Intel’s 7-nm Chips Behind Schedule, Free Cash Flows Remain Strong

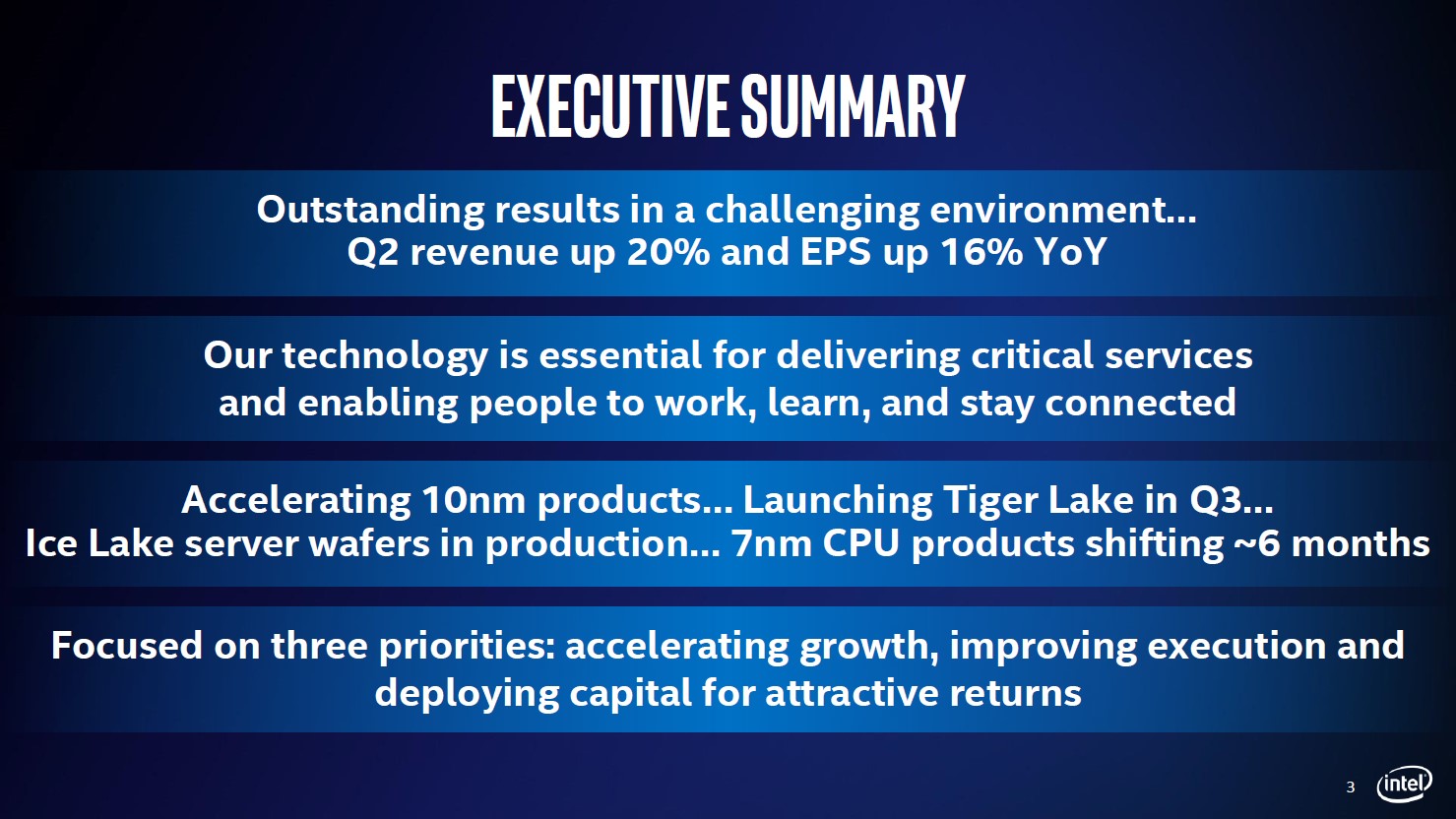

Image Shown: Intel Corporation made waves on July 23 when it announced its 7-nm chips were well behind schedule. Image Source: Intel Corporation – Second Quarter Fiscal 2020 IR Earnings Presentation

By Callum Turcan

On July 23, Intel Corporation (INTC) reported second quarter fiscal 2020 earnings (period ended June 27, 2020) that beat both consensus top- and bottom-line estimates. However, shares of INTC dropped during after hours trading that day due to Intel delaying the rollout of its 7-nanometer chips. The company offered full-year guidance for fiscal 2020 that indicated its growth trajectory was continuing in the face of the ongoing coronavirus (‘COVID-19’) pandemic, though investors were largely fixated on the delay of its 7-nm chip offerings.

Guidance Update

In fiscal 2019 (period ended December 28, 2019), Intel generated $72.0 billion in GAAP revenues which was up 2% from fiscal 2018 levels. For fiscal 2020, Intel expects to generate $75.0 billion in GAAP net sales, representing 4% annual growth. Given the macro background, namely rising US-China trade tensions in 2018-2019 and the COVID-19 pandemic in 2020, that represents quite decent performance.

Back in January 2020, Intel gave guidance for fiscal 2020 that called for $73.5 billion in revenue (on both a GAAP and non-GAAP basis) and a non-GAAP operating margin of 33%. That guidance was later pulled. Please note Intel’s new fiscal 2020 forecast is guiding for a 32% non-GAAP operating margin due to expected pressures on its gross margins this fiscal year, which we will cover in just a moment.

Management noted that Intel’s growth trajectory is supported by its ‘data-centric’ operations, with that business expected to post ~10% revenue growth this fiscal year as you can see in the upcoming graphic down below. However, its gross margins are expected to come under pressure this fiscal year as the firm rolls out its 10-nm Tiger Lake CPU (central processing unit) “soon,” which is geared towards laptops and gaming notebooks. Additionally, Intel also plans to launch its 10-nm Ice Lake CPU for servers later this fiscal year. Intel plans to mitigate some of the blow to its operating margin by scaling back its operating expenses on a relative (percent of annual revenue) basis. In the second quarter of fiscal 2020, Intel cut its R&D (research and development) and MG&A (marketing, general and administrative) expenses by over 5% year-over-year.

Image Shown: An overview of Intel’s guidance for fiscal 2020. Image Source: Intel – Second Quarter Fiscal 2020 IR Earnings Presentation

Within its earnings press release Intel noted that (emphasis added):

“Intel is accelerating its transition to 10nm products this year with increasing volumes and strong demand for an expanding line up. This includes a growing portfolio of 10nm-based Intel Core processors with “Tiger Lake” launching soon, and the first 10nm-based server CPU “Ice Lake,” which remains planned for the end of this year. In the second half of 2021, Intel expects to deliver a new line of client CPU’s (code-named “Alder Lake”), which will include its first 10nm-based desktop CPU, and a new 10nm-based server CPU (code-named “Sapphire Rapids”).

The company's 7nm-based CPU product timing is shifting approximately six months relative to prior expectations. The primary driver is the yield of Intel's 7nm process, which based on recent data, is now trending approximately twelve months behind the company's internal target.”

Shares of Intel’s competitor Advanced Micro Devices Inc (AMD) were up ~8% during after hours trading on July 23 due to the news that Intel’s 7-nm chip development strategy was behind schedule. Intel alluded to the firm considering using third-party foundries during its earnings call as part of a contingency plan. The problem comes down to Intel not being able to produce the 7-nm chips in an economical manner (that is what Intel is referring to by its lackluster “yield” in its earnings press release). Here is what management had to say on the 7-nm issue during Intel’s latest earnings call:

“Turning to our 7-nanometer technology. We are seeing an approximate six-month shift in our 7-nanometer-based CPU product timing relative to prior expectations. The primary driver is the yield of our 7-nanometer process, which based on recent data, is now trending approximately 12 months behind our internal target. We have identified a defect mode in our 7-nanometer process that resulted in yield degradation.

We’ve root-caused the issue and believe there are no fundamental roadblocks, but we have also invested in contingency plans to hedge against further schedule uncertainty. We’re mitigating the impact of the process delay on our product schedules by leveraging improvements in design methodology such as die disaggregation and advanced packaging. We have learned from the challenges in our 10-nanometer transition and have a milestone-driven approach to ensure our product competitiveness is not impacted by our process technology roadmap.”

Additionally, management reiterated Intel’s confidence in the firm’s medium-term product pipeline. The Q&A session got testy at times as analysts pushed management to provide greater detail on how Intel would catch up with its peers in terms of semiconductor production technology.

One analyst, Vivek Arya from Bank of America Corporation (BAC), noted that by the time Intel would be rolling out its first 7-nm chips (a client CPU product due out late-2022 or early-2023, with a data center CPU product due out in 2023), Taiwan Semiconductor Manufacturing Company Limited (TSM) or ‘TSMC’ would be on 3-nm chips, a generation ahead of Intel. Bob Swan, Intel’s CEO, responded by saying Intel had a lot of confidence in its product lineup through 2022 but that Intel was “evaluating the optionality that we have on ‘23 and beyond” which could involve utilizing third-party technology to catch back up. We intend to follow this story closely going forward.

Financial Strength Update

Intel generated $19.7 billion in GAAP revenues in the fiscal second quarter, up 20% year-over-year, with strong growth reported at its ‘Data Center Group,’ ‘Non-Volatile Memory Solutions Group,’ and ‘Client Computing Group.’ Rising demand for cloud computing infrastructure and desktops/laptops due to the working-at-home dynamic created by the pandemic supported sales growth at those units. Rising revenues allowed for Intel to grow its GAAP operating income by 23% year-over-year last fiscal quarter, assisted by operating expense declines and greater economies of scale.

However, Intel’s GAAP gross margins were down roughly 660 basis points last fiscal quarter. Management cited “faster uptake of our 5G ASIC (Application Specific Integrated Circuit) products, which are margin dilutive relative to the Company average and also continued acceleration of 10-nanometer products overall.”

There were some other headwinds Intel had to contend with last fiscal quarter. Intel’s ‘Internet of Things’ (‘IoT’) division saw its revenues decline year-over-year, in part due to pressures facing the global automotive industry which Intel caters to via its Mobileye unit. Going forward, Intel’s IoT division is expected to continue facing headwinds due to the sharp slowdown in global economic activity across the board. Reduced global automobile sales weighed on Mobileye’s performance last fiscal quarter, though we remain optimistic on the segment’s long-term future (article covering this segment in greater detail here). Intel spent ~$900 million acquiring Moovit recently to improve its ability to capitalize on the potentially massive “mobility-as-a-service” market (Intel noted this market could be worth $160 billion during its latest earnings call).

During the first half of fiscal 2020, Intel generated $10.6 billion in free cash flow as its net operating cash flow grew by 38% year-over-year, hitting $17.3 billion. Intel’s capital expenditures declined modestly during this period, hitting $6.7 billion, and management expects Intel’s capital expenditures will fall moderately in fiscal 2020 versus fiscal 2019 levels. For all of fiscal 2020, Intel is guiding for ~$17.5 billion in free cash flow. We appreciate the resilience of Intel’s cash flow profile in the face of the pandemic. Intel spent $2.8 billion covering its dividend obligations and $4.2 billion repurchasing its stock during the first half of this fiscal year, both of which were fully covered by its free cash flows.

The company exited the first half of fiscal 2020 with $25.8 billion in total cash and short-term cash-like investments versus $2.3 billion in short-term debt and $36.1 billion in long-term debt. However, Intel also had $3.9 billion in long-term equity investments (made up of marketable equity securities, non-marketable equity securities, and equity method investments) and $2.9 billion in other long-term investments (corporate debt, government debt, commercial paper, etc.) on the books at the end of this period which could be considered cash-like. Intel had a modest net debt position of ~$12.6 billion when looking at just its cash and cash equivalents balance versus its total debt load, or a ~$5.7 billion net debt load when including its other cash-like assets. Either way, we view Intel’s net debt load as manageable given its high quality cash flow profile.

Intel has a Dividend Cushion ratio of 2.4, earning the firm a “GOOD” Dividend Safety rating, and that Dividend Cushion ratio factors in high annual single-digit per share dividend growth over the coming fiscal years. We give Intel an “EXCELLENT” Dividend Growth rating. Since the start of calendar year 2012, Intel has grown its quarterly per share payout by ~57%, and we expect that growth trajectory to continue going forward.

Concluding Thoughts

We continue to like Intel in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Our fair value estimate for Intel sits at $61 per share, well above where shares of INTC are trading as of this writing. Though the hiccups at Intel’s 7-nm chip development process are concerning, the firm is planning ahead and part of that process involves accepting it may need to partner up with a leading semiconductor foundry (like TSMC) to stay near the top of the pack. Its strong financial position could enable Intel to make a strategic acquisition to help shore up its operations on this front.

Bigger picture, Intel’s cash flow generating abilities remain strong and its performance during the early stages of the COVID-19 pandemic indicates the firm will have plenty of financial firepower to help fix the problems it is having with its 7-nm chip technology and production capabilities. Intel is doing an effective job of offsetting gross margin pressures by cutting down its operating expenses, while still making meaningful investments in R&D (spending $6.6 billion on the category during the first half of fiscal 2020).

On a final note, Intel joined Facebook Inc (FB), among others, and recently invested $250 million in Reliance Industries’ Jio Platforms (a major telecommunications and internet application giant in India). We covered Jio Platforms’ operations and potential growth strategies in this article here.

----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: BAC, SCWX, SPY

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment