Don’t Throw the Baby Out with the Bathwater

Image: Erica Nicol

Takeaways:

Junk tech should continue to collapse, but the stylistic area of large cap growth and big cap tech should remain resilient.

Moderately elevated levels of inflation coupled with interest rates hovering at all-time lows isn’t a terrible combination. In fact, it’s not bad at all.

The markets are digesting the huge gains of the past few years so far in 2022, and the excesses in ARKK funds, crypto, SPACs, and meme stocks are being rid from the system.

Our best ideas are “outperforming” the very benchmarks that are outperforming everyone else. The BIN portfolio is down 6.4% and the DGN portfolio is down 3.2% year to date. The SPY is down 7.8%, while the average investor may be doing much worse. Our timing to exit some very speculative ideas in the Exclusive publication has been impeccable.

Beware of “best-fitted” backtest data regarding sequence of return risks. Research is to help you navigate the future, not the past. We remain bullish on stocks for the long haul and grow more and more excited as our simulated newsletter portfolios continue to hold up very well.

Don’t throw the baby out with the bath water. Stick with the largest, strongest growth names. We still like large cap growth and big cap tech, though we are tactical overweight in the largest energy stocks (e.g. XOM, CVX, XLE).

The latest short idea in the Exclusive publication has collapsed aggressively since highlight January 9, and we remain encouraged by the resilience of ideas in the High Yield Dividend Newsletter portfolio and ESG Newsletter portfolio.

Our options idea generation remains ongoing.

The next edition of the Dividend Growth Newsletter and High Yield Dividend Newsletter will be released February 1. The Best Ideas Newsletter and ESG Newsletter will be released February 15. The February edition of the Exclusive publication is scheduled for Saturday, February 5.

-----

By Brian Nelson, CFA

I know many of you may be growing concerned about the broad market environment, but I am not. The 24/7 business news, social media gurus, and acquaintances that are caught up in ARKK funds, crypto, SPACs, meme stocks can be very confusing at times. It’s sometimes hard to know what to think or who to believe.

Let’s first start with some facts and things that we think we know so we can build a foundation on which to build our thought framework on how to approach these markets. Year-to-date, the S&P 500 (SPY) has fallen 7.8% and the NASDAQ, as measured by the “cubes” (QQQ), has dropped 11.6%, according to data from YahooFinance.

However, the average stock in the simulated Best Ideas Newsletter portfolio has fallen 5.7%, and inclusive of “weighting” ranges, approximately 6.4%, besting the performance of both the SPY and QQQ so far in 2022. The average stock in the Dividend Growth Newsletter portfolio is down 4%, and inclusive of “weighting” ranges, approximately 3.2%, also doing better than the widely-followed equity indices.

But “beating the market” so far in 2022 is not the reality that others are facing today. In fact, it is far from it, and why we remain a niche research boutique. The chasm between what you’re reading at Valuentum, for example, and the panic that may be present elsewhere probably has never been larger.

Perhaps the securities most representative of the “age of speculation” today is the ARKK Innovation ETF (ARKK), which has fallen approximately 24.3% so far in 2022. Or Bitcoin (BTC-USD), which is down more than 20% year-to-date, according to data from Seeking Alpha, trading at $35,700 at the time of this writing.

Or perhaps the general market sentiment is reflective of those caught up in the Special Purpose Acquisition Company, or SPAC, craze. Year-to-date the Defiance NextGen SPAC IPO ETF (SPAK) is down almost 14% and down about 40% during the past 52 weeks, according to Seeking Alpha.

Or maybe sentiment is captured by the meme stocks. GameStop (GME) has fallen about 28% so far this year, while AMC Entertainment (AMC) is down approximately 34%, again according to Seeking Alpha data.

Our perspective of what’s happening in the markets is vastly different than others’. For example, Josh Brown wrote about “The Rules,” (1) which I assume is how one is supposed to behave when the markets are facing pressure. The first rule is “don’t complain.”

But what if you have nothing to complain about? What if you understand that after years of huge gains, a small pullback in the market can only be expected? The S&P 500 just advanced 28.6% in 2021, 18.3% in 2020, and 31.3% in 2019. The modest profit taking in some of our favorite ideas we’ve witnessed so far in 2022 is par for the course.

Even a 10%-20% decline in the largest U.S. benchmarks in 2022 for some of our favorite stocks wouldn’t be out of the ordinary. We have a long-term perspective with our ideas. Let’s take Alphabet (GOOG), for example, one of the top “weighted” ideas in the simulated Best Ideas Newsletter portfolio. The stock is down more than 10% so far in 2022, but it is still up nearly 38% during the past 52 weeks. Are we to believe that there are investors out there who are disappointed to have held Alphabet the past 52 weeks, while the ARKK ETF has been cut in half during the same time? I like to say that many of those that read Valuentum’s work never truly know how lucky they are to have found us.

Tell a friend about us.

That said, I can never tell you how or what to think because I don’t know your personal financial situation or risk profile. But I also can’t understand the perspective of the ARKK trader, the crypto speculator, the SPAC pumper, or the meme stock guru. But I can tell you one thing -- I’m excited about these markets. We just came off an excellent 2021 followed by a fantastic 2020 and an incredible 2019. The average stock in the simulated BIN portfolio and DGN portfolio is down a measly 5.7% and 4%, respectively, to start the year. That’s barely a blip in the strong long-term uptrend the past decade. Such a breather is to be largely expected.

But what about a more hawkish Fed? Expected, if not telegraphed for a very long time. How about the slowing of growth in some work-from-home stocks (e.g. NFLX, PTON)? Expected. People are going outside now, and things have been getting back to normal for some time. What about the collapse in speculative instruments like SPACs and meme stocks? This could only have been expected, in my view. What about the volatility in crypto? Well, for instruments lacking cash-based sources of intrinsic value, how could they not be volatile? This could only have been expected, too.

Everything is fine – and by fine, I mean that the long-term remains bright for U.S. stock investors.

Our team has also done a great job managing the risks of more speculative equity idea considerations, too. For example, the timing to "ring the register" on many of the "winners" in the Exclusive publication during the past several years has made a lot of sense. Some of our prior ideas for capital appreciation were only open for a few months. It's not only important to highlight great ideas for consideration, but also when it might make sense to consider reducing risk to them. Preservation of the mighty "gains" in Exclusive ideas has always been an important part of our efforts with the publication.

Some of you already know about the following and have read about it, but for the benefit of new members, please afford me the opportunity to discuss the experience with Celsius Holdings (CELH), for example. We highlighted the company as a Capital Appreciation idea in the September 2021 edition of the Exclusive publication and "closed" the idea just a few short weeks later for a nice 11% hypothetical "gain." Since the highlight price, however, shares have fallen 49.7%. That's a big difference when it comes to returns on the same idea.

CELH is but one example in the Exclusive, however. Through the latest edition, released January 9, the success rate* for Exclusive capital appreciation ideas stood at 87.9% (58 out of 66), while the success rate for short idea considerations stood at 89.4% (59 out of 66). We not only have selected "winners," but we have had the prudence and care to highlight when the risk/reward has started to tilt against investors by 'closing' the ideas. As I’ve noted before, I think, in some ways, the true evidence of the success of our publications, not only the Exclusive, is that perhaps many didn't even know how poorly some other investors are doing!

This is about the time in the market “correction” where we start seeing people come out of the woodwork, saying “See – you should have held 40% bonds in the 60/40 stock/bond portfolio. You’d be doing a lot better.” They then provide a “best-fitted,” backtest that starts right before the Great Financial Crisis, using above-average withdrawal rates to illustrate their point of view, a backtest that deflates the starting figure for equities in the early years where withdrawal rates can have a more punitive impact—and then the analysis ignores some of the strongest years of the bull market following the end of the backtest period (2019-2021), which is what’s most important and why analysis is done in the first place.

Remember that the reason for research is to help you position yourself for the future, not the past.

Have you seen this work? This is precisely the analysis we warn about in the book Value Trap. It is the walk-forward study that matters, the years after the publishing of the research. As the old saying goes, there isn’t a backtest that a researcher didn’t like. The reality is that nobody knows the future sequence of returns. Had one had a 60/40 stock/bond portfolio the past few years, one missed full exposure to stock market gains of 28.6% in 2021, 18.3% in 2020, and 31.3% in 2019; what’s a 5-7% pull back so far in 2022 in that context, right?

There are myriad measures of risk when it comes to retirement planning that we won’t go into here, but we think investors have left a lot of return on the table the past few years, and we only have modern portfolio theory to thank for that. There is one thing we can know for sure, however: It would take more than a 50% decline in some of the largest growth companies for an index representing their returns to be on par with the poor performance of the 60/40 stock/bond portfolio the past 10 years. That’s just not going to happen, in my view, and if it does – back up the truck baby!!! What a gift for bargain hunters that would be.

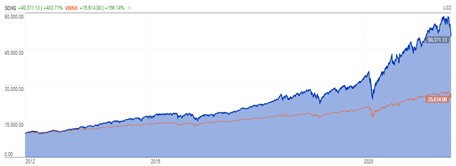

Image: Prudent and diversified stock selection among the largest, strongest, most well-known large cap growth equities (SCHG, blue fill) has outperformed exposure to the most widely-accepted standard asset allocation model, the Vanguard Balanced 60% stock/40% bond (VBINX, turquoise), by 245 percentage points during the past 10 years. Image Source: Morningstar.

Conclusion

The Best Ideas Newsletter portfolio >>

The Dividend Growth Newsletter portfolio >>

Yes, I’m still bullish on stocks for the long haul. I still think manageable inflation is good, and the 10-year Treasury rate remains benign. The net cash rich positions and current, future free cash flow generating potential of the largest growth entities remains the place to be, in my view.

Don’t throw the baby out with the bath water.

I remain excited about 2022 and beyond, and while I struggle to understand the current situation of the ARKK trader, crypto speculator, the SPAC pumper, or the meme stock guru, I’m not sure that I should care, nor should you. It’s certainly important to be open to new perspectives, but don’t just follow the herd.

Large cap growth has more room to run >>

* Success rate: The percentage of ideas highlighted in the Exclusive that have moved in the direction of our thesis (i.e. up for capital appreciation ideas and down for short idea considerations) through the current price or closed price, with consideration of cash and stock dividends. Success rates do not consider trading costs or tax implications. Trading is simulated. Past results are not a guarantee of future performance.

Tickerized for holdings in the SPY.

(1) https://thereformedbroker.com/2022/01/21/the-rules/

----------

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

2 Comments Posted Leave a comment