Our Thoughts on Intel’s Latest Earnings Report

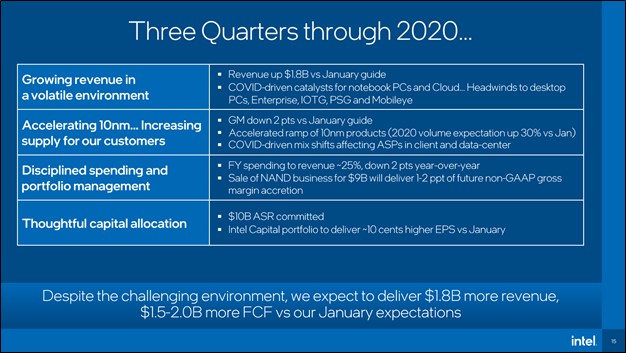

Image Shown: An overview of Intel Corporation’s performance during the first nine months of fiscal 2020. Image Source: Intel Corporation – Third Quarter of Fiscal 2020 IR Earnings Presentation

By Callum Turcan

On October 22, Intel Corporation (INTC) reported third quarter fiscal 2020 earnings (period ended September 26, 2020) that largely matched consensus expectations. Intel boosted its full-year outlook for fiscal 2020 on a net basis (which included an increase in its expected free cash flows this fiscal year) during its latest earnings update, though management reduced its forecast for Intel’s expected operating margins versus previous expectations. We continue to like Intel’s ability to generate sizable free cash flows, though we are concerned with its rising net debt load of late.

Quarterly Update and Guidance Change

Intel’s ‘PC-centric’ division posted sales growth of 1% on a year-over-year basis while its ‘Data-centric’ division experienced a 10% year-over-year decline in sales during the fiscal third quarter. Surging demand for desktops and laptops due to the work-from-home trend, prompted by the ongoing coronavirus (‘COVID-19’) pandemic, helped offset weakness elsewhere to a degree. Intel recently launched its 11th generation core processors with Intel Iris Xe graphics, dubbed ‘Tiger Lake’ by the company, which supports its outlook on the PC-centric front. These processors are geared towards laptops.

During the fiscal third quarter, Intel’s GAAP revenues dropped by 4% and its GAAP operating income declined by 22% on a year-over-year basis, though please note Intel’s performance during the previous two fiscal quarters was much stronger. During the first nine months of fiscal 2020, Intel’s GAAP revenues rose by 12% year-over-year and its GAAP operating income jumped higher by 17% year-over-year. Furthermore, while Intel’s diluted GAAP EPS declined year-over-year in the fiscal third quarter, Intel’s diluted GAAP EPS rose 12% year-over-year during the first three quarters of fiscal 2020.

Management raised Intel’s full-year sales guidance for fiscal 2020 during the firm’s latest earnings report by $0.3 billion. The company now forecasts it will generate $75.3 billion in GAAP revenues in fiscal 2020, good for 5% annual growth, though Intel lowered its operating margin expectations by 50 basis points (for both its expected GAAP and non-GAAP operating margin) versus previous expectations. Intel posted a ~30.6% GAAP operating margin in fiscal 2019 (period ended December 28, 2019), which is expected to shift down to 29.5% in fiscal 2020.

Part of the reason why Intel expects its operating margin will shift lower is due to headwinds facing its Data Center Group (‘DCG’), part of its Data-centric division. Average selling prices at DCG were down 15% year-over-year last fiscal quarter, though unit volumes were up 4% year-over-year. The DCG segment’s cloud-related operations performed well, with revenue from its ‘Cloud SP’ offerings up 15% year-over-year. Intel mentioned in its earnings press release that “a weaker economy due to COVID-19 impacted DCG's Enterprise & Government market segment, which was down 47 percent [year-over-year] following two quarters of more than 30 percent growth.” Arguably, demand for DCG’s offerings was pulled forward due to the pandemic, though investors were hoping for stronger performance on this front.

Intel’s Non-volatile Memory Storage Group (‘NSG’) posted an 11% year-over-year decline in sales last fiscal quarter (NSG is part of Intel’s Data-centric division); however, the company is selling off its NAND flash memory business (part of Intel’s NSG segment) for roughly $9.0 billion in cash as we covered in this article here. On a positive note, Intel’s Mobileye segment (another entity within Intel’s Data-centric division) resumed its growth trajectory (sales were up 2% year-over-year last fiscal quarter) as global automotive production began to recover.

Management also updated Intel’s expected net operating cash flow and capital expenditure forecasts for fiscal 2020. Now Intel expects to generate $32.2-$33.0 billion in net operating cash flow (up $0.1 billion at the midpoint versus previous expectations) and forecasts it will spend $14.2-$14.5 billion on capital expenditures (down $0.65 billion at the midpoint versus previous expectations). The company remains a free cash flow cow, and we will dig deeper into its financials in just a moment, but investors are beginning to question Intel’s medium-term outlook. During Intel’s latest earnings call, management noted that Intel expects to generate “approximately $18 billion to $18.5 billion” in free cash flow this fiscal year and additionally, that “we now expect to beat our January free cash flow guide by $1.5 billion to $2 billion.”

Financial Update

During the first nine months of fiscal 2020, Intel remained a free cash flow powerhouse. It generated $15.1 billion in free cash flow that easily covered $4.2 billion in dividend payments made during this period. With that in mind, Intel has also allocated a lot of capital towards buying back its stock of late. The company spent $12.2 billion repurchasing its shares through its ordinary buyback program during the first three quarters of fiscal 2020 along with $2.0 billion on buybacks through accelerated repurchasing agreements. We covered Intel’s $10.0 billion accelerated share repurchase program in this article here.

As of September 26, Intel had $18.3 billion in cash, cash equivalents, short-term investments, and trading assets on hand versus $36.6 billion in total debt (inclusive of short-term debt). From the end of fiscal 2019 to the end of the third quarter of fiscal 2020, Intel’s net debt load grew by $2.4 billion. The company also has a significant amount of non-current equity investments and other long-term assets on hand ($6.4 billion combined as of September 26) which could be considered cash-like, though both balances declined from the end of fiscal 2019 to the end of its latest fiscal quarter (indicating its net debt load arguably grew by more than $2.4 billion during this period, and please note we did not include those positions in our commentary noting the increase in Intel’s net debt load this fiscal year).

Intel’s net debt load has been growing of late due to its sizable share buybacks. The divestment of its NAND flash memory business could change that picture somewhat, however, the company appears likely to spend another $8.0 billion during the fiscal fourth quarter to complete its $10.0 billion worth of accelerated share repurchasing agreements which offsets the pending cash infusion from the asset sale (the $10.0 billion in share repurchase agreements announced in August 2020 are expected to be completed by the end of 2020, though it is not clear if that means calendar or fiscal year).

Shares of Intel are trading near the low end of our fair value estimate range as of this writing, and a compelling case can be made for the firm to buy back some of its stock, though management would be wise to also consider deleveraging going forward. A weaker balance sheet negatively impacts the outlook for Intel’s dividend growth trajectory. We would like to see Intel start to improve its balance sheet at the beginning of fiscal 2021.

Management Commentary

The biggest question on many analyst’s and investor’s minds was how Intel was going to fix the manufacturing problems facing its 7-nm chip development process (we covered that situation in great detail here). Intel continues to expand its 10-nm chip production capabilities; however, its competitors are already shifting towards 7-nm and 5-nm chip designs (and its competitors often use third-party foundries, semiconductor manufacturing facilities, to produce the chips that they design). As we have noted in the past, one of Intel’s options is to turn to third-party foundries such as Taiwan Semiconductor Manufacturing Company Limited (TSM) to fix its problems. Here is what Intel’s management team had to say in response to an analyst’s question on the issue during its latest earnings call:

“So as we think about 2023 and beyond, we're looking at the products required at that time. And we're evaluating our process versus other third-party processes. And the fundamental criteria, as you could imagine, are at the macro level fairly simple: schedule and schedule predictability, product performance and economics with supply chain -- our ability to control the supply chain best we possibly can.

So the criteria are relatively simple and we're evaluating each one of those kind of as we exit 2020 and really early 2021, because that's the time that we'll have to make the determination as to whether we're buying more 7-nanometer equipment or whether a third-party foundry would be adding that capacity. So we're going through this process really looking at our capabilities others' capabilities around those three fundamental criteria.

I would say since the last time we spoke, our 7-nanometer process is doing very well. I mean, last time we spoke we had identified an excursion. We had root caused it. We thought we knew the fix. Now, we've deployed the fix and made wonderful progress. But nonetheless, we're still going to evaluate third-party foundry versus our foundry across those three criteria. And the call will be towards the end of this year early next year…

And we'll learn a lot more as we have in the last 90 days during the course of the next 90 days and I think, be in a pretty good position to lay out our decision in the January time frame.” --- Bob Swan, CEO of Intel

Additionally, Intel’s CEO had this to note during his prepared remarks:

“We have another great lineup of products in 2022 and I'm increasingly confident in the leadership our 2023 products will deliver on either Intel 7-nanometer or external foundry processes or a combination of both.”

It appears Intel is open to utilizing a combination of its own production capabilities and third-party capabilities to meet its chip manufacturing needs. We await management’s commentary on the issue in the coming months.

Concluding Thoughts

We continue to be fans of Intel’s ability to generate enormous free cash flows, though we caution that management needs to lay out a concrete plan for how Intel will proceed operationally going forward. In our view, Intel continues to carry great dividend coverage on a forward-looking basis though its rising net debt load is not something we like. Share repurchases will support Intel’s EPS growth outlook and in moderation, represent a good use of capital; however, management needs to be cognizant of the impact its capital allocation priorities are having on Intel’s balance sheet strength. After Intel completes its accelerated share repurchase program, it plans to hold off on utilizing its remaining $2.4 billion in share buyback authority until “markets stabilize,” which we appreciate.

----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: SSNLF, SCWX, SPY

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

3 Comments Posted Leave a comment