Markets Back on Track – Seeking Net-Cash-Rich, Free Cash Flow Generators with Pricing Power!

By Brian Nelson, CFA

The past few trading sessions have tested the conviction of many equity holders, but we remain focused on the long run and believe the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and the High Yield Dividend Newsletter portfolio (available to registered members of that publication) are well positioned for long-term capital appreciation potential, dividend growth potential, and sustainable high yield dividend income, respectively.

During the trading session May 13, the Best Ideas Newsletter portfolio was led by some of our favorite net-cash-rich, free-cash-flow powerhouses. Moving convincingly higher, Apple (AAPL), Cisco (CSCO) and Microsoft (MSFT) have strong net cash positions on the balance sheet and generate impressive free cash flow well in excess of expected cash dividends paid. Though their current dividend yields aren’t as enticing as others’, all three have solid long-term dividend growth prospects backed by secure cash-based sources of intrinsic value.

One of the biggest winners in the Best Ideas Newsletter portfolio recently, Korn Ferry (KFY) also advanced nicely during the trading session May 13. The company has soared since December, after registering a coveted 9 rating on the Valuentum Buying Index (10 = best)--our rating system combines discounted cash-flow (DCF) valuation with timing indicators, the latter serving to further support our conviction in DCF-backed ideas. Facebook (FB) is currently the only 10-rated stock on the Valuentum Buying Index and remains one of the most underpriced stocks on the market.

On May 13, every constituent in the Dividend Growth Newsletter portfolio, save for the modest decline in Realty Income (O), was in the green on the trading session (see image at the bottom of this article). The charge higher was led by Home Depot (HD), which is benefiting considerably from the demand for housing remodels/additions thanks to homeowners reevaluating their living and working spaces after cocooning for months in their houses because of the outbreak of COVID-19. Do-It-Yourself (DIY) home projects are in vogue, and soaring lumber prices reveal that demand remains very healthy, supporting the steadily rising trend in housing prices.

Garbage Hauler Republic a Gem in the Trash Heap

Shares of garbage hauler Republic Services (RSG), one of our favorite tried-and-true dividend growth ideas also picked up some buying interest on the session May 13. The trash taker operates within a rational oligopoly, and along with rivals Waste Management (WM) and Waste Connections (WCN), owns most of the disposal capacity in the U.S. We love Republic Services’ free cash flow consistency, and many of its collection contracts have annual price-adjustment clauses that are tied to the Consumer Price Index (CPI).

Yesterday, May 12, the U.S. Bureau of Labor Statistics noted that the CPI advanced 4.2% during the past 12 months (all items before seasonal adjustment), and this should translate directly into pricing power at Republic. We think the garbage hauler is well-positioned to surprise to the upside in the quarters ahead given its lucrative contractual arrangements. At last tally, roughly 20% of Republic’s business is CPI-indexed, and this part of its business should see a nice step up to augment the garbage-hauler’s already-strong pricing power (its core price increased 5.6% in 2020).

Market’s DCF-Revisions Driving Money into Quant “Value”

Since the inaugural edition of Value Trap: Theory of Universal Valuation was published, an ETF tracking large cap growth (SCHG) has advanced more than ~85%, while an ETF tracking small cap value (IWN) has advanced ~45%. Value Trap’s plea for financial stability aside, the book’s core tenets rest on encouraging long-term investors not to play the “value versus growth” game, which uses ambiguous single-year snapshot multiples, but rather to focus on companies’ cash-based sources of intrinsic value--net cash on the books and future expected free cash flows.

Now that we’re passed the worst of the COVID-19 crisis, we’re watching what we think is a temporary trade back into some quantitative “value” stocks. These days, quant “value” primarily consists of energy and banking entities, and enterprise valuation-based intrinsic values for many energy/commodity producers and banking entities have advanced thanks to improved free cash flow expectations driven by higher energy resource pricing and net interest margins, respectively.

For example, we recently raised our fair value estimates of ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP) to account for such an improving outlook relative to prior free-cash-flow expectations. Importantly to emphasize, it is not long-term data going back to 1926, the concept of “reversion to the mean,” simple book-to-market ratios, or “blind faith” that is driving what could be a short-lived move that we’re seeing back into quant “value.” Rather, the driver is enterprise valuation (the discounted cash flow model), based on increased future free cash flow expectations.

Inflation May Very Well Be Transitory

Commodity prices tend to be cyclical in nature, and we don’t believe the recent commodity price moves are sustainable, but rather that they are dislocations, in part, that are temporary and caused by one-time events (e.g. timber producers shutting down during COVID-19 followed by growing housing demand; the Colonial Pipeline cyberattack and temporary gas shortages, and the like).

We tend to side with the Fed when they state that today’s inflation is largely transitory. After digging into the details of the CPI report, most of the spike in inflation, for example, came from used car sales driven by a temporary global chip shortage—this coincidentally has driven some interest in shares of Dividend Growth Newsletter portfolio idea Qualcomm (QCOM) during the trading session May 13. For many months now, Qualcomm has been working hard to keep up with demand for its processor chips.

But…

We know how to make processors for cars.

We know how to grow more trees for lumber.

We know how to extract shale oil to refine into gasoline.

Once headlines regarding gas shortages are forgotten and narratives regarding Fed-driven inflation slow (as they did following the Great Financial Crisis), we would expect inflation to moderate to more normalized levels. That’s what we think the 10-year Treasury note is telling us. The benchmark rate is right back to pre-COVID-19 levels, what one might expect in a healthy economy—even an economy that has become permanently changed through accelerated adoption of disruptive technologies during the worst of the COVID-19 pandemic.

Though we’ve increased our fair value estimates for many commodity-producing entities due to higher expectations of the present value of their future free cash flows, we’re sticking with tried-and-true net-cash-rich, strong expected free-cash-flow generators that have pricing power. In the coming age of electric vehicles, clean energy, and unrestricted domestic shale oil supply production, we doubt crude oil will ever see $150 per barrel again, and with banks and financials on a government leash, expected returns may be modest for financial entities over the long haul.

On the other hand, the recent quarterly numbers from the likes of competitively advantaged and secular free-cash-flow growers that have huge net cash positions--such as Apple, Facebook, and PayPal (PYPL) to name a few--have been phenomenal. There’s a limit to just how high commodity prices can go before supply floods the system, and we believe there are limits to just how high interest rates can rise given structural borrowing costs of the U.S. However, secular growth opportunities in reasonably priced big cap tech have a very long runway of growth ahead of them.

Modern Portfolio Theory Losing Relevance as Stocks/Bonds Continue to Trade in Unison

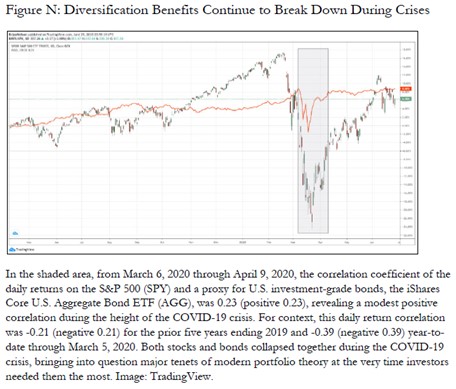

Image Shown: During the worst of the COVID-19 crisis, stock prices and bond prices fell in unison and asset correlations increased. Image Source: Value Trap

During much of the sell-off this week, prices of both equities (SPY) and investment-grade bonds (LQD) were highly correlated, much like they were during the COVID-19 crisis. The peculiarity is that in the face of higher inflation expectations, we might expect a bond sell-off, and many investors are betting on it, too (the short interest on LQD has soared to highest levels in ETF's history).

But with equity prices following bonds lower this week, it is rather peculiar given the pricing power of many constituents in the S&P 500 and the rather benign movement in the 10-year thus far. In any case, this is yet more evidence against the practicalities of modern portfolio theory (MPT) and raises one dynamic that keeps rearing its ugly head: Diversification benefits tend to break down at the very exact time they are needed.

Image Shown: The correlation between stocks and bonds increased during the sell-off this week, providing further evidence of the practical limitations of MPT. Image Source: TradingView.

Concluding Thoughts

We remain intensely focused on the cash-based sources of intrinsic value—net cash on the balance sheet and future expected free cash flow—when it comes to identifying price-to-fair-value-estimate mis-pricings as well as in assessing long-term dividend health. We think it may be tempting to rotate into some names where fair value estimate revisions have occurred, but the margin of safety around many energy/commodity producers and banking entities may be too large even for conservative investors.

We expect most energy/commodity producers to continue to endure boom-and-bust cycles, and banking entities to do the same, as the latter act more like utilities this day and age. Once implicitly nationalized during the Great Financial Crisis, and used as an extension of government programs such as the Paycheck Protection Program during the COVID-19 crisis, outsize economic profit spreads may remain limited for banks/financials given the punitive regulatory environment.

Facebook, of course, remains our top idea for long-term capital appreciation potential. Newmont Mining (NEM) remains our favorite dividend growth-oriented “inflation hedge” followed by garbage hauler Republic Services and its CPI-indexed contracts. AT&T remains our favorite high yield dividend idea, boasting a free-cash-flow covered ~6.5% dividend yield, and we prefer only diversified exposure to the energy and banking sectors through the Energy Select Sector SPDR (XLE) and Financials Select Sector SPDR (XLF).

We’ll be looking to deploy the ~10%-20% cash “positions” in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio in the coming months. The High Yield Dividend Newsletter remains “fully invested,” and Exclusive idea generation remains robust. If you haven’t already, please be sure to have a look at the video in this article to see how we assess the cash flow statement and balance sheet to uncover stocks with strong net cash positions and solid future free cash flows that handily cover expected cash dividend payments. We apply this laser-focus on financial statement analysis across our idea-generation suite of publishing products.

Downloads

Republic Services’ 16-page Stock Report (pdf) >>

Republic Services Dividend Report (pdf) >>

Newmont Mining’s 16-page Stock Report (pdf) >>

Newmont Mining’s Dividend Report (pdf) >>

AT&T’s 16-page Stock Report (pdf) >>

AT&T’s Dividend Report (pdf) >>

Strong Performance from Dividend Growth Newsletter Portfolio May 13

Image Shown: The pricing action of ideas in the Dividend Growth Newsletter portfolio. Image Source: Seeking Alpha.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment