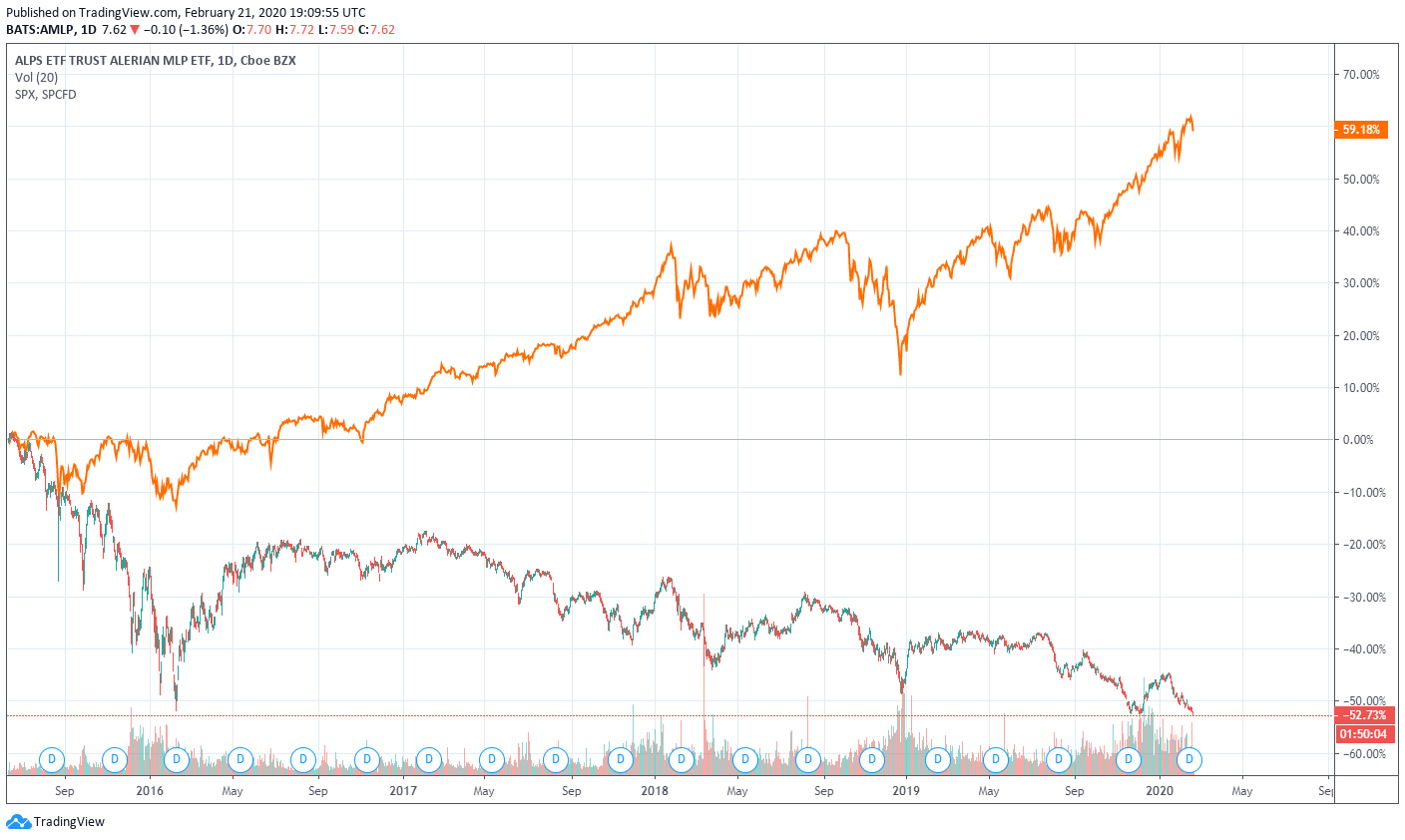

MLPs Hit 52-Week Low

Enterprise valuation is paramount. In June 2015, Valuentum released its bearish case to Barron's on Kinder Morgan (KMI) and the MLPs. This was no small call. Since then, on a price basis, the MLP ETF (AMLP) is down more than 50%, while the S&P (SPY) is up roughly 60% (orange line).

Read more about this story in Value Trap.

Award-winning book that recently earned acclaim from the prestigious Next Generation Indie Book Awards! Blue Ink Review Notable Book and Readers' Favorite 5 Stars! Wall Street doesn’t know it has a problem. Index and quantitative investors have been free-riding on the backs of active managers for years, but growth in price-agnostic trading may finally have reached the tipping point. Brian Nelson, former Director of Methodology at Morningstar and President of Investment Research at Valuentum, explains how enterprise valuation forms the Theory of Universal Valuation and why a focus on it may not only help you avoid value traps, but also save you from the next financial crisis. This is a 356 page book, including Preface, Notes, Bibliography and Index. The text is a response to many worrisome trends and processes in the investment management business today. The book strives to answer the question: what is the appropriate empirical evidence in evidence-based finance? Surely, not just any empirical evidence will do. The book is not meant to be controversial, but a discussion of the great contradiction of “explaining” stock return behavior between factor-based investing (which is based mostly on ambiguous, realized data within in-sample sets) and the efficient markets hypothesis (which is based on expectations of future data, realized or not) may make it so. The text is heavy in behavioral thinking and puts forth enterprise valuation as a behavioral framework in which to view stock prices and their movements. This book also shows how enterprise valuation is much more than a simple stock valuation tool, but rather that enterprise valuation is truly universal valuation, resting at the intersection of behavioral economics, quantitative theory, equity valuation, and therefore finance, itself. A reading of "The Data Dilemma and Valuentum Investing" in the Preface is necessary to understand the various types of data Nelson refers to frequently in this text: ambiguous, causal and impractical. Also emphasized in this book is the difference between in-sample, out-of-sample and walk-forward studies, the latter the author believes to be the most robust and authentic of processes. In the first section of this book (chapters 1 through 3), Nelson welcomes you on a journey through the early lessons of his career and introduces some of the major shortcomings of traditional quant factor-based analysis, while building up the importance of a common theme in this text: the information contained in share prices. In the second section of this book (chapters 4 through 6), the causal nature of enterprise valuation to stock prices is explained, culminating in the Theory of Universal Valuation, which offers enterprise valuation as the central theme to quantitative value studies, efficient markets hypothesis testing and beyond. If at any time, it gets too theoretical, Nelson encourages the casual reader to skip ahead. In the final section of the book (chapters 7 through 10), Nelson talks about practical application of the principles explained in this text: how enterprise valuation can be used to identify bubbles and mispricings, how it’s valuable to dividend-growth and income frameworks, how it’s connected to economic moat and economic castle theory, and how it can be applied practically in an equity portfolio setting, as in Valuentum investing. This book is not a how-to manual on how to perform enterprise valuation, or a get-rich-quick investment program, but rather a text that Nelson feels lays the foundation for a genuine conversation about stock investing, a conversation about price versus estimated intrinsic value. The book is chock-full of footnotes, too, offering greater depth in areas that may require it. This book is content-rich for the number of pages, as the author wants every sentence, every paragraph to be worth your while. Mr. Nelson has over 15 years' experience in enterprise valuation and holds the Chartered Financial Analyst designation.

Tickerized for the top 10 holdings in the Alerian MLP ETF.

1 Comments Posted Leave a comment