JD.com Set to Take on Amazon Head On

Image source: JD.com fourth quarter presentation

Chinese e-commerce giant JD.com has grown at a tremendous rate in recent years, and it is expected to continue taking advantage of a ripe opportunity in its home nation. However, management has more grandiose plans for its burgeoning e-commerce platform as it expects to make its US debut before the end of 2018.

By Kris Rosemann

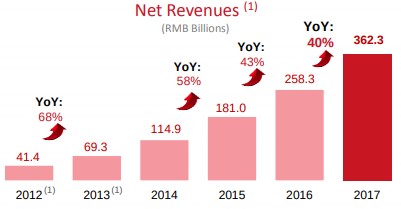

When you think of the Chinese Internet space, probably Alibaba (BABA), Tencent (TCEHY) and Baidu (BIDU) are among the first to come to mind, but there is another giant in the Chinese Internet space. You may not be aware of this, but ranked by revenue, JD.com (JD) is one of China’s largest e-commerce companies. Through its website, www.jd.com, and across mobile applications, JD.com offers a huge selection of products that are delivered quickly to consumers. It is one of the fastest-growing publicly-traded companies, too, growing revenue by at least 40% each year since 2012 and quickly becoming known as the “Amazon of China.”

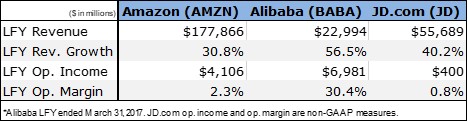

With JD.com’s revenue hitting $56 billion in 2017, it is catching up to global peer, Amazon (AMZN), whose revenue tally reached ~$178 million for the comparable period. Expanding along with Chinese consumer spending, JD.com further expects robust growth to be augmented in coming years thanks to its sprawling online presence and nimble, in-house logistics network that combine to offer several advantages over rivals. Management is also taking a bold strategy in its international growth endeavors, as it looks to take on behemoth Amazon on its home turf in the US by the end of 2018 and also in Europe in 2019. JD.com is also aggressively expanding its logistics-network capabilities as it gears up for the massive undertaking that will be challenging Amazon.

What Makes JD.com So Special?

Image source: JD.com fourth quarter presentation

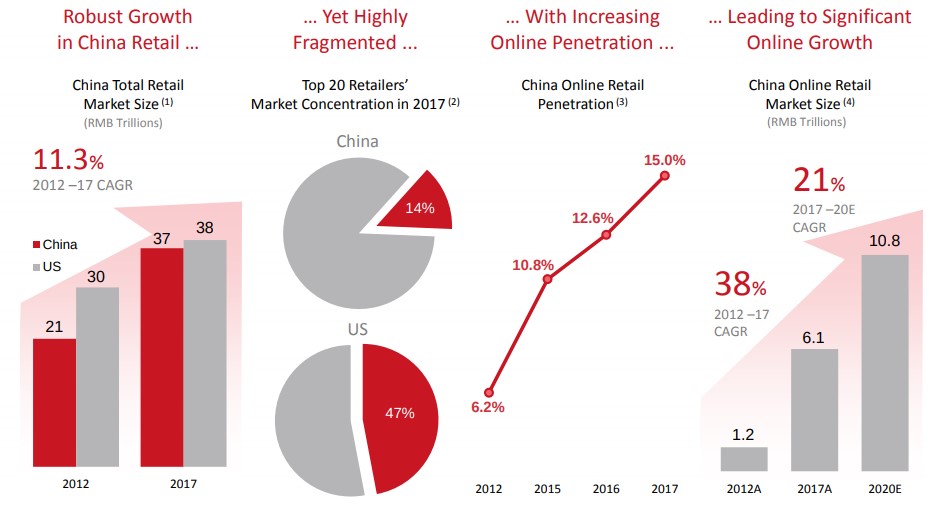

First, JD.com has considerable untapped potential in China alone. Online retail penetration in China grew to just 15% in 2017 from only 6.2% in 2012. By comparison, about 75% of the US population had accessed the Internet as of 2015, so there is a long runway of growth remaining. The overall size of the Chinese online retail market grew at a 38% CAGR to 6.1 trillion RMB over the same time period, while the total Chinese retail market advanced at a ~11% compound annual growth rate.

Though total retail market growth in China may slow in coming years, JD.com continues to expect robust online annual growth of ~21% through 2020, to 10.8 trillion RMB. We don’t expect concerns about trade tariffs between the US and China to damage this strong backdrop for JD.com either. The total Chinese retail market is only slightly smaller than that of the US (roughly 37 trillion RMB in China compared to 38 trillion RMB in the US), and it is far more highly fragmented than that of the US retail market as the top 20 participants account for only ~14% of the total market compared to ~47% in the US as of 2017.

Second, JD.com’s online presence is enhanced by a form of the network effect. As more customers continue to use its platform, its platform becomes more attractive to its partners and vice versa. This network dynamic has been on display in a meaningful way in recent years as its active customer accounts have grown roughly ten-fold since 2012 (to 292.5 million in 2017 from 29.3 million in 2012), and the average number of purchases by active customer accounts has risen to 25.7 as of 2016 from 3.7 in 2008. The company is effectively filling a rapidly-expanding area of demand for the growing Chinese consumer base, and as a network effect builds, it’s hard for it to stop, making it incredibly difficult for new entrants to gain traction.

Third, unlike Alibaba and Amazon, JD.com owns and controls its logistic network, which it points to as the main reason for its fast deliveries. CEO Richard Liu has even stated that it may dual-list its in-house logistics business in Hong Kong and the Chinese mainland. As a leader in the fragmented Chinese market, JD.com’s operational efficiency should keep it ahead of rivals thanks in part to a control-premium for its domestic logistics network that also allows for price leadership. JD.com has material margin expansion potential, in our view, both from leveraging more customers across its infrastructure, but also in driving efficiencies throughout its operations. Embracing next-generation technology in all aspects of its business--from advertising to supply chain management to demand forecasting and price optimization—will only help, too. Margin expansion has already been on display.

JD.com’s non-GAAP gross margin, for example, expanded to 13.8% in 2017 from 8.4% in 2012, and its non-GAAP operating margin rose to 0.8% from negative 4.2% over the same time period. Those who are familiar with US-counterpart Amazon understand the razor-thin operating margins that come in the early stages of the growth of online retail as e-commerce companies compete intensely on price and depend on robust volumes to generate meaningful profits. JD.com is already nicely free cash flow positive (dating back to 2012) as the measure came in at more than $2.4 billion in 2017, as measured by management, which includes adding back the impact of its finance-related credit products. The company also holds a solid net cash position on its balance sheet of more than $2.2 billion as of the end of 2017, but investors should be cognizant that its financial arm poses unique risks.

A Story Not Without Challenges

Though it’s hard not to see why JD.com’s expansion opportunity in China could be a slam-dunk, its international plans are far more risky and will require pristine execution. Management has targets to take its revenue profile to an even 50/50 split by domestic and international markets in the next ten years, with an even distribution of its international revenue across Southeast Asia, the US, and Europe. Its expansion efforts in Southeast Asia are already underway, and it should see relatively little competitive pushback in this market as it lacks an established player. JD.com’s proximity to the market and impressive logistic capabilities represent solid advantages.

However, taking on Amazon in the US will be no small task for JD.com, even with the aggressive growth plans it has for its logistics business, which recently secured $2.5 billion in outside funding as it plans to take the business public in Hong Kong in the next few years. Whether or not these investments will provide enough of an operational advantage relative to the firmly-entrenched Amazon remains to be seen and is exactly the kind of execution risk that makes foraying into the US such a risky endeavor. The potential for an increasingly protectionist US economy presents new challenges, too, even if trade war fears between the world’s two largest economies continue to ease.

JD.com plans to set up shop in Los Angeles before the end of 2018 that will eventually allow it to provide same-day delivery, a feature already well-established by Amazon in many markets. US retail giant Walmart (WMT) is likely to play a role in enhancing JD.com’s initial efforts in the US as Walmart holds a ~12% stake in JD.com and both have a mutual competitor in Amazon. JD.com’s strategy in the US is simple: to sell quality Chinese goods at prices lower than established competitors. Amazon’s entrenchment is a tremendous obstacle, and the network effect that has benefited JD.com in China has been in full swing for Amazon from some time now. Taking on Amazon is a massive challenge in itself, but JD.com’s haste in establishing a presence in the US is also likely aimed at beating Chinese competitor Alibaba, the only Chinese e-commerce firm larger than JD.com itself. Local partnerships such as its partnership with Walmart will be key for JD.com to establish itself and gain consumer trust in the US.

Conclusion

JD.com continues to have robust opportunities for growth in its domestic China market, but its international growth initiative adds another layer of risk to the story. Aggressive expansion plans for its logistics arm suggest management may not be willing to back down to any challenge, but we’re not convinced the company will be able to generate a materially sustainable competitive advantage via these investments in the US, especially after considering that it will need to take these investments across the globe to a market that already has a firmly-entrenched competitor with similar capabilities and innovative aspirations.

That said, we’ve raised our fair value estimate for JD.com to $47 per share as a result of its improving profitability and free cash flow generation, as well as a refining within our valuation model of the tremendous growth opportunity that exists in the attractive Chinese e-commerce market. Readers, however, should be aware that its razor-thin operating margins mean any estimate of its fair value will be quite sensitive to even minor changes in this forecast (especially mid-cycle operating margins). For example, a one percentage point change in our mid-cycle operating margin results in a $12 per share change in our fair value estimate, and we must make mention of the size of our fair value range, which accounts for country specific risks related to the Chinese economy as well as the execution risk associated with its international growth plans.

We find the story at JD.com so compelling that we are placing JD.com on our watch list for inclusion in the simulated Best Ideas Newsletter portfolio. Its free cash flow generating ability makes us slightly more willing to take on the uncertainty that comes with the sensitivity and difficulty in future operating margin expansion. We think JD.com is a company that belongs on your radar, if not as an investment opportunity then as one that could have an impact on the US online retail environment.

Related: EBAY, TGT, FXI, MCHI

---

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.