PayPal Expects to Double Its Annual Free Cash Flows By 2025

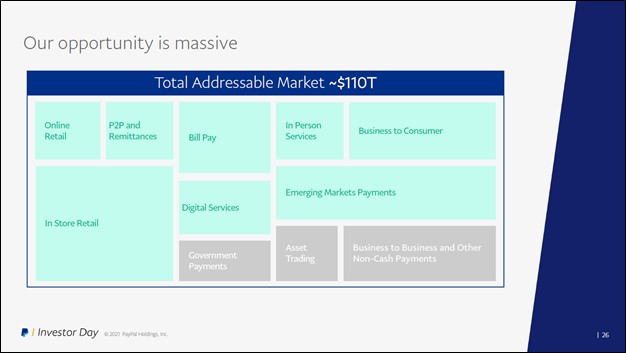

Image Shown: PayPal Holdings Inc views its total addressable market across the payment processing and solutions sitting at approximately $110 trillion, an enormous opportunity that the firm is well-positioned to capitalize on. Image Source: PayPal Holdings Inc – 2021 Investor Day Presentation

By Callum Turcan

We continue to be huge fans of PayPal Holdings Inc (PYPL) and include shares of PYPL as a top-weighted idea in the Best Ideas Newsletter portfolio. As of this writing, shares of PYPL have surged higher by ~140% over the past year as the company’s business model has proven to be incredibly resilient in the face of the coronavirus (‘COVID-19’) pandemic. PayPal’s ability to generate meaningful free cash flows in almost any environment is supported by its relatively low capital expenditure requirements to maintain a certain level of revenues.

The company’s position in the e-commerce realm is stellar given its ability to offer both consumers and merchants a comprehensive slate of financial services, with PayPal being a ubiquitous payment option on the digital checkout page across retailers and other businesses worldwide. PayPal’s mobile app allows its users to pay via a Quick Response code (‘QR code’) in physical store locations that are equipped to do so, providing its users with an easy-to-use contactless payment option.

During PayPal’s fourth quarter of 2020 earnings call, management noted that they were “very pleased with the early reception of (its) PayPal and Venmo QR codes, which are now accepted at over 600,000 retail locations” and that “across all of (its) in-store efforts, including QR, tap and pay and cards, we processed over $20 billion of [total payment volumes], with almost 10 million consumers using PayPal in store” last year. While the company’s in-store operations are a small part of its business so far, we appreciate its efforts on this front.

On February 11, PayPal hosted its 2021 Investor Day event and provided promising financial and operational guidance through 2025. PayPal expects to roughly double its annual free cash flows by 2025 from 2020 levels. In our view, this update further reinforces our optimistic view towards PayPal. When we update our free cash flow model of PayPal for the new year, we expect to increase our estimate of the company’s fair value.

More Active Users, Greater Engagement

In 2020, PayPal added 72.7 million net new active accounts (‘NNAs’) to its operations which included the 10.2 million NNAs added in the first quarter due to its acquisition of Honey Sciences for ~$4 billion in cash. A growing active user base helped enable PayPal to grow its total payment volume (‘TPV’) to $936 billion last year, up 31% versus 2019 levels. By the fourth quarter of 2020, PayPal had around 377 million active accounts.

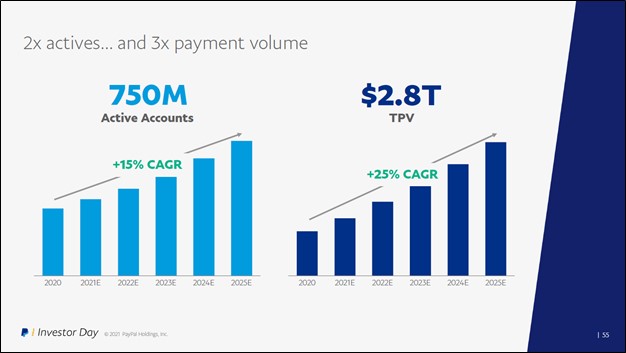

Looking ahead, management forecasts PayPal will roughly double its number of active accounts by 2025 while its TPV is expected to hit $2.8 trillion by the end of this period. PayPal views its medium-term growth outlook quite favorably, as do we, and we appreciate the promising guidance management issued during PayPal’s 2021 Investor Day event.

Image Shown: PayPal’s internal outlook is underpinned by an expanding active user base and rapid TPV growth. Image Source: PayPal – 2021 Investor Day Presentation

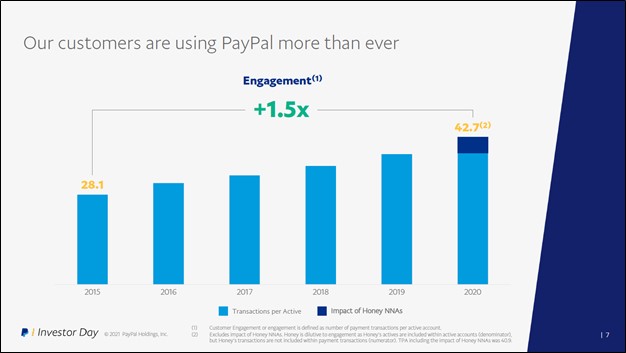

User engagement in terms of the number of transactions per active user (on average) has been steadily increasing during the past five years according to PayPal. We view this as an incredibly positive sign as it highlights the strong underlying demand for PayPal’s platform. Rising levels of user engagement combined with an expanding total active user base represents a powerful combination as it concerns PayPal’s TPV growth trajectory.

Image Shown: Not only is PayPal’s active user base growing, but each user (on average) has been steadily conducting a greater number of transactions per year across PayPal’s platform over the past five years. Image Source: PayPal – 2021 Investor Day Presentation

PayPal has several initiatives underway to continue building on this momentum. For instance, the PayPal noted during its 2021 Investor Day event that a sample set of users (about 59,000 domestic users) that utilized its ‘Buy Now, Pay Later’ installment payment program tended to see an increase in their weekly transactions and TPVs across PayPal’s platform (compared to levels of activity seen before the utilization of the installment payment service).

Launching new services provides PayPal additional ways to generate revenue while also potentially generating upside with the increased levels of engagement from its active user base. PayPal’s Venmo operation, a popular peer-to-peer money transfer app, launched the Venmo Credit Card back in October 2020 which is issued by Synchrony Financial (SYF) and backed by Visa Inc’s (V) payment network. However, that offering was limited to “select customers” only. On February 16, PayPal announced that the new Venmo Credit Card was now available to “all eligible Venmo customers” and Venmo app users can sign up through its app.

We're excited about PayPal’s ongoing monetization efforts at Venmo. During PayPal’s fourth quarter earnings call, management noted the goal was to generate $900 million in revenue from its Venmo asset this year. Successfully monetizing Venmo would provide a massive boost to PayPal’s cash-flow growth outlook.

Crypto

Another key announcement PayPal made back in October 2020 was that it would allow PayPal account users to store and trade cryptocurrencies. Management noted during PayPal’s fourth quarter earnings call that the firm “saw an exceptional response from our crypto launch” and that PayPal would expand the functionality of its digital wallet to allow customers to use cryptocurrencies as a funding source when shopping at one of the ~29 million merchants partnered up with PayPal. By the end of the first quarter of 2021, that functionality is expected to go live, though it appears PayPal will launch the service first in the US before launching the service in international markets a couple of months later.

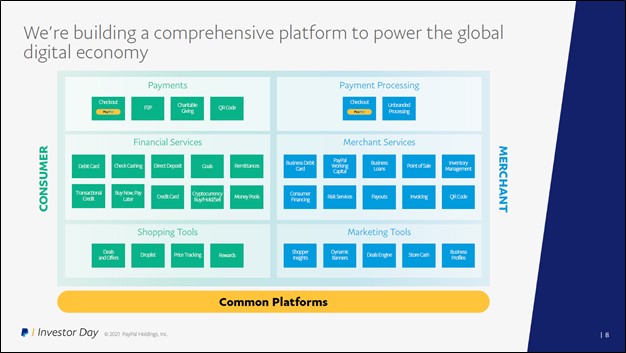

Sometime in the first half of 2021, PayPal will expand cryptocurrency trading and shopping-related services to its popular peer-to-peer money transfer app Venmo. During the company’s 2021 Investor Day event, the firm noted that half of its digital wallet users that utilize the service for cryptocurrency-related purposes log in to PayPal’s platform every day. PayPal plans to continue launching new services and expanding the functionality of existing services going forward that will cater towards the needs of its consumer and merchant customers. There is significant overlap as one can see in the upcoming graphic down below. PayPal views its total addressable market (‘TAM’) across the payment processing and payment solution space standing at a whopping $110 trillion.

Image Shown: PayPal’s goal is to keep building up its comprehensive slate of financial services that meet the needs of both its consumer and merchant user bases. Image Source: PayPal – 2021 Investor Day Presentation

Financial Outlook

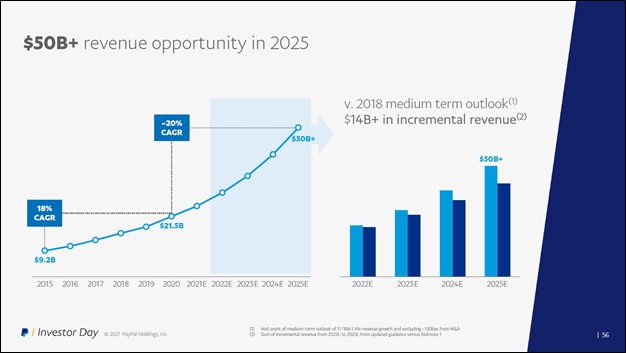

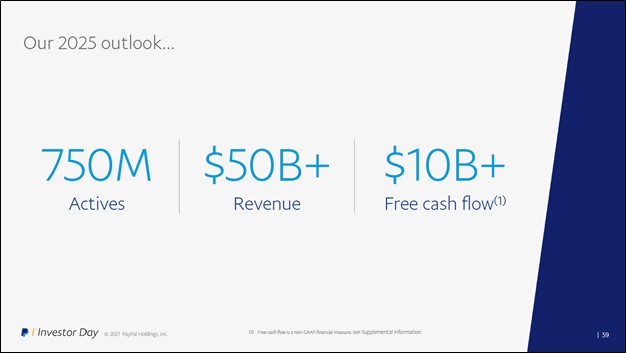

By 2025, PayPal sees its annual revenues reaching $50+ billion, up from $21.5 billion on a GAAP basis in 2020. Forecasted active user growth combined with the potential for rising levels of user engagement underpin PayPal’s expectations that its TPVs will grow at a brisk pace going forward, which in turn should enable the company to grow its revenues at a rapid clip in the medium term and beyond.

Secular tailwinds such as the proliferation of e-commerce, contactless payment options, and growing interest in cryptocurrencies are also key. Tesla Inc (TSLA) recently acquired $1.5 billion worth of Bitcoin (in US dollar terms) and indicated that it “expect[ed] to begin accepting bitcoin as a form of payment for (its) products in the near future” according to its 2020 Annual Report.

Though the current price of Bitcoin appears ludicrous (currently one bitcoin or BTC is trading ~$52,000 US dollars as of this writing), PayPal is indirectly catering towards the cryptocurrency industry, which mitigates its exposure to the volatility of the space to a degree. PayPal’s efforts to expand the functionality of its digital wallet, particularly as it concerns cryptocurrencies, should create new revenue-generating opportunities for the firm. We view PayPal’s long-term growth outlook quite favorably.

Image Shown: PayPal’s revenue growth outlook is bright. Image Source: PayPal – 2021 Investor Day Presentation

PayPal’s GAAP operating margin grew incrementally in 2020 versus 2019 levels as strong revenue growth (its GAAP revenues and operating income were both up ~21% year-over-year in 2020) contended with sharp increases in its operating expenses. The company is scaling up and investing heavily in its operations to support its growth runway. Over time, management sees room for PayPal to post significant (non-GAAP) operating margin expansion as one can see in the upcoming graphic down below. Revenue growth and operating margin expansion are forecasted to help grow PayPal’s (non-GAAP) EPS by ~22% CAGR from 2020-2025.

Image Shown: PayPal’s management team sees room for operating margin expansion going forward, aided by economies of scale and an eventual slowdown in the firm’s operating expense growth. Image Source: PayPal – 2021 Investor Day Presentation

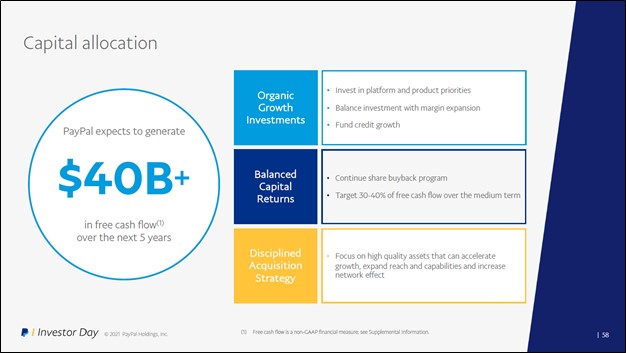

Putting this all together, PayPal expects to generate $40+ billion in free cash flow over the next five years according to guidance put forth during the firm’s 2021 Investor Day event. Management intends to continue pursuing share repurchases going forward with the company noting that it would aim to return 30%-40% of its free cash flows back to investors in the medium-term.

Investing in its current and future businesses remains a core focus for PayPal, as does ensuring the company has the funds to cover the expected growth in its credit business. PayPal aims to generate $10+ billion in annual free cash flow by 2025, which would be about double the $5.0 billion in free cash flow the company generated last year. For reference, PayPal spent $1.6 billion buying back its stock in 2020 and does not have a common dividend policy at this time.

Image Shown: PayPal aims to roughly double its annual free cash flows by 2025 versus 2020 levels. Image Source: PayPal – 2021 Investor Day Presentation

On a final note, we're big fans of PayPal’s pristine balance sheet. At the end of 2020, PayPal had $13.1 billion in cash, cash equivalents, and short-term investments on hand with no short-term debt and $8.9 billion in long-term debt on the books. PayPal also had $6.1 billion in long-term investments on hand at the end of 2020, which included $2.9 billion in cash-like assets (‘available-for-sale debt securities’ and ‘time deposits’) alongside $3.2 billion in strategic assets (and a negligible amount of restricted cash).

Including its long-term investments that are cash-like, PayPal exited 2020 with a ~$7.0 billion net cash position. Having a net cash position provides PayPal with ample financial firepower to pursue strategic acquisitions, repurchase its stock, and invest heavily in its business while maintaining its impressive financial position.

Image Shown: An overview of PayPal’s capital allocation priorities. Image Source: PayPal – 2021 Investor Day Presentation

Concluding Thoughts

Here, we would like to stress that when we roll forward our free cash flow model covering PayPal for the new year, we expect PayPal’s fair value estimate to increase. Shares of PYPL have been on a steep upward climb during the past year as investors are increasingly warming up to the company’s promising growth outlook. Launching adjacent services, growing its active user base, attempting to further boost user engagement levels, and potentially realizing operating margin improvements while capitalizing on secular growth tailwinds underpins PayPal’s promising free cash flow growth outlook.

We continue to be huge fans of PayPal and like exposure to the name in the Best Ideas Newsletter portfolio as a top-weighted idea. PayPal’s financials are rock-solid, and the firm has historically done a great job generating shareholder value (ROIC ex-goodwill > estimated WACC). Going forward, we expect that will continue being the case as PayPal has a “VERY ATTRACTIVE” Economic Castle rating. Members looking to read up on our thoughts concerning PayPal’s latest earnings report and near-term guidance are encouraged to check out this article here.

-----

Tickerized for PYPL, V, MA, XLF, AXP, DFS, COF, MELI, SQ, SYF, GPN, VRSK

Cryptocurrency related: GBTC, COIN, RIOT, MARA, HVBTF, MSTR, CAN, BITW, SOS, MGTI, SI, ARKF

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. PayPal Holdings Inc (PYPL), Visa Inc (V) and the Financial Select Sector SPDR Fund (XLF) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment