Domino’s Pizza Well-Positioned for Long Run

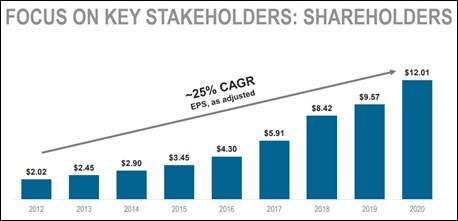

Image Shown: Domino’s has the right business model for the long haul. Unit economics are fantastic for franchisees, while same-store sales continue to benefit from first-mover digital initiatives. Earnings per share growth has been stellar for the past decade. Image Source: April 2021 Presentation.

By Brian Nelson, CFA

It could be a Tuesday afternoon or a Friday night. It’s never been easier to have your order from Domino’s Pizza (DPZ) delivered to your doorstep. With a few clicks on the app, you can place your order, track the pizza from the oven through delivery, and even know the name of the driver – all within a matter of minutes. From the young family looking for something quick and easy to eat to the sports fans wanting something for the game or to students in the classroom as a lunchtime treat, Domino’s flat-out delivers with ease and convenience. The company’s masterful digital efforts have positioned it well for the long haul, in our view.

On Thursday, April 29, Domino’s reported first-quarter 2021 numbers, and they were remarkable. U.S. same store sales advanced 13.4%, international same store sales leapt 11.8%, as the firm opened 175 stores during the period (36 in the U.S. and 139 internationally). The company is already the largest pizza chain the world (~17% of global market share in quick-service pizza), but store economics are so attractive to entrepreneurs that it’s difficult for franchisees not to continue to expand. Domino’s mostly-franchised (98%) business model is a win-win for investors, too, as capital spending remains light, while operating cash flow keeps coming in the door. Free cash flow was $136.3 million in the first quarter, with capex just ~11% of operating cash flow.

The first quarter of 2021 was the 109th consecutive quarter that Domino’s grew same-store sales internationally and the 40th consecutive quarter it has done so in the U.S. Business models with such established scale as that of Domino’s are few and far between, and menu innovation and its digital initiatives have kept it ahead of the game, while it gains share from missteps and controversies related to rival Papa John’s (PZZA). We’ve never been more impressed with Domino's, and we see no end to the world’s insatiable taste for pizza (and Domino’s dominance in this area). The firm’s net debt position just shy of $4 billion is worth watching, but free cash flow generation is very healthy.

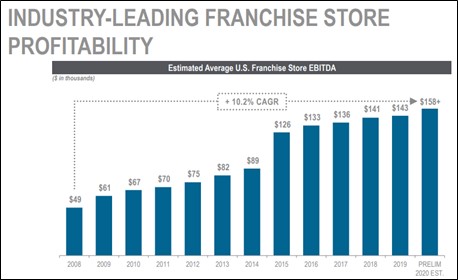

Right now, Domino’s has 17,600+ stores around the world (~6,355 in the U.S. with the balance internationally), and management believes that the U.S. could add another ~1,650 or so locations, while non-US store growth in its top non-U.S. markets could offer another 5,300+ with India and the U.K the biggest growth engines--and Australia, Mexico, and Brazil not far behind. The company’s business model is operationally simple (and repeatable) with approximately two thirds of sales coming from delivery and the balance carryout. Unit economics are incredibly attractive for franchisees, which on average, generate annual franchise store EBITDA of ~$160,000 (see image below), with 95% of franchisees in the U.S. starting as pizza delivery drivers or other in-store workers. Everything is in place for continued robust unit growth.

Image Shown: Franchise economics at Domino’s are highly attractive, helping to provide the invisible hand behind future restaurant growth. Image Source: April 2021 Presentation.

The wind is at Domino’s back, too, as the global quick-service pizza industry is set to expand in the low-single-digits in the U.S. and as much as 3%-6% internationally, while the competitive environment remains highly fragmented. The $85 billion market that Domino’s operates within offers both secular growth and share gains, especially as Yum Brands’ (YUM) Pizza Hut, known for its dine-in establishments, continues to close restaurants.

Since the end of the first quarter of 2020, for example, Pizza Hut has closed a net 820+ restaurants through the end of March 2021. Domino’s digital prowess is figuratively eating Pizza Hut’s lunch, and we don’t expect the trajectory of store closings at Pizza Hut to slow anytime soon. In July 2020, Pizza Hut’s largest U.S. franchisee, NPC International, filed for bankruptcy after years of slumping sales.

Little Caesars is working hard to grow share in the delivery market, but its primary focus has been carryout, and partnering with outsourced delivery apps such as DoorDash (DASH) may only offer Little Caesars a temporary solution--as Domino’s established delivery operations continue to function like a well-oiled machine. Domino’s is not losing its focus on trying to capture more carryout business either, as it ramps up Domino’s Carside Delivery (contact-free carryout). Though this area at Domino's has faced pressure more recently, with the economy opening up and Domino’s planning to market carside delivery more aggressively, carryout is poised to strengthen.

Concluding Thoughts

Domino’s has the right business model for the digital economy, and we expect robust net unit growth and retail sales growth in the mid-to-high single-digit range over the next few years. This asset-light, free-cash-flow generating franchisor is stealing market share hand over fist from its rivals, while it drives robust earnings expansion and buys back its own stock (it has a $1 billion repurchase authorization, as of February 2021).

Everything seems in place for Domino’s to remain atop the global quick-service pizza industry, as operational simplicity is the name of the game. Investors need to pay attention to Domino’s net debt load, but we see little in the way of this fantastic growth story. The firm remains one of our favorite restaurant ideas and a holding in the simulated Best Ideas Newsletter portfolio. The high end of our fair value estimate range stands at ~$480, with shares trading at ~$420 at the time of this writing.

Domino's 16-page Stock Report (pdf) >>

Domino's Dividend Report (pdf) >>

Tickerized for DPZ, PZZA, YUM, YUMC, DASH

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment