How the Payment of a Dividend Impacts Intrinsic Value Estimation

"Dividends are a transfer of cash to the shareholders that the shareholders already owned."

By Brian Nelson, CFA

Many investors use the strategy of dividend growth investing as a means to generate increasing income in their retirement portfolios to stay ahead of inflation, or as a means to grow an income stream in the decades before retirement. Though we think such a strategy has tremendous merit, we think it’s important for readers to understand the mechanics of how a cash dividend payment impacts the valuation (intrinsic worth) of a company.

How the Payment of a Dividend Impacts Valuation (Intrinsic Worth)

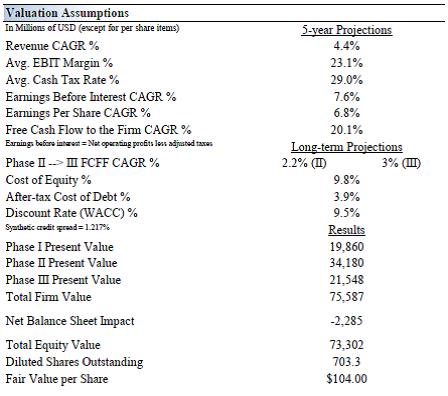

In this article, let’s walk through the valuation adjustments we perform when a company pays a dividend to hammer home how to think about the concept of a dividend, using historical data for 3M (MMM) in the example. For analytical purposes, we use the terms 'dividend' and 'distribution' interchangeably as they are treated the same when it comes to valuation (i.e. a cash outflow from the balance sheet), even though the tax implications for investors may be different for each. Below, please find 3M's summary valuation breakdown, as of its report dated December 25, 2013. This article is for educational purposes so it does not reflect our current opinion of 3M, which is beyond the scope of this note.

Image Source: Valuentum

Step I: Identifying the Company's Shares Outstanding and Net Balance Sheet Impact

First, there are two items that we’d like to focus on in this example (image above): 1) The line item ‘Net Balance Sheet Impact’, which is -$2.285 billion (negative $2.285 billion), and 2) the line item ‘Diluted Shares Outstanding,’ which is 703.3 million shares.

One of these figures can be found directly in 3M’s 2012 annual report Form 10-K while the other figure has to be calculated from data found in the Form 10-K. To download 3M's 2012 annual report Form 10-K, please click here; refer to pages 47 and 48. The Form 10-K is a large document so it may take some time to show up on your screen. On page 47 of that document, you’ll see the denominator we use in valuation, ‘Diluted Shares Outstanding’: 703.3 (million). It can be found near the bottom of the income statement.

On page 48, you’ll see how we arrive at the ‘Net Balance Sheet Impact’: cash and cash equivalents ($2.883 billion) + marketable securities ($1.648 billion) less long-term debt ($4.916 billion) less short-term borrowings ($1.085) and less two additional items we adjust for: capital lease obligations ($71 million) and the underfundedness of the company’s pension ($744 million) or our estimate of its current funding status (the pension was more than $1.9 billion underfunded at the end of 2012, page 79).

Net Balance Sheet Impact = $2.883 + $1.648 - $4.916 - $1.085 - $0.071 - $0.744 = -$2.285

Step II: Calculating How Much Cash Is Removed from the Balance Sheet Upon the Dividend Payment

Next, let's calculate how the payment of a dividend impacts the company's valuation.

On December 17, 2013, 3M significantly increased its quarterly dividend to $0.855 per share from $0.635 per share previously. The same day, 3M issued another press release in which it reaffirmed its long-term sales and earnings growth objectives and issued a 2014 earnings outlook of $7.30-$7.55 per share, a range that bounded the consensus estimate of $7.40 per share at the time. We assume there were ~703.3 million shares outstanding at the time 3M went ex-dividend a couple months later (2/12/14), so the cash transfer from 3M to its shareholders when it paid the quarterly dividend was ~$601.3 million (~703.3 million shares x $0.855 per share).

After the payment of the cash dividend to shareholders, the new intrinsic (enterprise) value estimate of 3M, using the balance sheet as the adjustment factor (since dividends are paid from cash on the balance sheet), would be ratcheted down by a total of ~$601.3 million. The ‘Net Balance Sheet Impact’ becomes a larger ‘negative,’ and the equity value of 3M would then go from $~73.3 billion to ~$72.7 billion, and the new fair value estimate would be $103.145 per share ($104 less $0.855). You’ll notice that the per-share valuation adjustment is precisely the amount that 3M paid to shareholders in cash dividends.

Perhaps counter to what one might think, and all else equal, a cash dividend payment reduces the intrinsic value of a company, much like your paying a personal "dividend" in the form of, let's say, a vacation for yourself would reduce your net worth. Cash is removed from your personal balance sheet in such a case, just like cash is removed from a company's balance sheet when the cash dividend is paid.

Wrapping Things Up

Companies can generally only increase our estimate of their fair value if they drive results and revisions that increase our future estimates of their earnings and free cash flow (relative to our previous forecasts), revisions of the future that would increase the discounted value of the company's future free cash flows over our three-stage valuation model and bolster total firm (enterprise) value.

"Taking money out of the company" to pay it to its owners (shareholders), as in the case of a cash dividend payment, counterintuitively reduces the intrinsic value of the company, all else equal. Coincidentally, this is why the stock price of the company is reduced by the amount of the cash dividend per share on the ex-dividend date, too.

Dividends should be viewed as a transfer of cash (wealth) to the shareholders that the shareholders owned anyway, as by definition, shareholders already have a claim on the company's assets. Paying an increasing dividend over time is not an economic-value-creating endeavor either. It is simply an ever-increasing income or wealth transfer, a movement of increasing funds from one place to another, sometimes with tax consequences.

Though not economic-value creating, paying a dividend can sometimes be 'value-preserving' if the management team would have otherwise destroyed value by overpaying for an acquisition or buying back expensive stock with the cash it instead used to pay the dividend. That doesn't change the reality that the value of a dividend-paying firm is still not in the income distributed to shareholders, per se, but rather in the economic-value creating actions the dividend-paying firm takes to replenish that income stream such that it is sustainable long into the future.

It is for this reason that one must pick their dividend payers wisely and go far beyond simple dividend growth analysis. After all, as a shareholder (owner), you already own that dividend in the form of cash on the balance sheet before it's paid.

NOW READ: What Causes Fair Value Estimates to Change?

-----

Did You Know? The Dividend Cushion ratio has done a fantastic job both in identifying strong dividend paying companies and anticipating dividend cuts, "Efficacy of the Dividend Cushion Ratio.

Energy pipeline MLPs have significantly reduced their capital-market dependency risks during the past several years. Read more here: Energy Pipelines: What a Difference A Few Years Have Made!

----------

Tickerized for holdings in the SDY. A version of this article appeared on our website January 14, 2014. This article is for educational purposes only. Article updated June 2017 and refreshed again March 24, 2023.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment