Putting the Environmental in ESG

Valuentum’s ESG newsletter helps identify which stocks have strong ESG scores, and which ones come up short. Subscribe to the monthly Valuentum ESG Newsletter today by selecting the ‘Subscribe’ button below (12 editions, $1,000/year).

By Valuentum Analysts

There is no single definition for ESG investing beyond the words that make up the acronym – Environmental, Social, and Governance. Investors looking at ESG may be doing so for a variety of reasons with a variety of different needs. But for every investor, a focus on ESG allows for a fuller consideration of the company, as a whole, as well as how that company impacts the 21st century landscape, as it relates to rewarding social responsibility by investing in companies that meet a certain benchmark for creating a positive impact on the world.

Investing will always be a holistic process, meaning that while ESG factors are very important, it's also good not to ignore other considerations of a good investment either. For example, one might not put their hard-earned money in a company with high ESG marks if it's headed toward tough times or even bankruptcy, but it may make a lot of sense to segment the population of fantastic investment ideas to find those that also emphasize and score well on ESG. We like ESG because it provides investors with ideas that are the best of both worlds: great investments that are also doing their part to make the world a better place.

E is For Environmental

The first consideration of ESG is Environmental. In a world of climate change, it may be difficult to see just how a company can be environmentally responsible while also putting the needs of investors first. As fans of The Good Place know, the increasingly complex nature of our existence (and our carbon footprints) brings about some thorny philosophical questions related to how to be “good” or how to judge that “goodness.’’ In the context of investing, we don’t have to solve all of these problems in order to identify companies that are doing better than others to be stewards of the environment.

The CFA Institute identifies several considerations for the environmental facet of ESG, including things like climate change, carbon emissions, air and water pollution, deforestation, energy efficiency, water scarcity, and more. Investopedia lists criteria that “include a company’s energy use, waste, pollution, natural resource conservation, and treatment of animals.” With such a broad swath of considerations, this is a complex analysis.

However, looking more deeply into how a company and its products interact with the environment on everything from research to manufacturing and energy use can yield a great deal of information on not only how environmentally conscious a company is, but also on the environmental risks the company faces. These risks can have financial implications on the company’s bottom line if not properly managed, but there can also be social pressures on the company that should be monitored as well.

For example, the pipeline arena is rife with social and environmental risk. Just this week, on October 4, 2021, it was reported that Amplify Energy (AMPY) suffered an oil leak off the California coast. The split of just 13 inches of a section with 4,000 feet of pipeline dumped as much as 144,000 gallons of crude oil into the waters of the Pacific. Though the latest oil spill in California doesn't come close to the Exxon (XOM) Valdez oil spill (1989) or the Deepwater Horizon spill in the Gulf (2010), the ecological costs to society from oil spills continue to be ongoing.

Pipelines are notorious for rupturing and causing environmental damage, which is why leaders at the top of these organizations need to be responsible and act in an ethical manner. But that's not always the case. This week, for example, the Pennsylvania Attorney General filed 48 counts of environmental crimes against Energy Transfer (ET) as a result of "repeatedly spilling thousands of gallons of drilling fluid" and failing "to report the spills to state environmental regulators" while working on the Mariner East 2 NGL pipeline.

Fines and operational disruptions are tangible items that impact the bottom lines of companies.

Environmental Analysis

Valuentum’s ESG analysis has several components. The first is a general assessment of the industry in which a company operates. This consideration looks at “how much of the company's revenue is derived directly or indirectly from the sale of tobacco, alcohol, weapons, gambling, crude oil or its derivatives, coal mining, coal-fired power plants, or other questionable activities that contribute heavily to environmental pollution (e.g. transportation, chemicals) or are generally associated with 'sin' stocks.”

If a company is making money from activities that are destructive to the environment, then the first section of Valuentum's ESG analysis essentially takes them out of the running for a high score on the ESG Scoring System. Some companies that wouldn't receive high marks in the first section cover a meaningful percentage of the S&P 500, as our rating system is not only punitive on mining and fossil fuel producers (directly), but also those that transport fossil fuels or use them heavily in their operations (indirectly), including transportation companies such as airlines like Delta (DAL) and trucking/delivery operators like FedEx (FDX), UPS (UPS), or Knight-Swift (KNX).

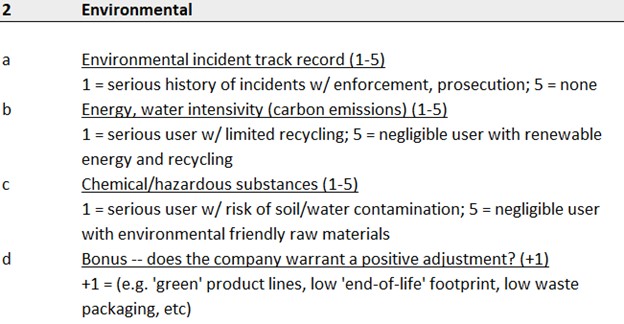

The next set of considerations has to do with how well a company is managing specific things like its environmental incident track record, carbon emissions, and risk of contamination. Each of the aspects below contributes a smaller percentage to the total score, but they are important to how the company operates as well as the potential risks if something goes wrong--or if regulations/penalties change in the future. These could also be areas that open up legal risks for companies if there is a spill, contamination, or other environmental event. Obviously, entities such as Amplify and Energy Transfer would be punished heavily in this area. Our analysts assign a score to each of the below items, as follows.

Image: This excerpt from the Valuentum Environmental, Social and Governance (ESG) Scoring System shows how environmental considerations are analyzed.

The final consideration that Valuentum looks at related to the environment are any positive adjustments for things the company is doing to reduce their carbon footprint. The intent to offset any damage done by normal business activities can balance out some inherent risk the company carries due to the industry it operates in. This is why we might not be completely negative on all mining entities such as South32 (SOUHY) and some other fossil fuel companies.

It, nonetheless, should be clear that there are certain industries, including those involved in mining and fossil fuels, that have an outsized risk just because of their industry, and there are other energy-intensive operations, such as manufacturing that will reduce the score no matter the industry. We believe a qualitative assessment allows our analysts to adjust for the unique environmental features of each company, helping to contribute to a score that is informative from a holistic standpoint.

Scoring low on an ESG rating doesn’t mean that a company can’t be “good” by any other measure – including on a price-to-fair value estimate (P/FV) basis or on the Valuentum Buying Index (VBI). It just means that viewing the company through an environmental lens reveals some concern for sustainability and risk. With our ESG focus, we like to find companies that not only have great investment potential but also register strong ESG scores.

The Bottom Line

Environmental considerations are just one piece of the ESG analysis, but they can reveal a lot about a company and its values. Companies that make a commitment to protecting the environment, especially those that are doing it better than their peers, are not only recognizing the social importance but also protecting themselves--and their investors--from negative financial impacts related to environment issues.

-----

Valuentum’s ESG newsletter helps identify which stocks have strong ESG scores, and which ones come up short. Subscribe to the monthly Valuentum ESG Newsletter today by selecting the ‘Subscribe’ button below (12 editions, $1,000/year).

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Tickerized for AMPY, XOM, ET, DAL, FDX, UPS, KNX, SOUHY, XLE, XOP, AMLP, AMZA, XME, LRGE, WOMN, NACP, ESGV, SUSL, SDG, ICLN, QQQ, XLU, ASML, TSM, FB, ORCL, RSG, AMRC, ALB, NEE

0 Comments Posted Leave a comment