Economic Commentary: Apple $225+, Brokers Tumble, Auto Sales Look Tired

"Though all signs point to increased volatility, we maintain our view that we’re well-positioned in the newsletter portfolios, and the ideas highlighted in the Exclusive publication consider the backdrop economic conditions we closely monitor." -- Brian Nelson, CFA

There has been plenty of news in the markets this week, with the Dow Jones Industrial Average (DIA) experiencing significant declines only to bounce back a bit. From where we stand, the markets look vulnerable technically, but that doesn’t mean we’re looking to change anything in the newsletter portfolios. We have some dry powder in the form of a ~10% cash weighting in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

The disappointing September ADP jobs report added to lower-than-expected ISM (Institute for Supply Management) manufacturing data, adding to recession fears and driving increased market volatility during the week ending October 4. Let’s talk to the Valuentum team about the latest economic developments, starting on a positive note. One of the highest-weighted ideas in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, Apple (AAPL), surpassed $225 per share recently.

Image: We increased the weighting in Apple two times recently: 1) in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio December 2018 and 2) in the Best Ideas Newsletter again in April 2019. Our fair value estimate for Apple stands north of $220.

Brian Nelson: Apple is one of the highest-weighted ideas in both newsletter portfolios, and we continue to like shares. The company is now trading roughly in-line with our fair value estimate, but we’re not making any changes to its weighting, as this fantastic idea continues to run higher. Consistent with the Valuentum methodology, we won’t truncate returns as shares approach intrinsic value, as some value strategies do. We let our winners run higher and try to capture the entire pricing cycle from undervalued and “going up” to overvalued and “going down.” Being patient remains a core part of the Valuentum process.

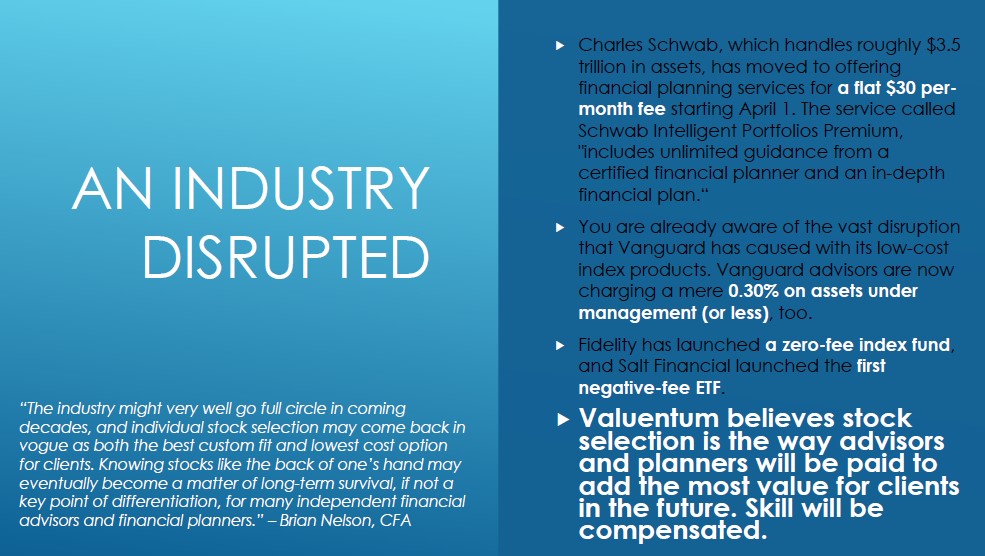

This week, building on to its flat $30 per-month fee for financial planning, Charles Schwab (SCHW) announced that it will cut online trading commissions to zero. We maintain our view that stock selection will continue to be the way advisors and planners will be paid to add the most value to clients in the future. This is an area we’re laser-focused on when it comes to serving individual investors and our advisor clients. We continue to travel around the country, explaining to individual investors the many changes that have been occurring in the financial industry. We’ll be in Los Angeles November 16.

Image: Valuentum’s presentation of its new book, Value Trap: Theory of Universal Valuation.

Callum Turcan: I suspect all brokers will be forced to do this at some point. Robinhood (funded by sweep accounts and its "Gold" offering) fundamentally shattered the industry's old business model.

Matthew Warren: Have they hit the zero-bound, or do they start offering rebates like the banks do to open an account? Yikes those stocks had big downdrafts on the news!

Image: Shares of TD Ameritrade Holdings have been punished as online trading commissions go to zero.

Brian: Interactive Brokers (IBKR) may have been the one to have started this latest commission war announcing late last month, IBKR Lite, “a new offering that will provide commission-free, unlimited trades on US exchange-listed stocks and exchange traded funds.” TD Ameritrade (AMTD) followed Charles Schwab’s lead, cutting commissions to zero. E*Trade (ETFC), Ally Financial (ALLY), and TradeStation have now eliminated commissions, too. LPL Financial (LPL) might start to feel the pinch, but one beneficiary could be Virtu Financial (VIRT) as it may benefit from higher trading volumes. Callum, what do you think about some of the key economic data this week?

Callum: I suspect this week’s big market moves are largely due to expectations the US will slap the EU with tariffs very soon and thus create another hot trade war, ostensibly over the Airbus (EADSY)-WTO ruling but in reality the Trump Administration has been gearing up for a trade war with Europe for some time now. The weaker-than-expected ADP payroll report is troublesome given the weakening macroeconomic outlook, and the lackluster industrial readings across the developed world earlier this week. Furthermore, additional US tariffs on China (FXI, MCHI, KWEB) are set to come into effect in the middle of October. Market participants are waking up and realizing that favorably monetary policy movements are a direct result of negative trade war headlines.

If the US were to levy significant tariffs on auto imports from the EU, that would really hurt Germany (EWG) which could prompt a stimulus bill to pass the Bundestag in order to offset exogenous shocks to an economy already slipping into (or according to some, already in) recession. Powerful positive forces--monetary policy stimulus that has already been approved or communicated to the market, along with the chance for fiscal stimulus which hasn't largely come into play yet in key markets like Germany, the UK (EWU), and France (EWQ)-- are meeting head on with very powerful negative forces (supply chain inefficiencies, tariffs boosting input prices, and unconventional retaliatory practices i.e. cutting off US investment in Chinese equities). Equity markets are whipsawing as a result.

Matthew: Auto sales seem tired, or at least not a source of growth, despite quite low rates and the "robust" consumer. Home sales (ITB) while getting a boost from the tick down in mortgage rates, also seems late cycle to me. Affordability is a major issue in so many hot markets around the country. Are the lower rates just temporarily pulling some fence sitters along? Will this be a blip or something more sustainable? I suspect the former. If job growth slows down, then the whole strong consumer story starts to unravel. It is a lagging indicator to watch. I think the more important one to watch is ISM Services. Will it follow the ISM Manufacturing lower?

Callum: To your point on auto sales Matt, the average selling price of a new automobile in the US has marched towards $40,000 as of 2019, up sharply from just over $30,000 back in 2009. A large part of this has been made possible by WTI/Brent (USO, OIL) crashing down from $80-110 per barrel in 2010-2014 to $50-65 per barrel of late, which sharply reduced domestic gasoline and diesel prices. Light duty trucks and crossovers/SUVs now represent the majority of US auto sales by volume (a change that happened earlier this decade) and rising domestic demand for more expensive, larger automobiles played a key role in supporting US manufacturing output this past decade (and output in North America at-large given interconnected supply chains).

However, the "average" middle class US consumer can only afford a new vehicle priced at ~$18,400 according to Bankrate.com. In order to bridge this gap, US consumers have turned to debt and longer loan periods. US auto debt stood at $1.3 trillion at the end of June 2019, up from ~$0.75 trillion a decade earlier, and the popularity of 7-year auto loans (versus the old standard of ~4 year auto loans) has exploded over the past decade allowing for more US households to afford relatively expensive new vehicles. This paradigm isn't sustainable and US auto sales peaked, in terms of unit volume, back in 2017. Should US consumer confidence weaken significantly, that could reduce demand for these auto loans, ultimately resulting in a sharp reduction in new U.S. automobile sales and weaker industrial output.

Matthew: Good point on price point and value of car sales as opposed to just volumes, Callum. It does feel like we are late in that cycle with increased use of 7-year financing and the like, though. Even if we cycle lower, it will ultimately bounce back of course. The technology content and interface of cars is changing so rapidly; I can see many folks wanting to keep up.

Callum: One important note about the lackluster ISM Services reading for September 2019. While the reading was over 50, weaker U.S. services performance will find it significantly harder to offset weak industrial data when it comes to supporting GDP growth and ultimately employment levels. Chances of another US rate cut this year just grew substantially, in my opinion.

Matthew: You’re right that a lot of the high secular growth companies caught a bid later this week, after a lot of recent pressure. I reckon your attribution is right, too. If the service economy ultimately turns down, that would augur recession. The ISM U.S. services reading points in that direction.

Brian: The news out Friday showed the unemployment rate ticking down to 3.5% versus 3.7% consensus and prior. The markets seem to be experiencing what best might be described as a tug-of-war, as bulls and bears continue to go back and forth whether a recession might be imminent, or that the signs we are witnessing recently is rather “pre-recession” type tendencies.

Image: The S&P 500 (SPY) continues to churn at current pricing levels, revealing higher levels of volatility.

The economic recovery/expansion has been about as robust and long as any in this country’s history, so the risks, in my view, remain heavily to the downside. This is why we’re seeing so much technical churning at current pricing levels, an indication that investors are anticipating a change in the trend, behavior that may actually cause the change in trend, itself.

Though all signs point to increased volatility, we maintain our view that we’re well-positioned in the newsletter portfolios, and the ideas highlighted in the Exclusive publication consider the backdrop economic conditions we closely monitor.

Join the conversation on the economy. Post your thoughts below! [Also tickerized for holdings in the DIA.]

1 Comments Posted Leave a comment