FedEx Indicates Its Outlook Is Improving

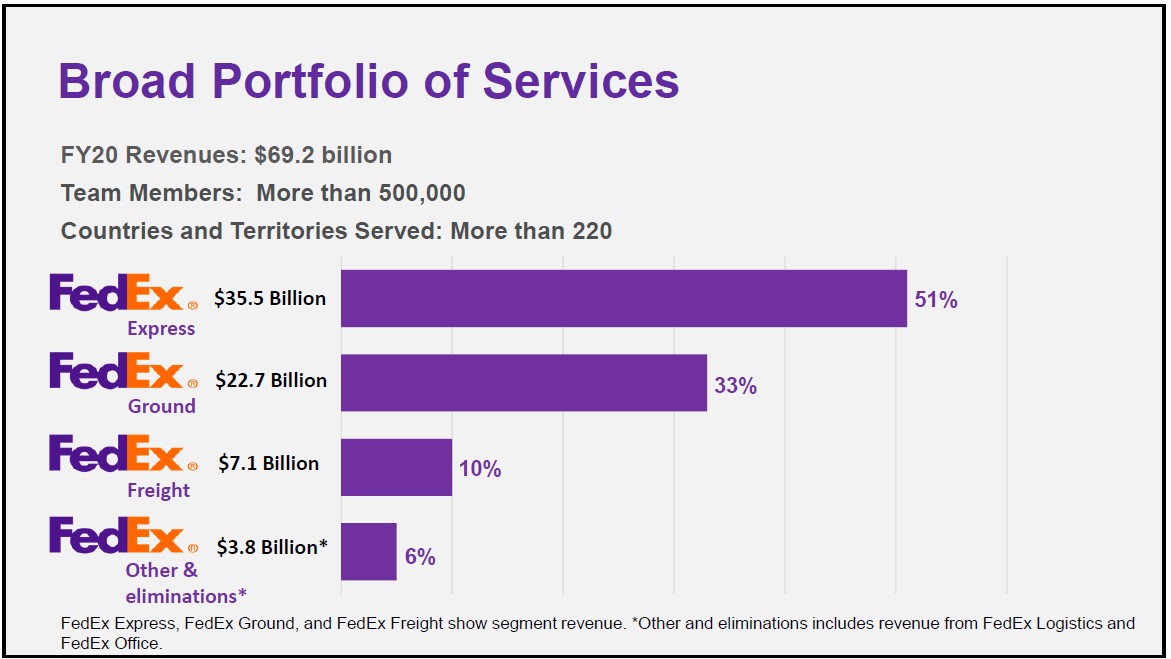

Image Shown: An overview of FedEx Corporation’s revenue generation by business segment in fiscal 2020. Image Source: FedEx Corporation – June 2020 IR Presentation

By Callum Turcan

On June 30, FedEx Corporation (FDX) reported fourth quarter fiscal 2020 earnings (period ended May 31, 2020) that beat both consensus top- and bottom-line estimates. Shares of FDX rallied during normal trading hours on July 1 as the air freight and logistics company’s outlook looked better than feared. Management did not provide full year guidance for fiscal 2021 given the uncertainties created by the ongoing coronavirus (‘COVID-19’) pandemic. During the firm’s latest quarterly conference call FedEx noted (emphasis added):

“The economic outlook is highly uncertain making forecasting incredibly challenging. Around the world, we saw a marked decline in global economic activity in the final quarter of fiscal year 2020. However, to date we have experienced week-over-week improvement in our business since hitting the bottom in mid-April. As we enter fiscal 2021, there are signs of tentative economic recovery under way.” --- Brie Carere, FedEx’s Chief Marketing and Communications Officer

Background

Shares of FedEx are trading near the lower bound of our fair value estimate range ($157 per share) as of this writing after peaking in 2018 at over $260 per share. Investors have steadily bid FDX lower since 2018 as FedEx’s integration efforts with TNT Express, which FedEx acquired in 2016 for roughly ~$5.0 billion (based on exchange rates as of early-July 2020), have not gone as smoothly as planned.

FedEx acquired TNT Express to gain access to its vast European road network, which in theory offered FedEx a way to scale up quicker and cheaper in Europe. As part of the deal, TNT Express had to sell off its airline operations which it did in conjunction with the FedEx deal. Here’s what FedEx had to say about ongoing integration expenses during its latest quarterly conference call:

“Despite the COVID-19-related delay of completing our air network integration into early 2022, we still expect TNT integration expenses to total approximately $1.7 billion. We expect to incur $170 million of integration expenses in fiscal 2021. Integration expenses will be much lower in fiscal 2022 as we complete the physical network integration of TNT into FedEx Express.” --- Alan Graf, CFO of FedEx

FedEx intends on using its air freight and ground logistics operations to aggressively expand its business-to-business (‘B2B’) and business-to-consumer (‘B2C’) volumes in Europe. That will require FedEx to complete the integration process (namely its air network with its ground network) before incremental synergies can be realized in earnest, which will take until fiscal 2022 according to management.

Other big moves FedEx recently made was to not renew its US air freight contract with Amazon Inc (AMZN) in 2019, the same year it announced it would no longer make ground deliveries for the e-commerce giant back. Management brought up Amazon just one time during FedEx’s latest quarterly conference call. One could argue FedEx’s decision seemed to be based off Amazon building out its own in-house logistics network that would eventually become a competitive threat to FedEx, so FedEx pivoted towards building up its relationship with its other customers. While this move created short-term headwinds to FedEx’s financials, the company is expecting that doing so will improve its long-term outlook.

Quarterly Update

In the fiscal fourth quarter, the company’s FedEx Ground (includes last mile delivery services) segment posted a 20% year-over-year increase in its revenues while its FedEx Express and FedEx Freight segments posted 10% and 17% year-over-year sales declines, respectively. Rising e-commerce demand led to greater residential shipping volumes which offset weak demand seen at FedEx’s commercial customers, keeping pandemic quarantine measures and the related shutdown in economic activity in mind. Management cited “a surge in residential deliveries at FedEx Ground and in transpacific, and charter flights at FedEx Express” as playing a key role in propping up FedEx’s financials last fiscal quarter.

FedEx’s GAAP revenues still moved lower by 3% year-over-year while its operating expenses rose by 2% year-over-year in the fiscal fourth quarter, which led to a material deterioration in FedEx’s financial performance. Segment level operating income at FedEx Ground declined by 17% year-over-year last fiscal quarter as the firm invested heavily in safety and sanitary measures to deal with the pandemic and protect its employees (which including personal protective gear, additional cleaning services, various medical and safety supplies, and additional security measures). Segment level operating income at FedEx Express and FedEx Freight were down 56% and 32% year-over-year, respectively, last fiscal quarter.

Please note that providing B2B logistics services tends to be a lot more lucrative than providing B2C logistics services. As the economy recovers and logistics demand picks up from commercial customers, FedEx’s financial and operational performance should improve going forward.

FedEx announced in February 2020 that the firm would attempt to optimize its last-mile delivery operations (particularly in the US) by planning to have FedEx Ground handle as many packages transported by FedEx Express as possible. Here’s additional commentary from management on FedEx’s evolving FedEx Ground strategy from the firm’s latest quarterly conference call:

“During the first half of fiscal 2021, we will complete the integration of FedEx SmartPost packages into standard FedEx Ground operations. We will also continue to focus on last mile residential optimization by directing certain U.S. day-definite residential and rural FedEx Express shipments into the FedEx Ground network to increase efficiency and lower our cost to serve.” --- CFO of FedEx

The company is betting that by perpetually pushing its various logistics solutions segments together and integrating company-wide operations, FedEx will be able to enhance its revenue generation abilities while reducing its cost structure. While the story is appealing, FedEx needs to deliver on its promises.

Balance Sheet Overview

FedEx had $4.9 billion in cash and cash equivalents on hand at the end of May 2020 versus less than $0.1 billion in short-term debt and $22.0 billion in long-term debt. We caution that FedEx’s net debt load is meaningful, and the company will need to retain access to capital markets at attractive rates to refinance future debt maturities. That appears to be the case, as FedEx issued out $1.0 billion in 3.800% Senior Notes due 2025, $0.75 billion in 4.250% Senior Notes due 2030, and $1.25 billion in 5.250% Senior Notes due 2050 in April 2020.

In late-May 2020, FedEx announced it had won approval from its lenders to modify its revolving credit agreements to better allow FedEx to ride out the storm. A couple of months earlier in March 2020, FedEx announced it was able to extend the maturity of its five-year $2.0 billion revolving credit line out to March 2025 and that it was replacing a previous short-term lending facility with a new 364-day $1.5 billion revolving credit line that matures in March 2021. Here’s what management had to say on FedEx’s liquidity position during the firm’s latest quarterly conference call:

“During the quarter, we took several actions to increase liquidity and strengthen our financial position. In March, we extended our $1.5 billion 364-day credit agreement, as well as our $2 billion five-year credit agreement. In April, we issued $3 billion of senior unsecured debt and used the proceeds in part to repay the borrowings under our credit facilities and commercial paper program.

In May, we amended the credit facilities to provide additional financial flexibility through the end of fiscal 2021, given the current environment. We ended the fiscal year with $4.9 billion in cash and cash equivalents and with $3.5 billion available under our credit facilities.” --- CFO of FedEx

FedEx’s liquidity position appears solid, especially when factoring in the company’s apparent ability to issue debt at attractive rates. Recent strength in FedEx’s share price further enhances its ability to raise funds in capital markets. When FedEx publishes its 10-K SEC filing for fiscal 2020, we will have more to say on its financial position including its cash flow profile.

Concluding Thoughts

Shares of FDX are trading near the low end of our fair value estimate range as of this writing as the market remains worried that asset integration efforts will continue to take several years to complete. FedEx is still incurring major expenses related to its TNT Express acquisition which was completed several years ago. Though the air freight and logistics industry is one where investors should expect such efforts to take a while given the regulatory and operational complexities of cross-border commerce, at some point FedEx needs to show it is up to the task at hand. With that in mind, the company’s strong liquidity position and management’s promises to improve FedEx’s operational performance over the coming years helps justify the recent recovery in FedEx’s share price.

-----

Air Freight & Logistics Industry – CHRW EXPD FDX ODFL UPS

Related: AMZN, XPO, FWRD, HUBG, ATSG, AAWW, AIRT, ECHO, USAK, SAIA, WERN, SNDR, KNX, CVTI

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment