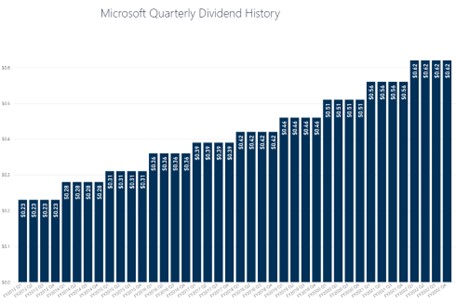

Dividend Growth Giant Microsoft Raises Its Dividend 10%!

Image Shown: Microsoft has been a fantastic dividend grower the past several years. The company announced September 20 another 10% increase in its quarterly dividend per share, to $0.68. Image Source: Microsoft.

By Brian Nelson, CFA

On September 20, dividend growth giant Microsoft Corp (MSFT) declared a quarterly dividend of $0.68 per share, a 10% increase from the prior rate, revealing a forward estimated yield of ~1.1% at the time of this writing. Microsoft has been the quintessential dividend growth stock, and the company remains an idea in the simulated Dividend Growth Newsletter portfolio, which has held up quite well during 2022 thus far.

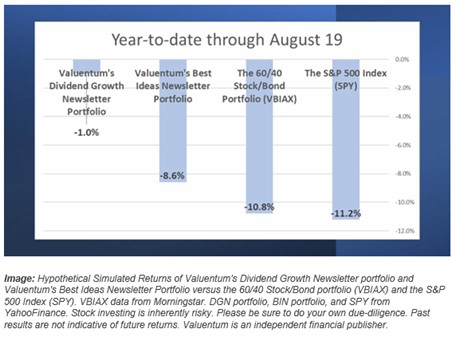

Image Shown: The simulated Valuentum newsletter portfolios have held up well in a very difficult market environment.

According to some estimates, the 60/40 stock/bond portfolio is having its worst calendar year since the Great Depression, and based on Morningstar data, the Vanguard Balanced Index (VBIAX) is now down nearly 16% on the year, through September 19. Over the same time period, dividend growth stocks have held up much better. Year-to-date through September 19, the SPDR S&P Dividend ETF (SDY) has fallen just ~4% over the same time period, showcasing the resilience of dividend growth equities during some of the market’s worst times.

Valuentum's simulated Dividend Growth Newsletter portfolio continues to be well-positioned. Included near the top of the simulated Dividend Growth Newsletter portfolio at a hypothetical weighting of 8%-12% is the SDY, but also Johnson & Johnson (JNJ), which is having a decent relative year, with flat performance. Microsoft is included in the second tranche of ideas in the simulated Dividend Growth Newsletter portfolio at a hypothetical 5%-7% weighting, along with several others, including Exxon Mobil (XOM), which yields ~3.8%, despite having an incredible 2022, up more than 57% year-to-date.

Concluding Thoughts

The dividend growth strategy continues to be resilient in a market environment where even the 60/40 stock/bond portfolio is faltering. Solid performance by Exxon Mobil this year and strong dividend growth across the simulated Dividend Growth Newsletter portfolio, punctuated by Microsoft’s latest hike are key reasons why dividend growth investors continue to be rewarded. We like Microsoft as a core idea in both the simulated Dividend Growth Newsletter portfolio and simulated Best Ideas Newsletter portfolio and believe dividend growth investors are well-positioned in the current market environment.

Dividend Growth Newsletter portfolio >>

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment