Conagra Brands Facing Major Inflationary Headwinds

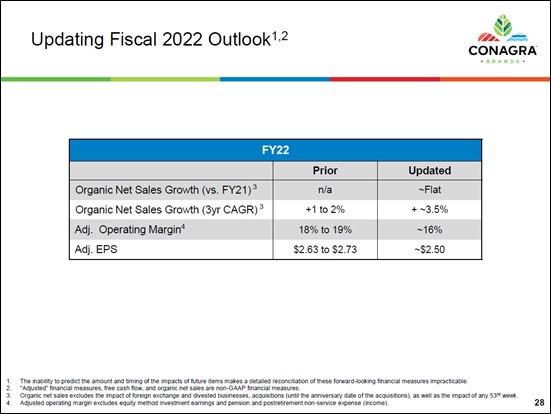

Image Shown: Conagra Brands Inc recently reduced its full-year guidance for fiscal 2022 in the face of major inflationary headwinds. Image Source: Conagra Brands Inc – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

On July 13, the company behind the Slim Jim, Duncan Hines, Gardein brands (among other), Conagra Brands Inc (CAG), reported fourth quarter earnings for fiscal 2021 (period ended May 30, 2021) that beat both consensus top- and bottom-line estimates. However, its guidance for fiscal 2022 came in a bit light in the face of major inflationary headwinds which saw shares sell off initially after the report was published. Please note that its fiscal 2020 was a 53 week reporting period while its fiscal 2021 was a 52 week reporting period, making GAAP year-over-year comparisons noisy, and that is before taking the coronavirus (‘COVID-19’) pandemic into account.

Headwinds Building

Inflationary pressures were a key theme during Conagra Brands’ latest earnings call after the firm reduced its guidance for fiscal 2022 (emphasis added):

“And as all of you know, inflation has continued to rise sharply since April. We now currently expect fiscal '22 inflation to come in around 9%. The difference between the 6% we expected a few months ago and the 9% we expect today equates to approximately $255 million in additional costs during fiscal '22. The bulk of this inflation can be attributed to continued increases in the cost of edible fats and oils, proteins, packaging and transportation since the timing of our Q3 call. While we are able to hedge some of our inputs, others, particularly certain proteins are not easily hedged.” --- David Marberger, Executive Vice President and CFO of Conagra Brands

Previously (the following are all non-GAAP metrics), the company aimed to generate 1%-2% annual organic sales growth, an adjusted operating margin of 18%-19%, and adjusted EPS of $2.63-$2.73 in fiscal 2022. Now, however, the firm expects its organic revenue to be flat this fiscal year while its adjusted operating margin is expected to come in at approximately 16% (versus 17.5% in fiscal 2021) and its adjusted EPS is expected to come in around $2.50 (versus $2.64 in fiscal 2021).

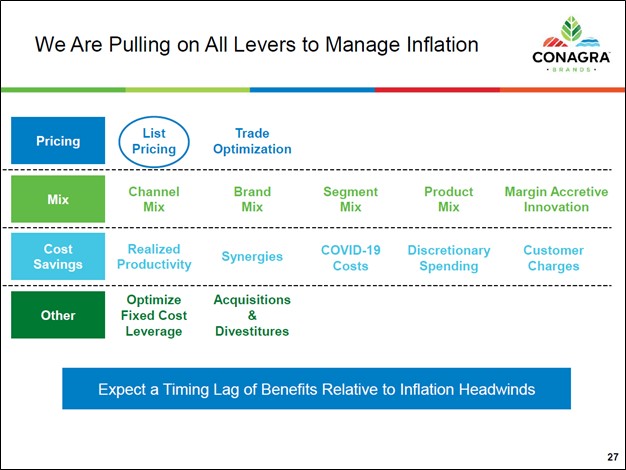

Rising input costs due to across the board inflationary headwinds are expected to hit its margins quite hard, and Conagra Brands is responding via pricing increases. The reduction in its expected organic sales growth appears to be in part due to expectations that the firm’s sales volumes will suffer modestly due to price increases, something management touched on during the firm’s latest earnings call (emphasis added):

“While this [updated] guidance is our best estimate of how we will perform in fiscal '22, our ultimate performance will be highly dependent on 4 critical factors: first, how consumers purchase food as restaurants, offices and schools continue to reopen; second, the level of inflation we ultimately experience; third, the elasticity impact as consumers respond to higher prices; and finally, the ability of our end-to-end supply chain to continue to operate effectively.” --- Executive Vice President and CFO of Conagra Brands

Management also noted during the firm’s latest earnings call that “we began implementing pricing actions on some of our products in the [fiscal] fourth quarter related to the initial inflation we experienced” though “we expect the negative impact of the cost inflation to hit our financials before the beneficial impact of our responsive actions.” Beyond pricing increases, Conagra Brands aims to bulk up its production capabilities, focus on innovation, bolster its e-commerce operations, and pursue “efficient and thoughtful marketing campaigns” to generate long-term value. Looking ahead, the company sees growth opportunities in the realm of snacks and frozen foods while maintaining its position in the consumer staples space.

Image Shown: Conagra Brands is doing all it can to manage rising headwinds from inflationary pressures. Image Source: Conagra Brands – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

In fiscal 2021, Conagra Brands generated $1.0 billion in free cash flow while spending $0.5 billion covering its dividend obligations and $0.3 billion buying back its stock. The company’s balance sheet is rather bloated as its net debt load stood at ~$8.9 billion (inclusive of short-term debt) at the end of fiscal 2021, and looking ahead, it is going to be tough sledding for a while. Conagra Brands will need to hunker down and ride out the storm.

Concluding Thoughts

We are not interested in Conagra Brands at this time. In our view, its weak technical performance of late is a sign that investors are increasingly losing confidence in the company’s ability to navigate headwinds arising from the current inflationary environment. Management appeared confident during the firm’s latest earnings call, but the market is not buying it. On the other hand, PepsiCo Inc (PEP) seems to be doing a solid job navigating the current environment. We covered the beverage and snack giant’s latest earnings report and guidance increase in this article here.

-----

Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT

Tickerized for CAG, CPB, BGS, GIS, K, TWNK, HSY, POST, UTZ, KHC, THS, CHEF, USFD, ANDE, APTN, SYY, JBSAY, MITC, NSRGY, OTLY, PPC, BRFS, SFM, NATH, UBC, COW, ALCO, HRL, JEF, MKC, FLO, BYND, TSN, FMCI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment