Nvidia Beats Second Quarter Estimates

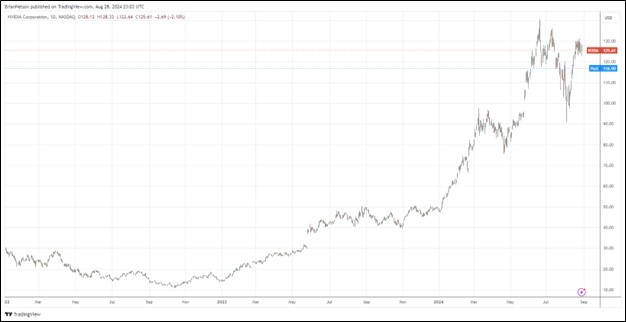

Image: Nvidia’s shares have been on a tear the past year.

By Brian Nelson, CFA

On August 28, Nvidia (NVDA) reported better than expected second quarter fiscal 2025 results, but the performance wasn’t strong enough for the market to bid up shares. Revenue of $30.04 billion was nonetheless up a whopping 122% on a year-over-year basis, while quarterly non-GAAP earnings per share came in at $0.68, up 152% from the year-ago period. Its GAAP gross and operating margin was 75.1% and 62.1% in the quarter, respectively.

In addition to record quarterly revenue and outsized levels of profitability, Nvidia posted record quarterly Data Center revenue, which advanced 154% in the second quarter from the same period a year ago. Second quarter Gaming revenue was up 16% from a year ago, Professional Visualization revenue was up 20% year-over-year, while Automotive revenue was up 37% from the same period last year. GAAP operating income increased 174% in its second quarter of fiscal 2025.

Management was upbeat about the quarter and outlook in the press release, too:

Hopper demand remains strong, and the anticipation for Blackwell is incredible. NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.

Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and NVIDIA AI Enterprise software are two new product categories achieving significant scale, demonstrating that NVIDIA is a full-stack and data center-scale platform. Across the entire stack and ecosystem, we are helping frontier model makers to consumer internet services, and now enterprises. Generative AI will revolutionize every industry.

On the heels of the strong second quarter fiscal 2025 report, Nvidia approved an additional $50 billion in share buybacks in addition to the $7.5 billion it still has remaining under its share repurchase authorization. Looking out to the third quarter of fiscal 2025, Nvidia expects revenue to be $32.5 billion, plus or minus 2%, while GAAP and non-GAAP gross margins are expected to be 74.4% and 75%, respectively, plus or minus 50 basis points. For the full year, management expects gross margins to be in the mid-70% range, which is a very healthy level of profitability. Our fair value estimate stands at $125 per share.

-----

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment