General Motors and the Union Strike!

Image Source: General Motors Company – IR Presentation

By Callum Turcan

A holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, shares of General Motors (GM) have come under pressure over the past month from the ongoing strike that involves roughly 46,000-48,000 of its workers (primarily in the US). So far, this strike has halted production at more than 30 General Motors facilities in the US and has negatively impacted operations at various auto parts suppliers as well. The walkout is now coming up on its second month if a deal isn’t reached soon. Talks between General Motors and the Union Automobile Workers (“UAW”) union reportedly took a turn for the worse over this past weekend (ended October 6) as the union rejected the auto maker’s latest offer and General Motors rejected the UAW’s latest deal. Negotiations are still ongoing. Shares of GM yield 4.4% as of this writing.

Covering the Strike

There are several points of contention between General Motors and the UAW including; a reduction in the length of time it takes for new hires to reach the highest pay tier (from eight years to something shorter), finding work for a production facility in Lordstown, Ohio, and numerous facilities in Michigan (to prevent those facilities from shutting down), reducing the export of cars General Motors produces in Mexico to the US, committing to preserving existing healthcare benefits (which are some of the most generous in the industry), other pay and pension concerns, and limiting pay discrepancies for temporarily workers (who aren’t necessarily entitled to profit sharing arrangements, which are very substantial at General Motors and other unionized US auto manufacturers).

Not all of these concerns can be met (it’s very unlikely General Motors fundamentally alters its production operations in Mexico), but General Motors has shown a real willingness to work with the UAW on certain issues. Please keep in mind that UAW-members who work for General Motors generally are the best paid in the industry, just ahead or on-par with UAW-members who work for Ford Motor Company (F), ahead of those at Fiat Chrysler Automobiles (FCAU), and well ahead of non-union auto industry workers that predominantly are in the US South region. General Motors has committed to investing billions in the US to adapt its production capabilities to meet the needs for the 21st Century. That means investing in electric vehicles (“EVs”), self-driving vehicles, SUVs, crossovers, and light duty trucks, and shifting production capabilities away from traditional passenger cars.

For instance, General Motors is reportedly contemplating converting its Lordstown plant to a battery production facility or selling that facility off to an EV start-up (which would in turn upgrade the facility). That’s tied into General Motors considering having some of its Michigan production facilities (that need new vehicle iterations to stay in operation) adapted to produce EVs (presumably light duty pickups). Both moves would preserve a significant number of good-paying jobs in the US while better allowing General Motors to shift some of its production capabilities away from traditional passenger over to EVs, a win-win.

Estimated losses due to strike-related production stoppages go as high as ~$1.0 billion (as of early-October), with automotive market research provider LMC Automotive estimating General Motors’ production losses stood at 118,000 vehicles through October 2. While these headline grabbing figures are significant, what matters most is the long run impact of ongoing union negotiations.

Cost Structure Reductions

CEO Mary Barra took over the top job at General Motors back in 2014 and set out to streamline many of the company’s operations. That process involved layoffs and structural changes at the firm’s production operations that are still going on to this day. Plants that were operating at just a fraction of their capacity, namely those producing passenger vehicles for US markets (which aren’t in high demand as US drivers are increasingly seeking out SUVs, crossovers, and light duty trucks), began the process of shutting down as the company shifted production towards vehicles in demand. At the start of 2019, General Motors’ saw these endeavors saving between $2.0 billion - $2.5 billion this year, with material cash savings on both the operating expense (more flexible production footprint) and capital expenditure front (less underutilized production facilities to maintain) expected 2020+.

The company is targeting North American headcount reductions of 14,000, with almost 4,000 salaried employees taking early buyout offers or having their contracts ended as of early-2019. Furthermore, please note that the entire EV production process generally requires (substantially) less labor hours than producing traditional vehicles with internal combustion engines, which should save auto manufacturers that can produce well-liked EVs (meaning those that adapt early enough to take meaningful market share in the EV space) enormous sums in the long run.

General Motors already has the Chevy Bolt offering, and longer term, the company plans to also use its luxury Cadillac brand to help build the necessarily production infrastructure (battery plants, new and upgraded auto plants, and charging station networks) to support material levels of EV sales in the future (EV sales are still a relatively small part of the global automobile market as of 2019). At the beginning of this year, General Motors teamed up with a group of companies to support the rollout of EV charging station networks in the US. We think General Motors’ all-electric Cadillac offerings could pose a serious threat to rival Tesla Inc (TSLA), especially as Cadillac targets the more lucrative SUV/cross-over market.

Assuming General Motors stays the course, we are still very optimistic on its forecasted free cash flow growth. While shares of GM have taken a hit over near-term headwinds, the company continues to deliver on what matters most and that’s serious cost structure improvements (the result of production rationalization, a must in the industrial world). We are late in the business cycle and sales of US automobiles likely peaked a couple of years ago, however, please keep in mind most of the value of equities comes from the mid-cycle and the perpetuity (forecasted free cash flows, discounted at an appropriate rate, in the Year 5+ period). The cost improvements CEO Mary Barra has secured so far has had a powerful uplifting impact on General Motors’ forecasted free cash flows.

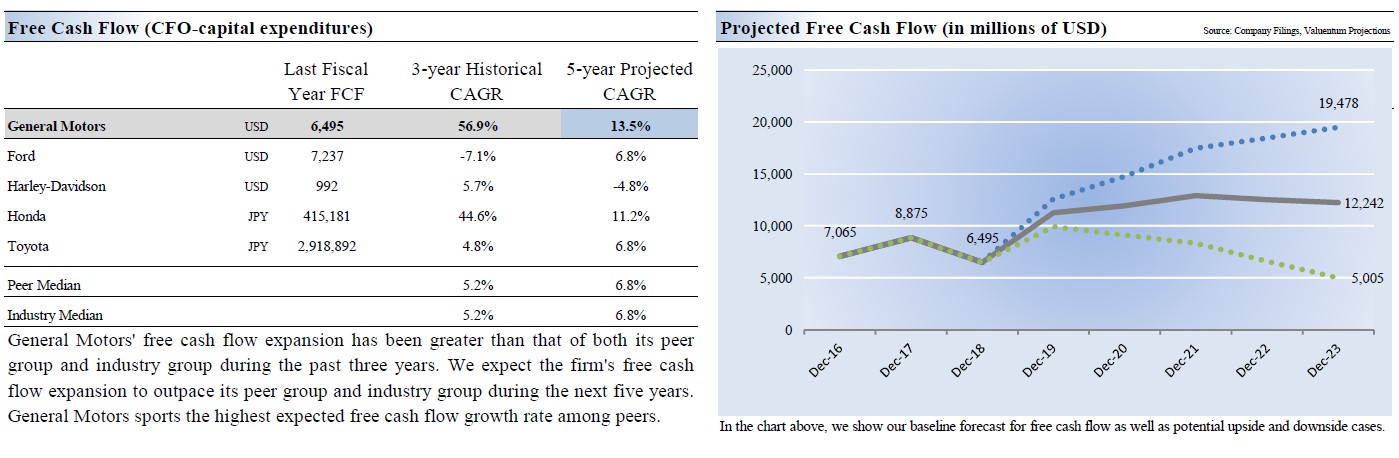

Highlighted in the graphic down below is General Motors’ expected free cash flow trajectory over the next five fiscal years from our 16-page Stock Report which can be accessed here---->>>>

Image Shown: Please note that under our base case scenario, we expect meaningful free cash flow growth at General Motors. Cost structure improvements play a key role in supporting this trajectory, with GM Cruise and EVs offering long-term upside in terms of new revenue growth opportunities.

Farther out, General Motors’ stake in autonomous vehicle venture GM Cruise highlights the auto maker’s ability to effectively invest in less conventional growth markets. The rollout of a commercial-level self-driving taxi service was delayed past 2019 as more work still needs to be done given the regulatory and engineering complexity of such an offering, but many in the industry still see the venture as one of the leaders in the self-driving world. GM Cruise has received backing from entities like Honda Motor Co (HMC) and SoftBank Group (SFTBY), raising ~$7.25 billion in the past year or so.

Concluding Thoughts

We like General Motors’ dividend coverage and its Dividend Cushion ratio stands at a healthy 3.5x after making certain adjustments (unadjusted, General Motors’ has a Dividend Cushion ratio of 1.3x given its large financial segment). Our fair value estimate for shares of General Motors stands at $48 per share, well above where GM is trading at as of this writing. We continue to like the name and will be monitoring ongoing UAW-GM talks very closely going forward.

Auto Making Industry – F GM HOG HMC TSLA TM

Auto Specialty Retailers Industry – AAP AN AZO CPRT GPC KMX KAR MNRO ORLY PAG

Related: CARZ, ADRA, RXI

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. General Motors Company (GM) is included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment