ASML Holding’s Bright Growth Outlook

Image Shown: Shares of ASML Holding NV are booming higher as demand for its photolithography systems, a crucial part of the semiconductor supply chain, continues to grow at a robust pace.

By Callum Turcan

On October 20, Netherlands-based ASML Holding NV (ASML) announced third quarter fiscal 2021 earnings (period ended October 3, 2021) that saw its GAAP revenues (in Euro terms) grow by 32% year-over-year to reach $5.2 billion. The firm designs and manufactures photolithography systems that are used to produce semiconductor components, a crucial part of the semiconductor supply chain. At the higher end of things, ASML Holding operates in a virtual monopoly given that the firm is leaps and bounds ahead of the competition when it comes to technological innovation.

We include ASML Holding as an idea in our ESG Newsletter portfolio (more on that here) and are huge fans of its capital appreciation potential. The firm also pays out a relatively modest dividend and in conjunction with its latest earnings report, announced an interim dividend of EUR€1.80 per ordinary share. Shares of ASML yield a modest ~0.5% as of this writing.

Earnings Update

In the third quarter of fiscal 2021, ASML Holding sold 79 photolithography systems versus 60 systems in the same period last fiscal year. ASML Holding reported net bookings of 178 photolithography systems last fiscal quarter, up from 73 net bookings in the same period the prior fiscal year, providing greater visibility regarding its near term cash flow trajectory. The company’s GAAP gross margin clocked in at an impressive 51.7% last fiscal quarter, up from 47.5% in the same quarter the prior fiscal year.

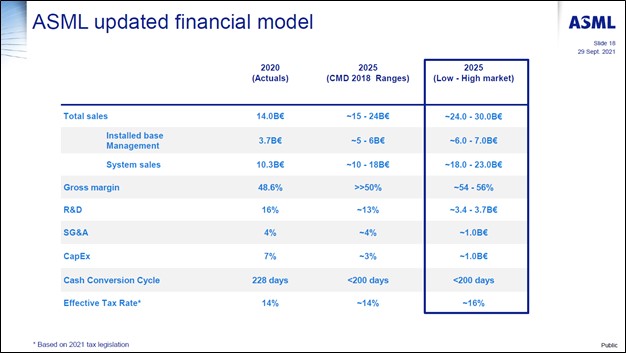

Surging demand for semiconductors has created an immense need for more semiconductor fabrication facilities (where “chips” are manufactured) and greater capacity at existing fabrication facilities, which in turn is driving up demand for semiconductor manufacturing equipment. In September 2021, ASML Holding put out guidance highlighting that it could reach EUR€24.0 – EUR€30.0 billion in annual sales by fiscal 2025 during an investor day event versus EUR€14.0 billion in fiscal 2020 (period ended December 31, 2020). Furthermore, ASML Holding aims to boost its gross margin up to 54%-56% by fiscal 2025, versus 48.6% in fiscal 2020, aided by economies of scale, ample pricing power, and a growing installed systems base around the world. The company’s latest earnings report indicates it is well on its way to achieving its medium-term goals.

Image Shown: ASML Holding is targeting meaningful revenue growth and gross margin expansion through fiscal 2025 versus fiscal 2020 levels. Image Source: ASML Holding – September 2021 Investor Day Event Presentation

During the first nine months of fiscal 2021, ASML Holding generated just under EUR€5.1 billion in free cash flow and spent a little over EUR€0.6 billion covering its dividend obligations along with just under EUR€6.0 billion buying back its stock during this period. The company ended the third quarter of fiscal 2021 with just over EUR€0.3 billion in net cash on hand, though please note that the firm does not break out any potential short-term debt in its current liabilities line-item. We are huge fans of ASML Holding’s stellar free cash flow generating abilities and pristine balance sheet.

The firm noted in its latest earnings press release that it announced a new share repurchase program in July 2021 that is set to run through December 2023 with up to EUR€9.0 billion in buyback authority. Some of those shares will be used to cover its employee stock plans and the remainder will be cancelled, according to its latest earnings press release. ASML Holding prioritizes share buybacks over its dividend payouts in terms of its capital allocation priorities, a strategy that fits in well with its rapidly growing business.

Management Commentary

Here is what ASML Holding’s President and CEO, Peter Wennink, had to say in the firm’s latest earnings press release:

"The demand continues to be high. The ongoing digital transformation and current chip shortage fuel the need to increase our capacity to meet the current and expected future demand for Memory and for all Logic nodes… ASML expects fourth-quarter net sales between €4.9 billion and €5.2 billion with a gross margin between 51% and 52%.”

We appreciate that ASML Holding expects its strong performance will carry on into the current fiscal quarter. Please note that just like virtually every other firm out there, the company is contending with supply chain issues that are holding back its near term growth potential somewhat. Once those headwinds start to abate, ASML Holding should be in a position to post even stronger revenue growth as it ramps up its manufacturing activities and ultimately deliveries of its photolithography systems.

Concluding Thoughts

ASML Holding is a tremendous way to play the ongoing boom in semiconductor demand. The firm’s medium-term growth targets are fantastic and supported by surging net bookings for its photolithography systems (clearly there is ample demand here for ASML Holding’s offerings). With a pristine balance sheet, shareholder friendly management team, stellar free cash flow generating abilities, and promising growth outlook, ASML Holding has a lot going for it. The company is a good fit for the ESG Newsletter portfolio, in our view, as ASML Holding scores well on our 1-100 (100 being the best) ESG rating system (94 out of 100).

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for TER, ASML, AMAT, LRCX, KLAC, TRMB, TXN, NXPI, ON, ADI, MU, XLK, SMH, SOXX

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Facebook Inc, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

2 Comments Posted Leave a comment