Lockheed Martin Marches Forward During These Harrowing Times

Image Source: Lockheed Martin Corporation – First Quarter Fiscal 2020 Earnings IR Presentation

By Callum Turcan

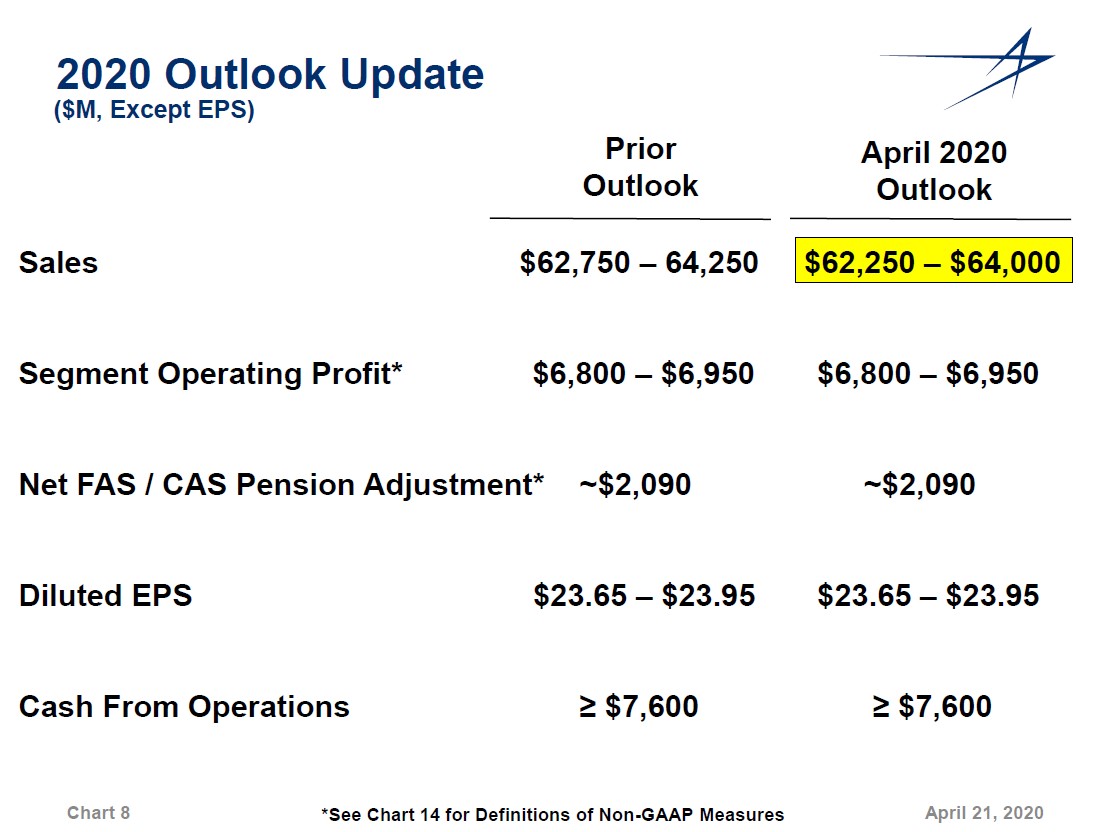

On April 21, Dividend Growth Newsletter portfolio holding Lockheed Martin Corporation (LMT) reported first-quarter earnings for fiscal 2020 (period ended March 29, 2020) that beat both consensus top- and bottom-line estimates. Even better, management largely kept Lockheed Martin’s fiscal 2020 guidance intact, save for a marginal reduction in the firm’s expected sales which is primarily due to supply chain and production issues that the ongoing coronavirus (‘COVID-19’) pandemic is creating for Lockheed Martin’s ‘Aeronautics’ business. With that in mind, Lockheed Martin is still forecasting ~6% revenue growth this year, highlighting the resilience of defense contractor’s financials even during harrowing times such as these. Shares of LMT yield ~2.6% as of this writing.

Great Quarter, Guidance Only Marginally Adjusted

While shares of LMT traded down on April 21 during the normal trading session, please note that US equities (SPY) sold off aggressively that day. We maintain our fair value estimate of $432 per share of LMT under our base case scenario, and Lockheed Martin’s strong fiscal first quarter report reinforces our thesis on the name as a top quality dividend growth play.

Image Shown: Lockheed Martin kept its fiscal 2020 guidance largely intact, save for a very marginal change in revenue expectations. Image Source: Lockheed Martin – First Quarter Fiscal 2020 Earnings IR Presentation

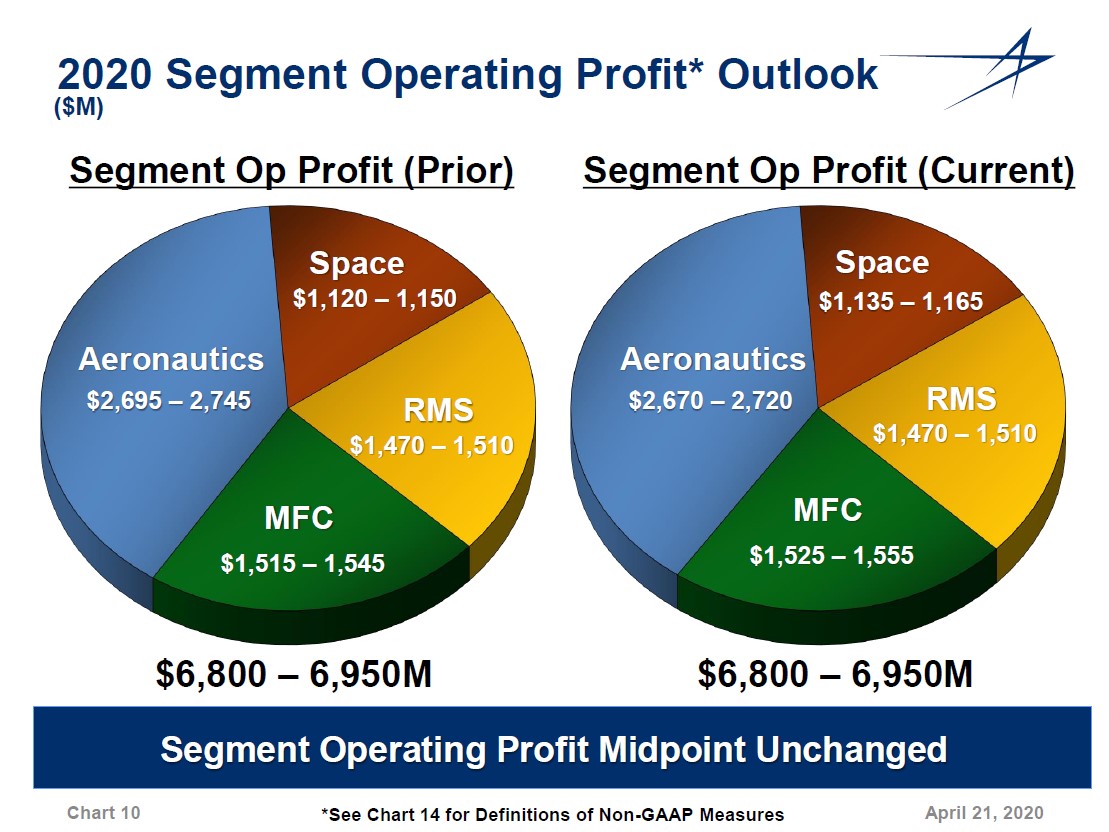

While Lockheed Martin reduced the midpoint of its forecasted revenue growth by $375 million in fiscal 2020, management maintained the firm’s total segment operating profit forecast with stronger than expected performance at Lockheed Martin’s ‘Missiles and Fire Control’ and ‘Space’ segments offsetting weaker than expected performance at its Aeronautics segment as you can see below. Guidance for Lockheed Martin’s ‘Rotary and Mission Systems’ segment was left unchanged.

Image Shown: Lockheed Martin’s strength at its other three core business segments is offsetting modest production and supply chain problems at its Aeronautics segment, allowing for management to maintain the firm’s expected total segment operating profit forecast for fiscal 2020. Image Source: Lockheed Martin – First Quarter Fiscal 2020 Earnings IR Presentation

During Lockheed Martin’s latest quarterly conference call, management had this to say (emphasis added):

“Our teams are successfully addressing many of the risks that have arisen due to the COVID-19 impacts. Our manufacturing facilities are open, and our workforce is engaged. The situation will evolve, and we will continue to monitor our business environment for areas of concern. The corporation remains committed to delivering the products and services needed for our customers and to maintaining a safe and healthy workplace for our employees.

In recognition of this unprecedented situation, the U.S. government has taken several actions that continue to reinforce the importance of our nation's defense industry. The Department of Homeland Security deems the defense industrial base to be part of the nation's essential critical infrastructure. And the Department of Defense has issued guidance that confirms the expectation that companies providing products and services in support of national security continue to maintain staffing and work schedules to perform their crucial functions.

The DoD also published a deviation on progress payments memo, issuing a blanket increase to progress payment rates for both large and small businesses. Stable and reliable cash inflows provide needed visibility for all businesses and will be especially important to many small and medium-sized suppliers. These actions underscore the country's commitment to our industry and importantly, to our supply chain, which provides tremendous innovation and strength to our national security products.”

As Lockheed Martin is deemed an essential business and remains one of the cornerstones of the American defense contracting industry (and that’s true for Western governments at-large as well), the US federal government wants the firm to continue operating (in a safe and reasonable manner) during the pandemic given the need to maintain military supplies and combat readiness. For geopolitical and strategic reasons, Lockheed Martin is being called upon to continue serving the American armed forces and the company is ready, fully capable, and happy to oblige.

During the conference call, management noted the firm is “committed to continued hiring during this crisis and have added close to 1,000 new employees over the past few weeks, in addition to advertising for 5,000 open positions” which will help ensure delivery schedules can be met. We appreciate everything frontline workers are doing to ensure parts of the economy can continue functioning, and hope everyone and their loved ones stay safe out there.

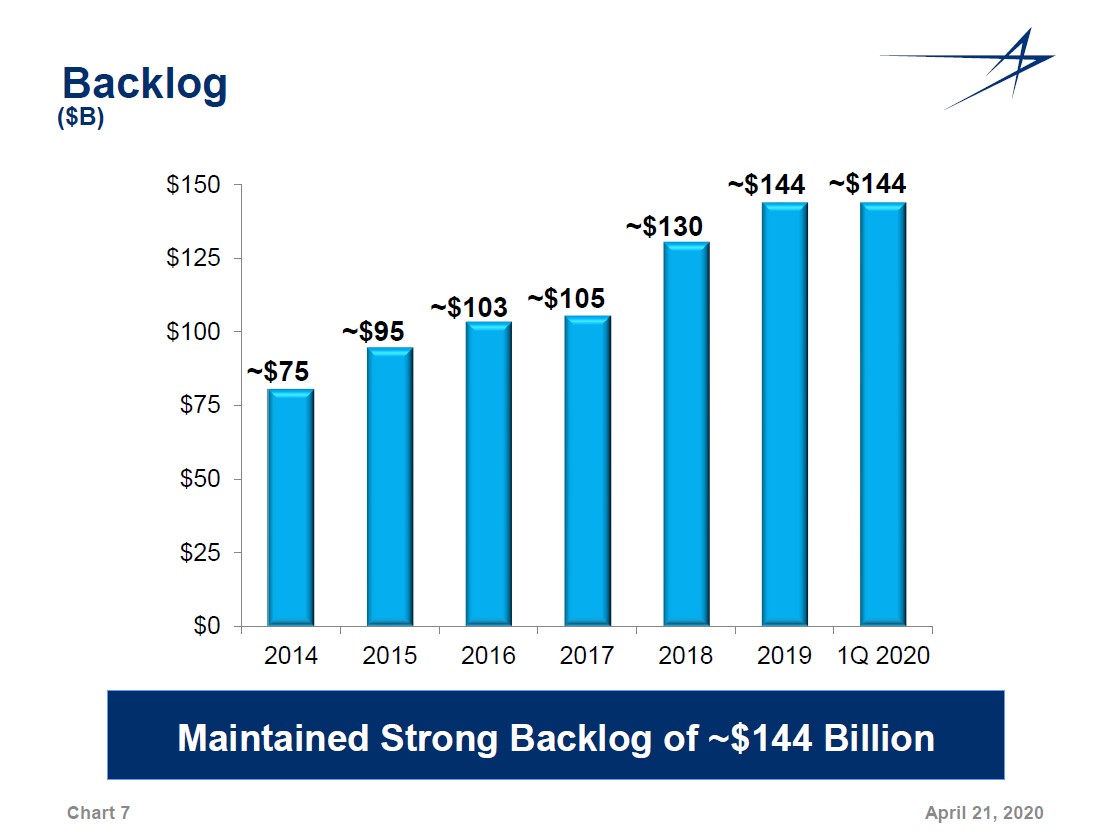

Backlog Maintained

As the US government, and other national governments around the globe, still intend to make serious investments in their defense capabilities (including the F-35 program, which is Lockheed Martin’s big growth and cash flow driver), Lockheed Martin maintained its large backlog. In fact, its backlog grew by over $0.1 billion from the end of calendar year 2019 to late-March 2020, hitting $144.1 billion at the end of Lockheed Martin’s first quarter of fiscal 2020. Its Missiles and Fire Control and Rotary and Mission Systems segments both posted nice sequential backlog growth. Here’s what management had to say during Lockheed Martin’s latest quarterly conference call:

“We received more than $15 billion in orders this quarter, maintaining our backlog at approximately $144 billion, our all-time high. RMS garnered the largest set of awards, with the total exceeding $7 billion, led by our Sikorsky organization, which booked over $4 billion of orders, including over $2 billion for a performance-based logistics contract for the U.S. Navy to provide sustainment services on our MH-60 SEAHAWK platform; and award of $500 million for the second low-rate initial production, or LRIP, contract for 12 combat rescue helicopters; and $470 million awards -- award for LRIP 2 of the presidential helicopter contract, adding 6 aircraft to the program and bringing the total order to 12 rotary aircraft out of a total program of record of 23 aircraft.”

Please note that on March 31, after the reporting period, Lockheed Martin won a $4.7 billion contract from the US Department of Defense for 78 F-35 warplanes noting specifically that the US needed an additional “48 F-35A combat aircraft for the Air Force, 14 F-35B combat aircraft for the Marine Corps, 16 F-35C fighter aircraft for the Navy” as part of the deal. Lockheed Martin is on a roll when it comes to ensuring its cash flows remain robust over the coming years. Additionally, Lockheed Martin won several other contracts at the end of March, including a $0.2 billion services contract to provide “engineering, maintenance, logistics manpower and material support to continue to develop, sustain and produce software builds as well as carryout developmental flight tests in support of the Joint Strike Fighter aircraft” which covers the F-35 program.

Image Shown: Lockheed Martin’s large backlog supports its growth outlook. Image Source: Lockheed Martin – First Quarter Fiscal 2020 Earnings IR Presentation

Last quarter, Lockheed Martin delivered 22 F-35 warplanes, three C-130J Super Hercules military transport aircraft, 13 domestic helicopters, and two international helicopters. While those deliveries were either flat or down marginally from fourth quarter fiscal 2019 levels, Lockheed Martin has communicated that the firm can continue meeting its commitments (in at least some capacity) in the near-term going forward, which we really appreciate.

Financial Overview

During the fiscal first quarter, Lockheed Martin reported year-over-year GAAP revenue growth of over 9%, with that trajectory supported by its Aeronautics segment posting solid double-digit sales growth. Share buybacks marginally reduced its outstanding share count, helping Lockheed Martin grow its diluted GAAP EPS by almost 2% year-over-year to $6.08 last fiscal quarter.

As of the end of Lockheed Martin’s first quarter of fiscal 2020, its cash and cash equivalents balance came in at $2.0 billion (up almost $0.5 billion from the end of the previous fiscal quarter) while its total debt load (inclusive of short-term debt, which stood a tad below $1.3 billion) grew marginally to $12.7 billion.

We appreciate management keeping cash on the books as that allowed for Lockheed Martin to reduce its net debt load by over $0.4 billion sequentially, bringing it down to $10.7 billion at the end of the last fiscal quarter. Furthermore, please note that in our past article (link here) covering Lockheed Martin, we applauded the company for reducing its net debt load from $13.3 billion at the end of fiscal 2018 to $11.1 billion at the end of fiscal 2019 (period ended December 31, 2019) which means that since the end of calendar year 2018, its net debt load has dropped by over $2.6 billion through the end of its latest reporting period.

The company generated $2.3 billion in net operating cash flow in the fiscal first quarter while spending $0.3 billion on capital expenditures, allowing for $2.0 billion in free cash flows. Dividend payments came in at $0.7 billion and a bit less than $0.8 billion was spent on share repurchases, both of which were fully covered by free cash flows. We like both Lockheed Martin’s dividend coverage and dividend growth trajectory which is supported by its quality financial performance over the past few years and its very promising outlook underpinned by an improving balance sheet and growing project backlog. Lockheed Martin earns a “GOOD” Dividend Growth and Dividend Safety rating, along with a Dividend Cushion ratio of 1.8 which could improve over time if the firm continues to pare down its net debt position.

Leadership Change

Lockheed Martin’s CEO and chairwoman, Marillyn Hewson, has delivered sound operational and financial results since becoming CEO in January 2013. She will be leaving that post to become the executive chairwoman while James Taiclet (who apparently also goes by “Jim”) will be taking over the CEO position effective June 15 of this calendar year. The incoming CEO has had plenty of experience in the aerospace industry and that resume includes working as president at Honeywell Aerospace Services, a division of Honeywell International Inc (HON), and as vice president of engine services at Pratt & Whitney, now a division within Raytheon Technologies Corporation (RTX) after Raytheon merged with United Technologies. Having aerospace experience is very important for a firm like Lockheed Martin given its extensive exposure to the space.

Mrs. Hewson is leaving after working for several decades at Lockheed Martin, and had this to say in the press release announcing the move:

"I know it is the right time to transition the leadership of Lockheed Martin. The corporation is strong, as evidenced by our outstanding financial results last year and a record backlog of business. We have a bright future – particularly with Jim and our outstanding leadership team at the helm… I'm pleased the board agreed with my recommendation. As Lockheed Martin's next CEO, Jim will lead the company forward in its next phase of growth and value creation."

We appreciate that the leadership change appears smooth and that plenty of time was given to make the transition happen as seamlessly as possible (the leadership change was announced in mid-March 2020 and will become effective after a three-month transition period), and we wish Mrs. Hewson the best.

Concluding Thoughts

We continue to like Lockheed Martin in our Dividend Growth Newsletter portfolio and view the firm’s cash flows as extremely resilient during these turbulent times. Its dividend appears well secured and its net debt load is coming down, while its growing backlog supports its cash flow outlook.

-----

Prime Aerospace & Defense Industry – BA FLIR GD LMT ROC RTX

Conglomerates Industry – MMM DHR GE HON [UTX is now part of RTX]

Aerospace Suppliers Industry – ATRO HEI HXL TDY TXT SPR

Related: SPY, XAR

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The SPDR Aerospace & Defense ETF (XAR) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Lockheed Martin Corporation (LMT) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment