Favorite Miner Newmont Shines Bright

Image Source: Newmont Corporation – June 2021 IR Presentation

By Callum Turcan

On January 13, 2020, we added shares of Newmont Corporation (NEM) as an idea to the Dividend Growth Newsletter portfolio (link here). The gold miner has a top-notch asset base located in favorable mining jurisdictions with ample reserves to maintain and potentially grow its production base over the coming years. Other than gold, Newmont also produces silver, lead, copper, and zinc.

Newmont Shines Bright as Stellar Income Growth Idea

When Newmont joined the Dividend Growth Newsletter portfolio its quarterly dividend stood at $0.14 per share, though management had communicated on January 6, 2020, that Newmont was set to increase its quarterly payout up to $0.25 per share starting in April 2020. That was the news that caught our attention, and after reviewing our cash flow model covering Newmont, we decided to add the gold miner as an idea to the newsletter portfolio. After management pushed through additional payout increases over the following quarters, Newmont’s quarterly payout now sits at $0.55 per share.

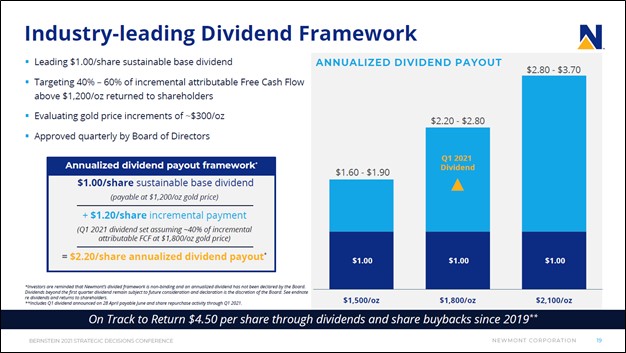

As of this writing, shares of NEM yield ~3.1% on a forward-looking basis. Newmont’s dividend policy includes a base payment and an incremental payment as the firm aims to distribute 40%-60% of its incremental free cash flow to investors when gold prices (such as COMEX) are trading north of $1,200 per troy ounce. COMEX gold futures for August 2021 deliveries are currently trading near $1,900 per troy ounce as of this writing.

Image Shown: An overview of Newmont’s dividend policy. Image Source: Newmont – June 2021 IR Presentation

From January 13, 2020 to the end of normal trading hours on June 5, 2021, shares of Newmont were up ~69% while the S&P 500 (SPY) was up ~30% during this period according to Yahoo Finance data, before including dividend considerations. The top end of our fair value estimate range for Newmont sits at $90 per share, well above where shares of NEM are trading at currently, indicating there is potentially room for further capital appreciation upside going forward.

Though the goal of the simulated Dividend Growth Newsletter portfolio is to generate stable and growing income ideas, the strongest mining entities are among the types of companies that are best suited to navigate an environment where inflationary pressures are growing. Gold and other commodity prices are on a nice upward trend of late, which supports Newmont’s outlook.

Should an enormous infrastructure package get signed into law in the US, that would further improve Newmont’s outlook given how another wave of US fiscal stimulus spending would act as a nice tailwind for gold prices. Copper prices have surged over the past year or so and would be a major beneficiary of additional infrastructure spending in the US, though copper remains a small part of Newmont’s production profile.

Acquisition Update

In May 2021, Newmont completed the acquisition of GT Gold by acquiring the shares in the Canadian junior mining firm it did not already own. The firm spent approximately USD$0.3 billion in cash acquiring that stake. Newmont now owns the Tatogga project in the “Golden Triangle” district of British Columbia, Canada. The Tatogga project seeks to develop the Saddle North deposit which is home to sizable gold and copper resources, and Newmont sees room for further exploration upside in the region. We covered this acquisition in detail here.

Newmont also owns 50% of the nearby Galore Creek project, which includes substantial undeveloped copper, gold, and silver resources. Teck Resources Ltd (TECK) owns the remaining 50% stake in the Galore Creek project. The current pricing environment for gold and copper likely supports future development activities at both projects, though please note both endeavors are still in the exploration and appraisal stage. Any commercial development would take several years to bring online and first a project would need to officially get sanctioned.

Earnings Update

On April 29, Newmont reported first quarter 2021 earnings that missed consensus top- and bottom-line estimates as its operations contended with headwinds arising from the coronavirus (‘COVID-19’) pandemic. Its Cerro Negro gold mine in Argentina and Yanacocha gold mine in Peru were cited as facing major headwinds in the first quarter. Newmont’s attributable gold production came in at 1.46 million ounces, down 2% year-over-year while its attributable gold equivalent ounce (‘GEO’) production from other metals declined by 6% year-over-year in the first quarter.

Shares of NEM still marched significantly higher since its latest earnings report was published as investors looked towards the future. Management reiterated Newmont’s full-year production guidance for 2021 that calls for 6.5 million ounces of attributable gold production and 1.3 million GEO of production of other products (copper, silver, lead, and zinc). The firm’s output is expected to be weighted towards the back half of 2021. Newmont generated over $0.4 billion in free cash flow during the first quarter and exited March 2021 with a net debt position of $1.2 billion (inclusive of short-term debt and ‘lease and other financing obligations’ and exclusive of ‘investments’).

In late March, Newmont announced that it had secured a $3.0 billion “sustainability-linked revolving credit facility” that “includes a pricing feature based upon third-party sustainability performance measures and includes overall improved pricing from the previous facility.” By amending the terms of its 2019 credit facility, the updated and extended credit line expires in March 2026 and provides Newmont with ample access to liquidity to cover its medium-term financing needs. We are intrigued by the move, particularly if Newmont can reduce its financing costs on a relative basis going forward, as indicated in the press release.

Operational Update

At its Boddington gold mine in Western Australia, Newmont announced that its first autonomous haulage system (‘AHS’) trucks were online as of this past March during the firm’s latest earnings call. Newmont intends to continue growing its AHS truck fleet at the site to improve safety conditions and extend the mine’s producing life going forward. The firm noted that deploying these AHS trucks should generate “significant productivity improvements” that are expected to put downward pressure on fuel expenses as stoppages from shift changes and employee breaks are no longer a factor. Improved safety conditions were also cited as a major benefit here.

Looking ahead, management aims to roll out AHS trucks at Newmont’s other mines around the world while also seeking additional ways to automate its mining operations. These types of investments could improve Newmont’s cost structure while extending the life of its producing mines, which in turn would bolster its cash flow generating abilities over the long haul in any gold pricing environment.

Pivoting to Newmont’s embattled Musselwhite gold mine in Canada, those operations faced headwinds from COVID-19 in the second quarter of this year, though management remains optimistic that the mine’s production will keep ramping up going forward. Operations were halted at the Musselwhite mine due to a fire in 2019. The remediation work to repair the damages from that fire and a materials handling project that was commenced in 2016 were both completed in late 2020. Going forward, ramping the Musselwhite mine up to its full potential while taking advantage of the efficiency gains the materials handling project is expected to generate should provide a nice tailwind to Newmont’s future financial performance.

Outlook

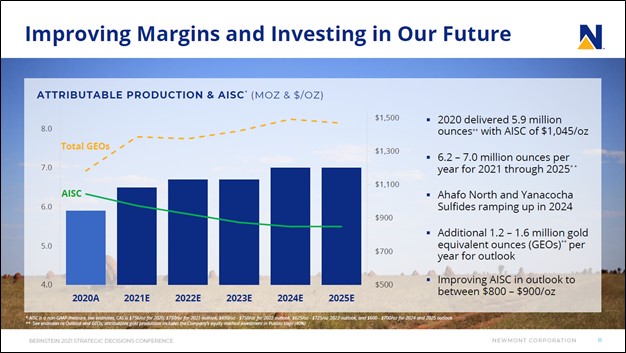

Newmont expects its production base will move higher over the coming years (using 2020 as a baseline) while its all-in sustaining costs (‘AISC’) per ounce are expected to trend lower over the coming years as highlighted in the upcoming graphic down below. Robust commodity prices, a growing production base, and an improving cost structure should go a long way to enhancing Newmont’s ability to generate free cash flows in the future. Newmont forecasts that its performance in 2021 should improve materially over 2020 levels as it concerns its production and profitability metrics, though as noted previously, its output is weighted towards the back half of the year.

Image Shown: Newmont’s outlook through the middle of the 2020s decade is bright and underpins its stellar income growth runway. Image Source: Newmont – June 2021 IR Presentation

Concluding Thoughts

Newmont celebrated its 100th year anniversary in May 2021, as did we, given the gold miner’s outperformance during the past year and a half. We continue to view Newmont as one of the best positioned miners out there and see the company as a way to hedge against growing inflationary pressures. Newmont’s dividend growth outlook remains bright as management is committed to rewarding income seeking investors. We continue to like Newmont as an idea in the simulated Dividend Growth Newsletter portfolio.

Downloads

Newmont's 16-page Stock Report (pdf) >>

Newmont's Dividend Report (pdf) >>

-----

Mining & Chemicals Industry - APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, CMP, AA, KALU, MLM, VMC, NUE, CSL, SON, ALB, FUL, ATR, GGG, SHW

Related: GLD, CPER, SLV, NG, TECK

Other: GOLD, AEM, KGC, IAG, AUY, EGO, FNV, EXK, AG, FSM, CDE, GDX, GDXJ, NUGT, IAU, JNUG, SIL, GGN, PHYS, DUST, AGQ, USLVF, SGOL, AU, KL, HL, GFI, HMY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment