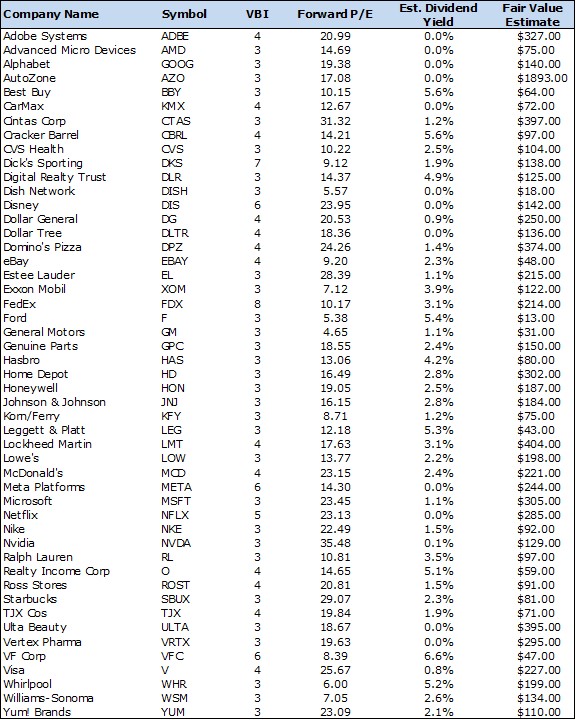

Recent Fair Value Estimate Updates

Image Source: Valuentum

By Brian Nelson, CFA

Our work is always forward-looking in nature, consistent with the markets, which drive pricing and valuation on the basis of future expectations. 2022 has no doubt been a difficult year for many an investor across asset classes, not just equities. Perhaps the biggest insight provided by the Valuentum analyst team for this year came in the second edition of the book Value Trap, “Renowned Investor Brian Nelson Publishes Second Edition of Best Indie Book Award Winner Value Trap: Theory of Universal Valuation,” but such an insight has often been reiterated on our website and through the newsletters, too.

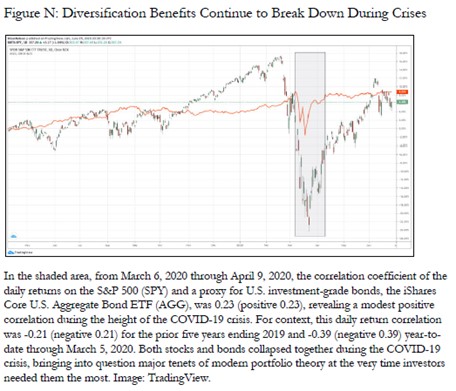

To put it bluntly: We became significantly worried about the diversification benefits of the 60/40 stock/bond portfolio a few years ago, and sure enough during 2022, the 60/40 stock/bond portfolio is now having its worst year since the Great Depression, by some estimates. This is yet another example of where investors and advisors may fall into traps, relying too much on historical data/statistical correlations that may not be relevant today. On the most basic level, rising interest rates are negative to both stock and bond values, and while the sell-off in equities has been surprising this year, the corresponding and nearly unprecedented weakness in bonds should not have been surprising to Valuentum members.

An Excerpt from the Second Edition of Value Trap, released in 2020

Image Source: The Second Edition of Value Trap, released in 2020

Many of our members have told us that we nailed this call, and we think growing "bearish" on the benefits of the 60/40 stock/bond portfolio prior to what is turning out to be a multi-sigma event for the portfolio may be better than our landmark call on MLPs (AMLP) prior to their collapse in 2015, or better than our warning on the value factor, before its worst year in history in 2020. We’re proud to have gotten ahead of this trend, and while the S&P 500 (SPY) hasn’t done great this year, equities pack a much more powerful punch to returns over the long run, meaning that those with the 60/40 stock/bond portfolio may be getting a bad deal – they’re exposing themselves to too much downside risk with bonds, for not as much return as that of equities.

We’re all waiting for a quick rebound in stocks, but it may be some time yet before we can talk about potentially reaching new highs in the equity markets again. For starters, our analyst team has updated a number of stock and dividend reports the past couple weeks as a result of a substantial weakening in the global economy, signaling to us that there are some very tough times ahead, as we have outlined in the following work: “Microsoft Hinted at Trouble… (October 8),” “Things Have Changed Fast… (October 5),” “Nike’s Fundamental Backdrop Speaks of Serious Impending Global Recession” (September 30), “Things Are Bad Out There (September 28),” “…Food Price Inflation Continues to Wreak Havoc on Consumer Budgets (Sep 21),” “U.S. Housing Market Showing Signs of Weakness (September 11),” “Massive Unrest in Europe, Energy Crisis Could Be the Catalyst to Topple the Global Markets (September 8),” “Now Bearish… (September 5), “Outlook for Europe, China Is Bleak (August 31),” “Video: We Expect A Huge Market Flush! Looking to “Raise” Incremental Cash (August 27),” “ALERT: Making Some Big Changes (August 19).”

These updated reports largely cover the consumer discretionary arena (XLY), but we have made a number of changes to the fair value estimates of ideas in the simulated Best Ideas Newsletter portfolio, as well as in other areas from FedEx Corp. (FDX) to AMD (AMD). We’ve grown bearish on the equity markets, and while the change to bearish from bullish may seem abrupt, things have changed fast, as we have outlined in our October 5 note above. Importantly, many members have also noted that we "saved them" from diving head-first back into the market in August in the midst of what turned into a bear market rally and then another big sell-off. Since August 19 when we started to “raise cash” in the simulated Best Ideas Newsletter portfolio, the S&P 500 has fallen by more than 14%. We’re staying very much on top of things for members. Importantly, we removed PayPal (PYPL) from the simulated Best Ideas Newsletter portfolio at that time in August.

2022 has been a difficult market environment and arguably one of the most challenging I have had to handicap since I started in this business. The selling at the start of the year may have easily been dismissed as repercussions from a fallout in alternatives, namely crypto, non-fungible tokens, and collectibles, but this negative wealth effect spilled over into Silicon Valley, where selling among the largest and strongest tech stocks ensued, a dynamic that coincided with Meta Platforms’ (META) weakness due to Apple’s (AAPL) iOS changes and TikTok’s rise. Then, the weakness at the big box retailers, inventory builds at discretionary players, coupled with yet another impending negative wealth effect from stock, bond, housing declines, which may have yet to materialize.

This year has fell apart in a hurry. As we have outlined in the links to the many works above, there’s a lot of negatives out there in the global marketplace, and by extension, we would not be surprised if this third-quarter earnings season becomes a very difficult one for S&P 500 companies (with a lot of negative guidance revisions). We continue to be significantly “overweight” the energy sector across the simulated newsletter portfolios, save for the simulated ESG Newsletter portfolio, and we won’t hesitate to drop Meta Platforms if its outlook disappoints when it reports third-quarter results.

Concluding Thoughts

We’ve made a number of fair value estimate changes across our coverage universe as a result of what we expect to be substantial weakness in the global economy in the coming quarters.

Many of our fair value estimate adjustments have come in the consumer discretionary sector, but we have also made tweaks to the fair value estimates of companies in the simulated Best Ideas Newsletter portfolio. Though 2022 has been a tough year, we’ve been steady at the wheel, calling the nearly unprecedented fall in the 60/40 stock/bond portfolio this year, the mid-teens percentage weakness in the SPY following the summer rally, all the while driving “outperformance” through the latest simulated Best Ideas Newsletter portfolio update August 19. Another update will be forthcoming.

This year has been tough, but it’s been a lot worse for asset allocators that missed out on the big bull market run in equities if they held a hefty allocation in bonds the past decade. Let’s keep our guards up as this market looks like it might get a lot worse before it gets better.

Nelson: Executing the Valuentum Strategy (September 1) >>

-----

----------

Image Source: Value Trap

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment