Enterprise Products Partners Reports Strong 3Q, Impressive ~7.5% Distribution Yield

Image Source: Enterprise Products Partners

By Brian Nelson, CFA

There are now only 15 holdings in the ALPS Alerian MLP ETF (AMLP) as the number of master limited partnerships (MLPs) on the market continues to shrink. According to data from ALPS Advisors, the Alerian MLP Infrastructure Index, on a total return basis, has advanced just 0.74% during the past 10 years. During the past half-decade or so, the group has undergone a considerable number of distribution cuts, as energy markets have waned.

The ALPS Alerian MLP ETF is having a much better year during 2022, however. The performance so far during 2022 won’t make up for the collapse in the sector during the past decade, but it will help. Year-to-date, the ALPS Alerian MLP ETF is up more than 25% so far this year, and one of our favorite ideas is Enterprise Products Partners L.P. (EPD). The company reported solid third-quarter results, released November 1, and we continue to like EPD as an idea in the simulated High Yield Dividend Newsletter portfolio.

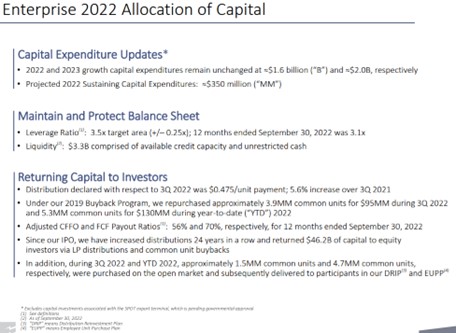

Many know that we’re not big fans of the MLP industry’s metric distributable cash flow (DCF), as it excludes growth capital spending, which is an outflow that impacts the financial health and capacity of an entity. Growth capital spending is not something that should be excluded in dividend health analysis, nor within the valuation context. Enterprise Products Partners has gone a long way in providing greater transparency for investors, and we liked the cash-flow performance at the company in its third-quarter report:

Adjusted cash flow provided by operating activities (“Adjusted CFFO”) was $2.0 billion for the third quarter of 2022 compared to $1.7 billion for the third quarter of 2021. Enterprise’s payout ratio of distributions to common unitholders and partnership unit buybacks for the twelve months ended September 30, 2022, was 56 percent of Adjusted CFFO. For the twelve months ended September 30, 2022, Adjusted Free Cash Flow (“Adjusted FCF”) was $3.0 billion. Excluding $3.2 billion used for the acquisition of Navitas Midstream Partners, LLC (“Navitas Midstream”) in February 2022, the partnership’s payout ratio of Adjusted FCF for this period was 70 percent.

The strength in the period for EPD was driven in part by its newly-acquired Midland Basin natural gas gathering and processing business, as well as better margins across its portfolio in natural gas processing and in its natural gas pipeline business. Enterprise Products Partners did experience some weakness in its propylene business, but quarterly volumetric records were set for “NGL fractionation, ethane export, butane isomerization and fee-based natural gas processing volumes.” The firm closed the third quarter with $29.5 billion in total debt principal outstanding.

Concluding Thoughts

The Alerian MLP ETF has faced considerable pressure during the past 10 years, generating a paltry annualized return, but shares of many constituents have improved during 2022 as energy resource prices have bounced back. Though we generally shy away from MLPs, more generally, Enterprise Products Partners is one of our favorites given the increased transparency it provides to investors when it comes to cash-flow metrics. Since its IPO, Enterprise Products Partners has raised its distribution 24 years in a row. Shares yield ~7.5% at this time.

Tickerized for holdings in the AMLP.

---------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.

---------------------------------------------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment