Post-Mortem on Facebook (Meta Platforms): Apple Crushed Our Thesis

Image: Thesis creep kept us excited about Meta, but we've since trimmed the "weighting" in the simulated Best Ideas Newsletter portfolio, as updated August 19. What more can we say--Apple is eating Facebook’s lunch, and the iPhone giant is now advancing with its advertising revenue, too. Apple blew up our thesis on Meta, and that's the long and short of it.

By Brian Nelson, CFA

Meta Platforms (META) wasn’t the first idea that hasn’t worked out perfectly for us, and it won’t be the last. Frankly, we’re as surprised as the next person at how quickly things fell apart at Meta, and there wasn’t much time to be patient on the idea as the savviest portfolio managers like to do. The collapse was swift and deep.

But again, it wasn’t our first misstep, and it won’t be our last.

In the High Yield Dividend Newsletter portfolio, we took on the risk of AT&T (T) when we knew that the company had a huge net debt position, one of the reasons why the company had an elevated dividend yield in the first place. But we put our confidence in AT&T CEO John Stankey, who had said he’d support the dividend in its Annual Report (2/8/21), and the company had the free cash flow to do so.

AT&T wasn’t an unforced error. We knew it was a high-risk yield play (its Dividend Cushion ratio was -0.1, where anything less than positive 1 is considered risky), and we knew high yield dividend stocks themselves are not for the faint of heart. When it came to AT&T, quite simply, the CEO pulled a 180 on us, and cut the dividend on account of pursuing a new strategy. There’s not much we could do about that, having subsequently removed shares from the High Yield Dividend Newsletter portfolio last November.

Then, there was, of course, PayPal (PYPL), which we just removed from the simulated Best Ideas Newsletter portfolio on August 19. As long-term investors, we can’t complain about the "returns" from PayPal after it was spun-out of eBay (EBAY)—they have been good—but what a disaster of a year for the company in 2022. With hindsight being 20/20, and this hasn’t been the first time we’ve said this, we could have “outperformed” the market even more had we "taken" some profits on Meta and PayPal at the top.

The latest experience with Meta and PayPal has reminded me of another name we had trouble with in the past, Teva Pharmaceuticals (TEVA). Here’s what we wrote about Teva back in early 2017:

Lacking exposure to the broader equity market during these “frothy” times, we had decided to let this big winner run after it converged to fair value in April 2015 (and it was only a small position at cost), but the decision to do so has clearly come back to bite us in a big way. You may say that we nailed the valuation dynamics for shares, and the Valuentum Buying Index rating system did what it was supposed to do, but we didn’t execute effectively at the portfolio management level. Said differently, our valuation processes and methodology worked wonderfully, but broader market dynamics kept us involved when we should have taken profits off the table.

What has happened in the past is now behind us, however, and today, we have the difficult task of having to evaluate Teva with a fresh mind on a go-forward basis, both with respect to the company’s ongoing fundamentals and whether it should remain in the Best Ideas Newsletter portfolio. Our experience with Teva is one of the most disappointing situations we’ve ever been in--watching this big winner fall back to cost. Everything about the Valuentum methodology told us to consider removing shares when technicals rolled over at fair value in the mid-$60s. The Valuentum process didn’t fail--we came up short on execution.

That was back in early 2017 -- and look at how great things have been since then!

Some readers like to throw stones, and that’s okay, but we don’t judge our successes on one or two or three ideas over the course of the past few years. We use the Valuentum Buying Index to source ideas in a diversified manner in the simulated Best Ideas Newsletter portfolio. To cherry pick a few ideas that didn’t work out this year and ignore the Exxon Mobil (XOM) and Chevron (CVX) calls that are up huge since mid-last year isn’t quite how we look at things.

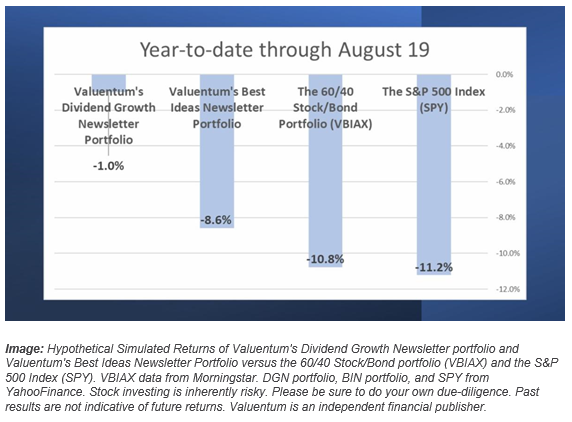

The simulated Best Ideas Newsletter portfolio is outperforming the market (and the 60/40 stock/bond portfolio) through August 19, 2022, this year. It seems no matter how many times I say it, no matter how many times I write about it, we always must revert back to #10 on the “16 Most Important Steps to Understand the Stock Market,” a note I wrote way back in 2013, almost a decade ago now. Here’s an excerpt from that note:

10) Investors Will Not Get Everything Correct But Getting Everything Correct Is Not The Goal of Investing. If you believe that you will get everything correct as an investor, you may want to consider outsourcing your investment decision-making to a money-manager because it's almost certain you will be disappointed. Individual investors sometimes think that every idea should work out, and immediately at that. This, unfortunately, is wrong. If you are a good investor, your winners will outperform your losers and you will make money. If you're an excellent investor, you'll still have a lot of losers, but you'll end up beating the market.

The fact of the matter is that you will be wrong at times, but that's okay. You will make mistakes, and they won't be tragic (hopefully). Some of your investments will lose money. It's inevitable. Investing is about achieving goals, not being correct all of the time. I remember one time I received an email from one of our members. He proceeded to tell me that he was so happy that we picked 8 winners, but he was extremely disappointed that 1 of our ideas did not work out. For some reason, he didn't understand that an 8 to 1 ratio is not only good, but unbelievably fantastic! Importantly, it seems that no matter how many times investors read this step, it never quite takes with them.

Yep, I wrote this all the way back in 2013.

The reality is that with the Meta Platforms thesis, Apple (AAPL) simply crushed it, and we were in denial for many months, even as we prudently executed patience. Months ago, we thought the iOS privacy changes may spur additional advertising spending at Facebook. Instead, advertisers flinched. We were huge fans of Meta’s free cash flow, and then when we saw the additional expected capital spending influx, we wrote it off as just another investment cycle. But it was an abnormally higher amount of spending. Why Zuckerberg, why!?

When others were criticizing the metaverse, we stayed optimistic for far too long. We still think the metaverse will pan out, but it’s hard to predict what may happen 5-10 years into the future, and the "hair on the name" just became far too much. With Meta, we experienced “thesis creep,” and when we got word that Meta would issue new debt, that was the last straw. No longer was it growing fast, no longer was it as strong of a free cash flow generator, and no longer was it going to be a debt-free powerhouse. Ugh! Our thesis became completely broken right in front of us – in a matter of just a few months!

We’re as disappointed as anyone, but everyone knows that being wrong with one or two or five or ten ideas is just part of investment idea generation, and that’s what happened with Teva Pharma years ago, AT&T more recently, and then with Meta and PayPal this year. We’re just not going to get everything right, and while we’re disappointed in a couple of our calls so far in 2022, what a shame if it means we must keep our heads down when the simulated Best Ideas Newsletter portfolio is “outperforming,” not only the SPY but also the 60/40 stock/bond portfolio through August 19, 2022, this year.

In this business, we understand you never hear about the big calls you get right. You only hear about the calls you get wrong, and we’re okay with that. We understand. That’s something we learned a long time ago. We’re disappointed in Meta and PayPal, too, but only just as much as we’re proud of Exxon Mobil and Chevron – our last two ideas in the simulated Best Ideas Newsletter portfolio that are up huge since they were added! We have to keep everything in portfolio context, and we know that almost all of our members do.

The video below talks about diversification and how we use the Valuentum Buying Index to source ideas. Investors treading with any fewer than 15-20 stocks are taking on far too much firm-specific risk, in our view. As a final note, we still like Meta near these technical support levels, but only as a smaller "weighting" in the simulated Best Ideas Newsletter portfolio, as updated August 19. What more can we say--Apple is eating Facebook’s lunch, and the iPhone giant is now advancing with its advertising revenue, too.

We can’t look back with Meta and PayPal, no more than we can with Teva and AT&T, and the many other stocks we’ve gotten wrong the past decade. Having both winners and losers is par for the course. Let’s keep moving forward!

----------

Technology Giants Industry - META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, TXN, EBAY, ADP, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

1 Comments Posted Leave a comment