Chesapeake Energy’s Pain Indicates Nothing “Safe” About Energy MLP Distributions

Summary

There is nothing "safe" in the stock market, and given the track record of the distributions of pipeline MLPs, there is nothing "safe" about pipeline MLP distributions.

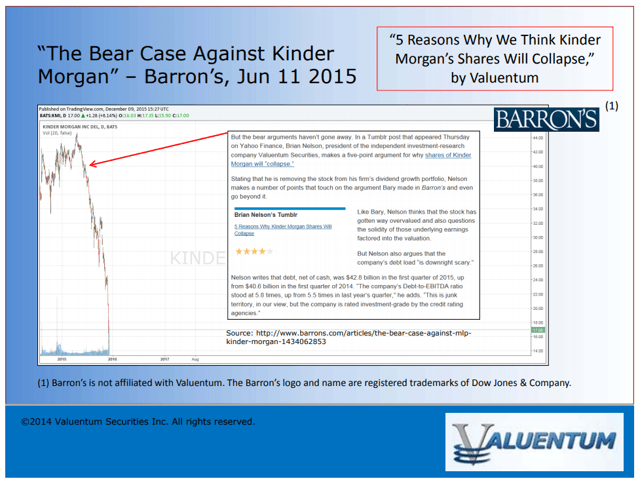

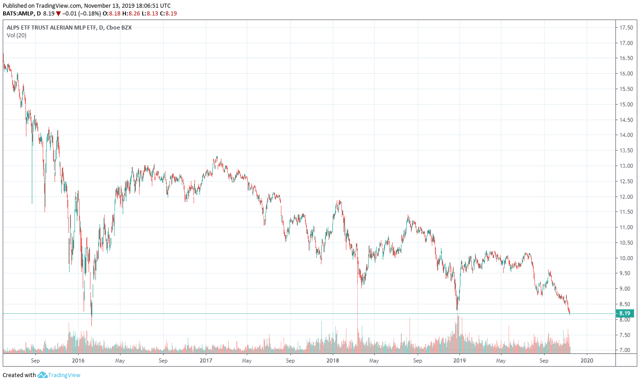

The MLP business model continues to be phased out, a trend that we anticipated when we made our bearish call on the group in June 2015.

Chesapeake Energy's pain is a yet another reminder of the pipeline MLP group's exposure to energy resource pricing through the health (or rather ill-health) of its customer base.

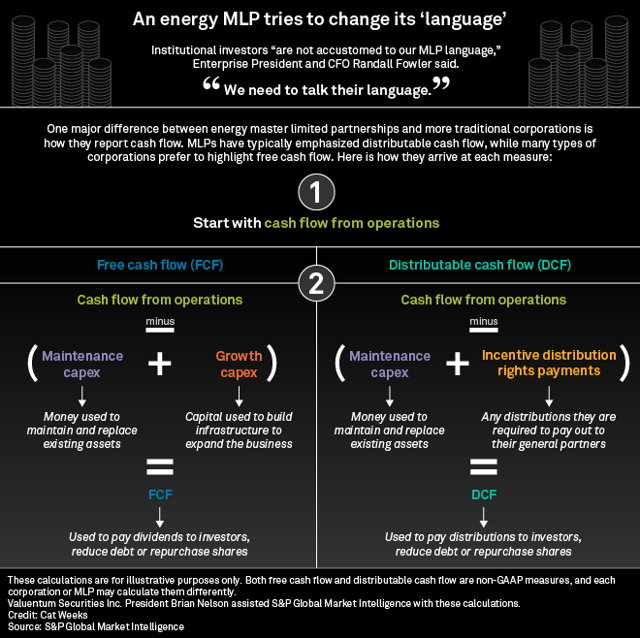

We continue to encourage pipeline operators to disclose free cash flow (cash flow from operations less all gross capital spending) prominently in press releases, alongside other industry-specific metrics.

Investors of Chesapeake could get completely wiped out in a Chesapeake bankruptcy, and this could have implications across the pipeline MLP arena.

Image Source: Valuentum slide deck, December 2015. Valuentum turned bearish on Kinder Morgan in June 2015.

By Callum Turcan and Brian Nelson, CFA

Valuentum has said it before, and we’ll say it again: the master limited partnership (MLP) business model for energy equities is on its way out. Since Kinder Morgan (KMI) rolled up its infrastructure in 2014, more than 40% of energy infrastructure is now comprised of C-corps, with midstream after midstream company transitioning away from the MLP business model, a percentage that's up from practically nothing in 2013 and just 15% at the end of 2014, a trend we predicted, despite extreme levels of skepticism years ago. Read more about the fall of energy MLPs and Kinder Morgan in the Preface of the book Value Trap: Theory of Universal Valuation.

We also take big objection to research that describes energy MLP distributions as “safe.” For starters, there is really nothing “safe” when it comes to equity investing, in general, but the reality is that given the track record of MLP distributions during the past five years, in no way should they be described as being anything close to being “safe.” According to data by CBRE Clarion, for example, during the past five years, there have been over 110 distribution/dividend cuts, consisting of "48 outright cuts by MLPs/corps that still exist" and "63 cuts either from mergers w/ backdoor cuts or from MLPs that no longer exist."

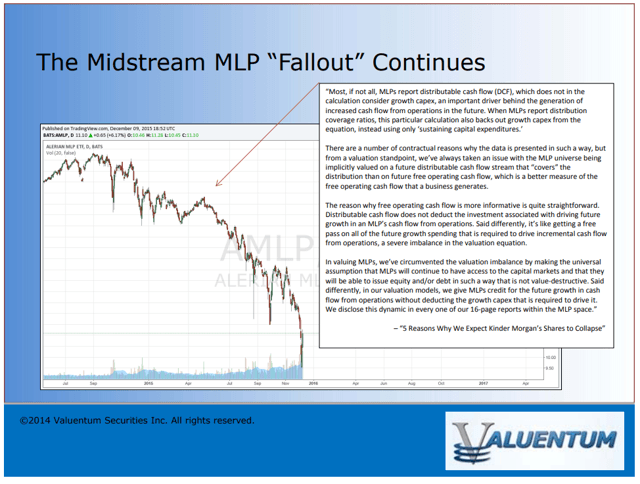

Image Source: Valuentum slide deck, December 2015. Valuentum released its bearish case on MLPs in June 2015.

Pipeline Companies Not Immune to Energy Resource Price Volatility

What many had believed about pipeline MLPs is that they were relatively immune to energy resource prices. While this may seem true at face value (given their toll road operations), it's not exactly right. During the fall in MLP prices in 2015 as energy resource prices collapsed, the market began to worry about the implications of the health of pipeline customers, particularly as the credit rating agencies took a hard look at re-rating the independent oil and gas space in the event of lower price decks. As growth prospects for the customers of pipeline equities waned, and as their financial health became a greater concern, many market participants began to come around that pipeline MLPs were implicitly tied to energy resource prices through the health of their customers, if not explicitly tied in certain cases with direct exposure.

This same dynamic is true today. Pipeline MLPs are largely tied to energy resource pricing through the health of their customer base, and this was on display more recently. Chesapeake Energy (CHK) reported abysmal third-quarter results November 5 that showed that total production fell 11% year-over-year, and lower realized natural gas prices and NGL prices contributed to more pain. Chesapeake Energy’s large debt load coupled with the lower energy resource prices are now raising worries about whether the firm will be able to continue to operate as a going concern; from the firm’s 10-Q:

Fluctuations in oil and natural gas prices have a material impact on our financial position, results of operations, cash flows and quantities of oil, natural gas and NGL reserves that may be economically produced. Historically, oil and natural gas prices have been volatile, and may be subject to wide fluctuations in the future. If continued depressed prices persist, combined with the scheduled reductions in the leverage ratio covenant, our ability to comply with the leverage ratio covenant during the next 12 months will be adversely affected which raises substantial doubt about our ability to continue as a going concern. Failure to comply with this covenant, if not waived, would result in an event of default under our Chesapeake revolving credit facility, the potential acceleration of outstanding debt thereunder and the potential foreclosure on the collateral securing such debt, and could cause a cross-default under our other outstanding indebtedness. We are actively pursuing with support from the Board of Directors a variety of transactions and cost-cutting measures, including but not limited to, reduction in corporate discretionary expenditures, refinancing transactions by us or our subsidiaries, capital exchange transactions, asset divestitures, reductions in capital expenditures by approximately 30% in 2020 and operational efficiencies. We believe it is probable that these measures, as we continue to implement them, will enable us to comply with our leverage ratio covenant.

Chesapeake Energy is now a penny stock, and we have doubts that the firm will be able to make it to the other side of the weakness without some serious shareholder dilution, if not a Chapter 11 filing that completely wipes the equity clean. This is worth repeating: in the event of a Chapter 11 filing, it is very likely that existing shareholders will get nothing. That said, the implications on pipeline MLPs as a result of Chesapeake’s weakness and potential reorganization or liquidation is not negligible. Two pipeline equities that are arguably most at risk are Crestwood Energy Partners (CEQP) and Williams (WMB), according to East Daley Capital. Kinder Morgan, Plains All American (PAA), and Energy Transfer (ET) also have some exposure.

Not only is Chesapeake Energy’s fundamental (and share price) weakness a stark reminder of just how exposed pipeline MLPs to energy resource pricing, the latest news shocking the energy MLP space is an AP report suggesting “that the FBI has launched a corruption investing into how Pennsylvania issued construction permits for the $3 billion Mariner East pipeline project.” This has sent shares of Energy Transfer tumbling. At this point, it is difficult to handicap any outcome of the investigation, but it certainly isn’t good news, with Energy Transfer selling off more than 5% during the trading session November 13. Investors continue to have to take a leap of faith to invest in some of the riskier pipeline players, in our view.

We Continue to Call for Improved Transparency

Investors have benefited from improved transparency as many pipeline operators have transitioned away from using the MLP business model to C-corps, and we continue to applaud this trend that has only accelerated the past few years. Convoluted MLP ownership structures continue to be discarded, and in evaluating C-corps, analysts are better able to assess intrinsic value based on "correct" valuation methods, namely the free-cash-flow-to-the-firm process (which considers all capital expenditures). One of the major issues that we identified during 2015, prior to the collapse in pipeline MLP prices, was that many investors were valuing the space excluding growth capital spending, as in the measure distributable cash flow, and others were just focusing on the distribution, which was not supported by free cash flow (FCF), or the traditional measure by which to assess dividend health. In 2015, the MLP business model was a "house of cards," and collapsing energy resource prices caused credit markets to tighten and external capital to dry up.

Had MLPs at the time disclosed free cash flow, instead of distributable cash flow, prominently in press releases, investors would have been able to make better decisions prior to the "crash." Instead, a bubble was created based on distributable cash flow measures and what we describe as financially-engineered distributions, and many investors got burned thinking that such distributions were supported by internal means, as most dividends are with respect to corporates. We maintain our view that pipeline operators that do not cover their distributions with traditional free cash flow (FCF) are capital-market dependent and operate at the whim of the health of the equity and credit markets. Here is a helpful graphic that Valuentum helped S&P Global put together recently that shows how Free Cash Flow (FCF) differs from Distributable Cash Flow (DCF), not to be confused with discounted cash flow, which goes by the same acronym.

Image Source: S&P Global

Please stop saying that pipeline MLP distributions are “safe.” Nothing in the stock market is “safe,” especially the distributions of a group that have experienced more than a 110+ cuts during the past few years. As has been the case during the fallout in energy in 2015, pipeline MLPs are exposed to volatile energy resource prices via the health of their customer bases, if not directly. Chesapeake has reminded investors of this.

Image: The Alerian MLP ETF (AMLP) has been absolutely pummeled since we soured on the space in June 2015.

We maintain our view that the MLP business model will eventually go the way of the dodo bird. We've already witnessed a tremendous reformation in the pipeline MLP space with C-corp transitions and distribution cuts, all of which we predicted many years ago. In fact, we pounded the table saying that this would happen.

We encourage the placement of free cash flow (FCF) next to distributable (DCF) cash flow in press releases, as Enterprise Products (EPD) has taken the lead in doing so. We hope that every MLP will follow. We maintain our view that with more transparency, investors win.

High Yield Dividend Newsletter Portfolio Implications

As it relates to the High Yield Dividend Newsletter portfolio, Enterprise Product Partners and Magellan Midstream Partners (MMP) are also home to quality assets and most importantly, have management teams that historically have made decisions equity holders can appreciate (MMP got rid of IDRs back in 2009; EPD's more recent capital expenditure commentary and focus on free cash flows is reassuring). Their cash flows are strong and their growth ambitions are reasonable, which is why they represent solid ways to generate consistent and sizable income streams. That being said (putting near-term tax considerations aside for a moment), equity holders in MMP and EPD would likely benefit from a C-corp conversion as they would then have a true say in the future decision making at both companies (which would likely see an even greater focus placed on free cash flows).

For instance, EPD continues to expand its petrochemical operations (plans to build another PDH facility in Mont Belvieu, Texas) at a time when investors would prefer to see its capital expenditures come down at a faster rate, and keeping in mind petrochemical operations do not generate real "fee-based" revenue streams. The financial performance of petrochemical operations are highly influenced by changes in market prices (for raw energy resources, namely natural gas liquids and natural gas, and changes in prices for the end products), and that's true for natural gas liquids processing revenue (under certain contracts) as well. If EPD was a C-corp, like Kinder Morgan or ONEOK (OKE), it would likely be forced to focus more so on free cash flows (which would involve scaling back its petrochemical growth strategy), and those free cash flows would then allow for net unit buybacks. EPD has been touting unit buybacks for a while now, but that's a questionable strategy when the firm is not consistently free cash flow positive and actively issuing out units to plug the gap.

Weak unit price action seen at Energy Transfer says it all. C-corp conversions are the best way to fix this, as better governance and real accountability (to equity holders) is required to keep the "Empire Building" mentality at bay. ET is a midstream MLP that, in our view, could justify a meaningfully higher intrinsic value...if it converted to a C-corp, got rid of its current management team, and focused on free cash flows to pay down its onerous debt burden. The company has some quality assets, but continues to generate negative headlines by pursuing growth projects at all costs (sometimes that works, i.e. the Bakken Pipeline, and sometimes that doesn't work, i.e. Mariner East 2/2X, the Rover Pipeline, the Revolution project, etc etc.), and those growth projects are likely destroying equity holder value at this point. Many investors view ET as home to some of the best midstream assets around, but dislike its spending habits and current management team.

We continue to be on high alert when it comes to MLPs, and that shouldn't be surprising to anyone. No changes to the High Yield Dividend Newsletter portfolio at this time.

Tickerized for holdings in the AMLP.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson and Callum Turcan do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment