Nike’s Digital Strategy Supports Its Future Revenue Growth and Margin Expansion Prospects

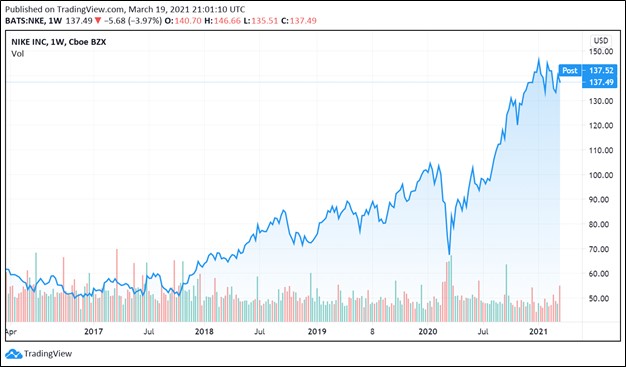

Image Shown: Since announcing the launch of its Consumer Direct Offense initiative in June 2017, Nike Inc has done a stellar job building its omni-channel selling capabilities. The company’s digitally-oriented direct-to-consumer strategy offers it the opportunity to enhance both its long-term revenue growth outlook and operating margin expansion potential. On March 18, Nike reported mixed earnings though its near-term guidance indicates its financial performance will continue to rebound after taking a beating from the COVID-19 pandemic. As of this writing, shares of NKE are trading in the upper bound of our fair value estimate range, indicating shares are roughly fairly valued at this time.

By Callum Turcan

The coronavirus (‘COVID-19’) pandemic has made it clear that companies with strong omni-channel selling capabilities are in a much better position than their physical-store dependent peers. Home delivery, curbside pickup, and order online/pickup in-store represent some of the main ways companies are meeting demand received through their digital platforms. E-commerce demand has boomed over the past several quarters and that trajectory has legs, in our view. Though e-commerce was already steadily becoming a larger part of the global economy over the past two decades (adoption rates vary across geographical regions), the pandemic has accelerated that trend.

Nike Inc (NKE) recognized the need to develop omni-channel selling capabilities earlier than most, and part of that strategy involved building out an ecosystem of mobile apps and related websites. The apparel, footwear, equipment, and accessory company announced its ‘Consumer Direct Offense’ initiative back in June 2017 and the goal is to build up a sizable direct-to-consumer (‘DTC’) business with a large e-commerce component. The company has its fitness apps Nike Run Club and Nike Training Club along with the Nike app, which supports its e-commerce operations, and its Nike SNKRS app that focuses on footwear. Its digital strategy also involved Nike parting ways with Amazon Inc (AMZN) a couple of years ago so Nike could better control its digital strategy.

Earnings Update

On March 18, Nike reported third quarter earnings for fiscal 2021 (period ended February 28, 2021) that saw its ‘NIKE Direct’ sales grow by 20% year-over-year, hitting $4.0 billion. Please note NIKE Direct includes sales from its digital platforms and company-owned physical stores (as compared to its wholesale operations). Nike brand digital sales grew 59% versus the same period the prior year, with double-double increases in every geographical market according to the earnings press release. The company’s GAAP revenues grew by 3% year-over-year in the fiscal third quarter, hitting $10.4 billion, though that fell short of consensus analyst estimates.

Management noted during Nike’s fiscal third quarter earnings call that “as of today, approximately 35% of (its) NIKE-owned stores are closed and this situation continues to be dynamic” highlighting the stiff headwinds the company continues to face. On a positive note, Nike’s e-commerce strength continued into March. Additionally, in markets where physical stores were able to reopen, Nike was seeing a favorable response from consumers according to its management team.

Last fiscal quarter, Nike reported $0.90 in GAAP diluted EPS (up 70% year-over-year) that beat consensus analyst estimates. Its bottom line surged thanks to a combination of modest revenue growth, a 7% year-over-year reduction in its operating expenses (almost entirely due to headwinds arising from the COVID-19 pandemic), and a significant improvement in its GAAP gross margin. Nike’s GAAP gross margins expanded by ~130 basis points year-over-year in the fiscal third quarter with management citing NIKE DIRECT and digital sales as being key.

The company did not provide a cash flow statement in its earnings press release, and as of this writing has yet to publish the related 10-Q SEC filing, though Nike did include its balance sheet statement. Nike exited February 2021 with $3.1 billion in net cash on the books (inclusive of its negligible short-term debt). Net cash positions are an immense source of strength during good times and bad.

Operational Update

In the fiscal third quarter, Nike’s sales were down year-over-year across the board geographically speaking (at its ‘North America,’ ‘Europe, Middle East & Africa,’ and ‘Asia Pacific and Latin America’ reporting segments), save for its Greater China (FXI, MCHI) segment which reported 51% year-over-year sales growth with strength seen at every core product category (footwear, apparel, equipment). Please note that the third quarter of Nike’s fiscal 2020 (period ended February 29, 2020) ended before widespread lockdown measures were enacted outside of China, meaning that year-over-year comparisons are a messy read.

Furthermore, logistical headwinds were at play last fiscal quarter at it concerns Nike’s North America business. Starting in late December, Nike faced headwinds from congestion at US West Coast ports and container shortages which “delayed shipments to wholesale partners and lower-than-expected quarterly revenue growth” however, Nike expects to make up those sales in the fiscal fourth quarter according to recent management commentary. On a positive note, Nike noted its North America segment reported its first fiscal quarter with $1.0 billion in digital revenue during its latest earnings call.

China was largely locked down in the year-ago period as the government instituted aggressively quarantine efforts to slow the spread of the COVID-19 pandemic. As quarantine measures were eased, Nike reported a sharp rebound in its performance in the Greater China region. Here is what management had to say on the subject during Nike’s latest earnings call (emphasis added, lightly edited):

“With that, let’s turn to Greater China, which achieved its second consecutive $2 billion quarter and grew 42% on a currency-neutral basis, with EBIT growth of 75% on a reported basis. NIKE Direct grew 52% versus the prior year, with more than 40% growth in digital and nearly 60% growth in NIKE-owned stores as the retail market largely returned to normal,including strong double-digit growth in partner retail stores, widening our market lead as the favorite brand with consumers.

As I mentioned earlier, [the] Chinese New Year was a key highlight and through our Express Lane offense, we created and delivered hyperlocal products to celebrate the moment, including the Dunk Low and the women’s Dunk Disrupt, which both instantly sold out. Our women’s business grew more than 60% versus the prior year and our 2 new Nike Live stores are resonating deeply with her since opening.

In digital, we focused on engaging and serving members across multiple platforms, including live stream and social media. During Chinese New Year, we doubled our number of high-value members. We also – while also increasing member retention. We’re excited by the opportunity we see ahead and so we are accelerating investment in Greater China, including in the local consumer digital experience, new retail concepts and omni-channel integration with our owned and partner stores.” --- Matt Friend, CFO of Nike

Guidance

Looking ahead, Nike expects to post approximately 75% revenue growth this fiscal quarter on a year-over-year basis as its business continues to recover from the COVID-19 pandemic. Please note that the fourth quarter of fiscal 2020 (period ended May 31, 2020) was brutal for Nike as lockdown measures sent its GAAP revenues tumbling lower by 38% year-over-year. Nike expects its gross margins will expand this fiscal quarter and management cited growth at its higher margin NIKE Direct business as being part of the reason why. Logistical hurdles are expected to continue for the time being and Nike’s operating expenses are expected to move higher this fiscal quarter as the company intends to continue invest heavily in its digital businesses while resuming pre-pandemic levels of marketing activity according to management.

Nike noted it would provide fiscal 2022 guidance during its next earnings call, though management noted the firm was “already exceeding our pre-pandemic levels of business” and that Nike “expect[s] the momentum [it is] seeing to translate into continued strong revenue growth” as it concerns its performance heading into the new fiscal year. We caution that France recently entered another lockdown in a bid to better contain the COVID-19 pandemic and alleviate the stress the public health crisis is placing on the nation’s hospitals. In the near-term, headwinds from the pandemic will continue to create hurdles for Nike, though its digital and DTC operations will help mitigate those headwinds to a degree.

Concluding Thoughts

Shares of Nike are trading in the upper bound of our fair value estimate range as of this writing, indicating shares are fairly valued at this time. In the near term, the trajectory of Nike’s financial performance will be heavily influenced by the trajectory of the COVID-19 pandemic and whether quarantine measures are eased or increased. Longer term, the ability for Nike to build up a sizable digitally-oriented DTC business will not only support its revenue growth prospects but should also continue to enhance its margin performance as well. We love the company, but we are not interested in adding Nike to our newsletter portfolios at this time.

Nike's 16-page Stock Report (pdf) >>

Nike's Dividend Report (pdf) >>

-----

Discretionary Spending Industry - ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for NKE, UA, UAA, ADDYY, ADDDF, DECK, CROX, SKX, SHOO, LULU, GOOS, ELY, GOLF, FL, JDSPY, JDDSF, SCVL, DKS, HIBB, BGFV, MSGN, MSGS, BATRA, MANU, MVP, FXI, MCHI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) and The Walt Disney Company (DIS) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment