Covering the US-China “Technological Arms Race”

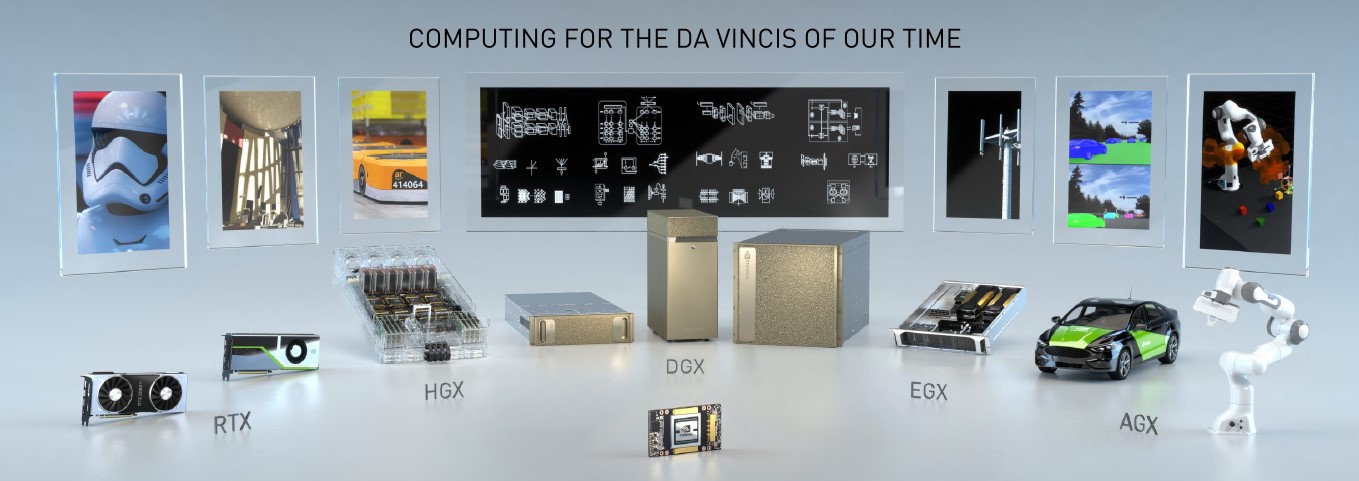

Image Shown: The future of geopolitical tensions will likely boil down to what some see as a “technological arms race” between the US and China. Image Source: Nvidia Corporation (NVDA) – May 2020 Presentation

By Callum Turcan

Given the rise of US-China geopolitical tensions, we wanted to cover the changing state of the semiconductor industry and the rare earth minerals landscape. Recent announcements from Taiwan Semiconductor Manufacturing Company Limited (TSM) or ‘TSMC’ caught our eye. For some background, in the world of semiconductors, there are what is referred to as fabrication facilities and foundries. The former is used to make chips for internal purposes while the latter contracts out its production capacity to third parties to make chips for external purposes. TSMC is considered a foundry operator, with the second-largest wafer production capacity (silicon wafers are slices of semiconductors) and the largest chip contract producing capacity in the world at the end of 2019 according to some reports.

Recent Events

Very recently, TSMC reportedly agreed to build a ~$12.0 billion semiconductor foundry in Arizona that would be capable of producing five-nanometer chips for third parties that will likely be used to create some of the electronic components in smartphones, computers, tablets, and other electronic devices. That could potentially involve producing some of the growing amount of electronical components used in automobiles as the shift to semi-autonomous and fully-autonomous vehicles starts to get underway in the 2020s (which will require significantly larger volumes of electronical components used in automobiles), keeping in mind the US is considered a leader in this space. Reportedly, such a facility would create 1,600 direct jobs and thousands more in indirect jobs, keeping in mind these are fairly well paying jobs (particularly as it relates to the direct jobs created) given the high-tech and lucrative nature of the semiconductor industry. Construction, if everything proceeds as planned, would begin in 2021 and production would commence by 2024.

Please note that while 5-nm chips represent the cutting edge of semiconductor technology in terms of commercially available production capacity as of now, TSMC (and others) are already pushing forward with 3-nm chips. While these offerings will not be available in commercial quantities for at least a couple of years, it is important to keep the next stage of the industry on your radar. Reportedly, Samsung Electronics Co. Ltd. (SSNLF) was previously targeting mass production of 3-nm chips by 2021, before the coronavirus (‘COVID-19’) pandemic materialized, and now the South Korean firm is aiming for mass production by 2022. TSMC aims to start mass production of 3-nm chips within a couple of years, possibly by 2022 according to some analysts, though everything is up in the air right now and COVID-19 has delayed efforts in this arena.

Most importantly, we want to stress that, while TSMC’s investment in the US is a big deal and potentially represents the beginning of a semiconductor supply chain shift away from East Asia and towards the US, it’s nearly impossible to stay ahead of the curve in this fast-moving space without existing facilities. Please keep that idea in mind as we shift gears a bit here.

Pivoting to Intel Corp (INTC), one of our favorite companies and a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, Intel is reportedly holding talks with the US government about building its own semiconductor foundry in the US. While Intel possess its own domestic production capabilities in Chandler (Arizona), Hudson (Massachusetts), Rio Rancho (New Mexico), and Hillsboro (Oregon), the US government is pushing for Intel to build a foundry that would serve other clients. According to CNN Business, Intel has confirmed it is interested in bulking up its domestic production capabilities and its ability to serve third parties. Furthermore, according to a letter sent from Intel to the Pentagon obtained by the WSJ, Intel is very keen in teaming up with the US Department of Defense to build a domestic semiconductor foundry.

Geopolitical Significance

On a geopolitical level, the US wants semiconductor manufacturers to build new fabrication facilities and foundries in the country to reduce its domestically-based tech industry’s reliance on overseas supply chains. The 21st Century will be one built on semiconductors and heavily reliant on overseas supply chains, leaving the economy exposed to exogenous shocks and external geopolitical pressures.

The US is putting pressure on China’s tech giant Huawei (a leader in 5G telecommunications infrastructure and a major smartphone manufacturer) by stepping up restrictions on which entities can and can’t do business with the company (or what licenses must be obtained before doing business with Huawei). Please note that Huawei is seen by many Western analysts as an extension of the Chinese state, though on paper it is a privately-held firm.

Ostensibly, the US is imposing restrictions on Huawei due to its alleged business dealings with Iran, but this is about far more than that. Various Western analysts see Huawei’s 5G telecommunications infrastructure having backdoors that could allow for foreign actors to access information of strategic national security or economic importance. On May 15, 2020, the US Department of Commerce put out a press release noting that those restrictions on Huawei were tightening further (from the press release):

The Bureau of Industry and Security (BIS) today announced plans to protect U.S. national security by restricting Huawei’s ability to use U.S. technology and software to design and manufacture its semiconductors abroad. This announcement cuts off Huawei’s efforts to undermine U.S. export controls. BIS is amending its longstanding foreign-produced direct product rule and the Entity List to narrowly and strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology.

Since 2019 when BIS added Huawei Technologies and 114 of its overseas-related affiliates to the Entity List, companies wishing to export U.S. items were required to obtain a license.[1] However, Huawei has continued to use U.S. software and technology to design semiconductors, undermining the national security and foreign policy purposes of the Entity List by commissioning their production in overseas foundries using U.S. equipment…

[1] In May 2019, BIS added Huawei Technologies Co., Ltd. (Huawei) and certain non-U.S. affiliates to the Entity List (with additional affiliates added in August 2019) on the basis of information that provided a reasonable basis to conclude that Huawei is engaged in activities that are contrary to U.S. national security or foreign policy interests. This information included the activities alleged in the Department of Justice’s public Superseding Indictment of Huawei, including alleged violations of the International Emergency Economic Powers Act (IEEPA), conspiracy to violate IEEPA by providing prohibited financial services to Iran, and obstruction of justice in connection with the investigation of those alleged violations of U.S. sanctions.

In response, Huawei has reportedly been shifting its focus towards securing semiconductor supplies domestically and reducing its reliance on supply chains based in countries like South Korea and Taiwan. For instance, Reuters reported in mid-April 2020 that Huawei would shift some of its contract needs away from TSMC and towards Shanghai-based Semiconductor Manufacturing International Corp (SMICY) or ‘SMIC’ for short. A large part of the change was reportedly due to expected increases in restrictions from the US on companies doing business with Huawei (which ended up being the case).

However, given that TSMC is far further along the technology curve than SMIC in the realm of semiconductor production capabilities (SMIC recently started producing 14-nm chips while TSMC is already producing 5-nm in commercial quantities and has a line of sight of 3-nm chips in the medium-term), in the short- to medium-term there’s only so much work Huawei can shift away from TSMC towards SMIC. Longer-term, however, there is a growing chance of China preferring to have its national tech champions source their semiconductor supplies domestically (state subsidies and other measures will potentially be used to speed this process along). TSMC is acutely aware of how the shifting geopolitical landscape is upending “traditional” supply chains and by investing in the US, TSMC is showcasing its desire to remain a key partner of Western companies.

Another consideration involves the lithography systems used to print patterns on silicon wafers, a space where Netherlands-based ASML Holding NV (ASML) is a dominant player. Should US restrictions on technology transfers continue to grow, it may become hard for SMIC to keep up given the need to turn to other sources of lithography systems and the services required to maintain those systems. We covered ASML Holding in great detail in this article here.

Rare Earth Minerals Considerations

On the other hand, whether China clearly has a strong hand to play comes down to rare earth minerals which are the essential building blocks in modern electronic components. Reuters reports that China is home to ~85% of the globe’s rare earths processing capacity (as of 2019) and that from 2014-2017, ~80% of the rare earth minerals imported by the US came from China. The news agency also reports that over 80% of the world’s rare earth minerals were mined in China as of 2017.

Additionally, Reuters noted that rare earth minerals are made up of 17 different elements including “lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, scandium, [and] yttrium” which are expensive to process. Anything from wind turbines to lasers to motors in electric vehicles require these rare earth minerals to function, highlighting the immense strategic significance of such resources.

In California, the Mountain Pass mine is currently the only domestic source of rare earth minerals in the US according to the WSJ. A couple of years ago MP Minerals, backed by the Chicago-based hedge fund JHL Capital Group, bought the Mountain Pass mine out of bankruptcy as a bet on the growing geopolitical divide between the US and China. While the Mountain Pass mine produces rare earth minerals, those resources must first be shipped over to China to get processed which diminishes most of the strategic value of those resources. In order to rectify this situation, the Pentagon provided MP Minerals with grants to help fund studies relating to the potential construction of a domestic rare earths processing plant according to the WSJ.

As an aside, Australian-based Lynas Corporation Ltd (LYSCF) and Texas-based Blue Line Corp are working together to build a different rare earths processing facility in Texas in a project that’s also backed by the Pentagon, according to the WSJ. That facility would reportedly be a rare earth minerals separation facility that’s geared toward heavy rare earth minerals (such as dysprosium and terbium) and potentially could also focus on light rare earth minerals (such as neodymium, praseodymium and lanthanum) as well according to Mining Magazine.

Another joint-venture, this one between USA Rare Earth LLC and Texas Mineral Resources Corp (TRMC), aims to bring a pilot project online that would process rare earth minerals in Wheatridge, Colorado, with those minerals coming from the planned Round Top mining project based near El Paso, Texas. That facility should soon be operational, and work continues on studying the potential rare earth minerals-oriented Round Top mining project.

The US is moving toward shoring up its rare earth supply chain and processing capabilities, but it will take some time before these rare earth processing facilities get approved and sanctioned, let alone built. China has aggressively used its dominance in the rare earth minerals space in the past as a geopolitical bargaining chip, particularly as it concerned Chinese-Japanese relations. Both the US and China have advantages and disadvantages in the brewing battle for technological and semiconductor supply chain supremacy.

Concluding Thoughts

Both the US and China are leaning on their strengths and shoring up their weaknesses as it relates to semiconductors, rare earth minerals, and the global “technological arms race” that some see creating a great “digital divide” between Western and Chinese/Russian geopolitical forces. We continue to closely monitor this space given the immense importance the semiconductor and rare earth minerals space poses for the global economy and will provide our members with updates as new information becomes available.

-----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Diversified Mining Industry – BHP FCX NEM RIO SCCO VALE WPM

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Related: ASML, CAJ, NINOY, SMICY, SSNLF, TRMC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Cisco Systems Inc (CSCO) and Intel Corporation (INTC) are both included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment