Realty Income continues to boast a massive net debt position, which stands at ~$19.3 billion at the end of the second quarter, and the firm’s operating cash flow less its ‘investment in real estate’ remains firmly negative through the first half of 2023, all the while rising interest rates continue to pressure REIT shares more generally, and e-commerce continues to proliferate, putting many retailers backs against the wall. We continue to include a couple select REITs in the High Yield Dividend Newsletter portfolio, but we expect REITs to continue to languish in the current economic environment, particularly as brick-and-mortar remains under pressure and as employees balk at returning to the office. It’s quite possible we have seen the best in REIT equity performance for a very, very long time, but to be fair, REITs haven’t done great the past decade either, trailing the broader S&P 500 over this time period.

All told, the markets are finally making sense again, and we remain huge fans of big cap tech and the stylistic area of large cap growth. Though entities are starting to register high ratings on the Valuentum Buying Index, we’re not pulling the trigger on either Alibaba or Korn/Ferry in light of the tremendous risks related to U.S-China relations for Alibaba and the lack of fundamental catalysts for Korn/Ferry. That said, should these firms’ technical and momentum indicators shape up, their equity prices could really catch a bid, in our view. The newsletter portfolios continue to deliver in a big way, not only generating "outperformance" relative to the market-cap weighted S&P 500 during 2022, but also positioning well for the boom in big cap tech and the stylistic area of large cap growth that has materialized in 2023. We’ve said it before, and we’ll say it again: Don’t throw the baby out with the bathwater. Thank you for reading and have a nice holiday weekend!

Select the company's link below to access their stock webpage where their 16-page stock report (pdf) can be downloaded. The stock webpage also houses the company's dividend report (pdf), where applicable, as well as the latest company/industry commentary and news.

Automatic Data Processing (ADP)

Walgreens Boots Alliance (WBA)

Kind regards,

Brian Nelson, CFA

President, Investment Research

Valuentum Securities, Inc.

brian@valuentum.com

Questions for Valuentum’s Brian Nelson >>

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment