Lockheed Martin Shocks the Market

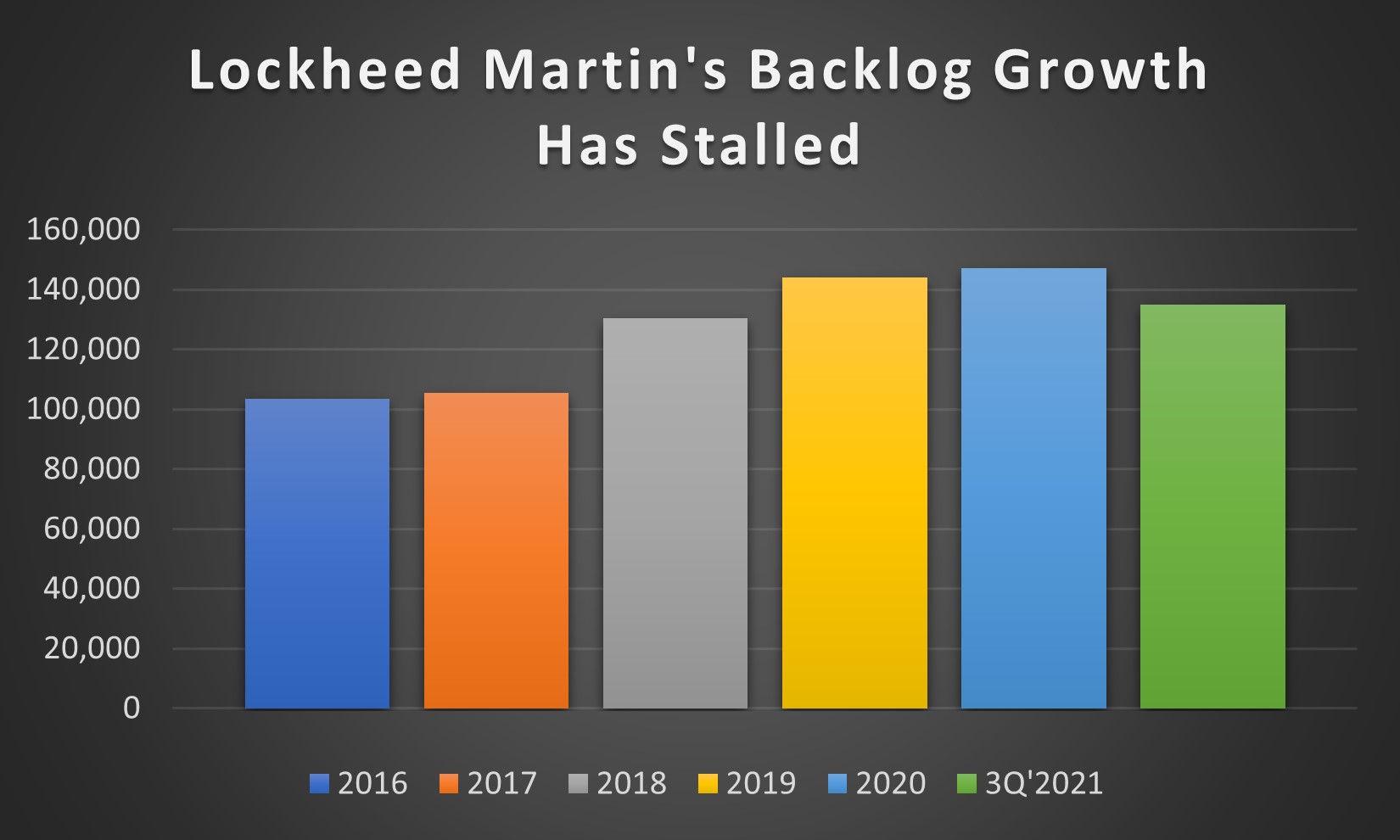

Image: After years of backlog growth at Lockheed Martin, the third quarter of 2021 revealed a sharp year-over-year decline to the tune of ~8.3%. The company’s outlook also left a lot to be desired.

By Brian Nelson, CFA

Lockheed Martin (LMT) reported mixed third-quarter 2021 results Tuesday, October 26, but “mixed” might be too gracious of a word. Though it did beat the consensus number for third-quarter non-GAAP earnings per share, revenue didn’t just miss marginally, but by more than a $1 billion, with the top line falling 2.8% on a year-over-year basis. Clearly, Lockheed had promised more than it could deliver, and we had been taken in by the optimism. We expect to lower our fair value estimate.

There’s no sugarcoating Lockheed Martin’s third-quarter report, and its outlook left a lot to be desired, too. Its outlook for the remainder of 2021 revealed a revenue and ‘business segment operating profit’ guidance cut to below its prior targeted range coupled with a reduction in expectations for cash flow from operations. Though its adjusted diluted earnings per share was increased from its prior guidance range for 2021, clearly the bottom line is lower-quality earnings considering the revenue pressure and cash flow guidance reduction.

We outlined how much we liked Lockheed Martin as a dividend growth idea in the note, “Dividend Growth Idea Lockheed Martin Has Ample Space Upside,” but a look at some of the company’s business trends during 2022 will result in a rather large fair value estimate decrease. Lockheed expects 2022 net sales to fall from 2021 levels, to ~$66 billion; we had been expecting revenue to advance to north of $70 billion during 2022, so the change in trajectory is quite pronounced (its backlog fell to $134.8 billion from $147.1 billion on a year-over-year basis in the quarter, too). To say that the market was surprised is an understatement as the stock fell double-digits following the news.

The company’s cash flow from operations are expected to be greater or equal to $8.4 billion during 2022, assuming certain provisions in the Tax Cuts and Jobs Act of 2017 are continued by Congress, but it may come in at $6.4 billion or greater ($2 billion less), if not. We had been expecting operating cash flow of ~$9.4 billion on the year, and while the guidance has the potential to be much lower than what we had been anticipating, cash flow generation is still quite robust, given the company’s comparatively asset light operations. For example, capital spending as a percentage of operating cash flow has been ~18.4% during the first nine months of the year, a characteristic that helps LMT drive a strong ROIC.

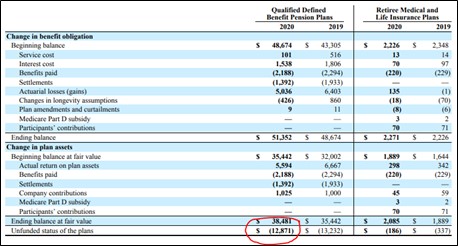

Free cash flow, as measured by GAAP cash flow from operations less GAAP capital expenditures, has covered cash dividends paid 1.85x through the first nine months of 2021, so there’s no immediate threat to Lockheed Martin’s dividend payout. Total debt stood at ~$11.7 billion relative to a cash equivalents balance of $2.7 billion, but the pending acquisition of Aerojet Rocketdyne (AJRD) for $4.4 billion may put even more pressure on the company to deliver operationally, considering the growing net debt position and the firm’s large pension deficit, which stood at ~$12.9 billion at the end of 2020.

Image: Lockheed is contending with potential deteriorating cash flow, a growing net debt position from its Aerojet Rocketdyne acquisition, and a hefty underfunded pension. Image Source: Lockheed Martin’s 2020 Form 10-K

We plan to make a number of adjustments to our valuation model of Lockheed Martin following the report, but we’re not losing sight of the company’s attractive competitive position in the global defense and space industry and solid free-cash-flow generation profile. It’s also hard not to like the prime contractor on the F-35 and a firm that invests heavily in R&D to drive solutions for the U.S. defense--and nobody can argue that Lockheed’s executive team is not shareholder friendly. On September 23, the company increased its quarterly dividend ~7.7%, to $2.80 per share, while increasing its buyback authorization.

Concluding Thoughts

Lockheed Martin reported a terrible third-quarter 2021 report and offered a gloomy outlook, but there are still reasons to be optimistic. The company retains strong coverage of the dividend with traditional free cash flow and has a burgeoning backlog of $134.8 billion (2.04x expected 2022 revenue).

Its acquisition of Aerojet Rocketdyne may breathe new life into an executive team that may need to sharpen its focus on delivering for investors, and its hard to argue with the strength of its competitive position. We’ll be lowering our fair value estimate upon the next update, but investors are getting paid a ~3.4% dividend yield to wait for management to right the ship.

The company retains its position in the simulated Dividend Growth Newsletter portfolio.

Tickerized for holdings in the ITA.

-----

Image Source: Value Trap

----------

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment