A Key Inflection Point for Gilead Sciences

We have closely followed events at Gilead Sciences for signs of an inflection point as we have long felt the market is myopically focused on the Hepatitis C franchise instead of cash flows. Our decision to add the idea to the simulated Dividend Growth Newsletter portfolio and the simulated Best Ideas Newsletter portfolio has played out very well as the share price remains locked in an uptrend. We are updating our thesis following the recent conference call.

By Alexander J. Poulos

Looking Past HCV

Image Source: Gilead Sciences

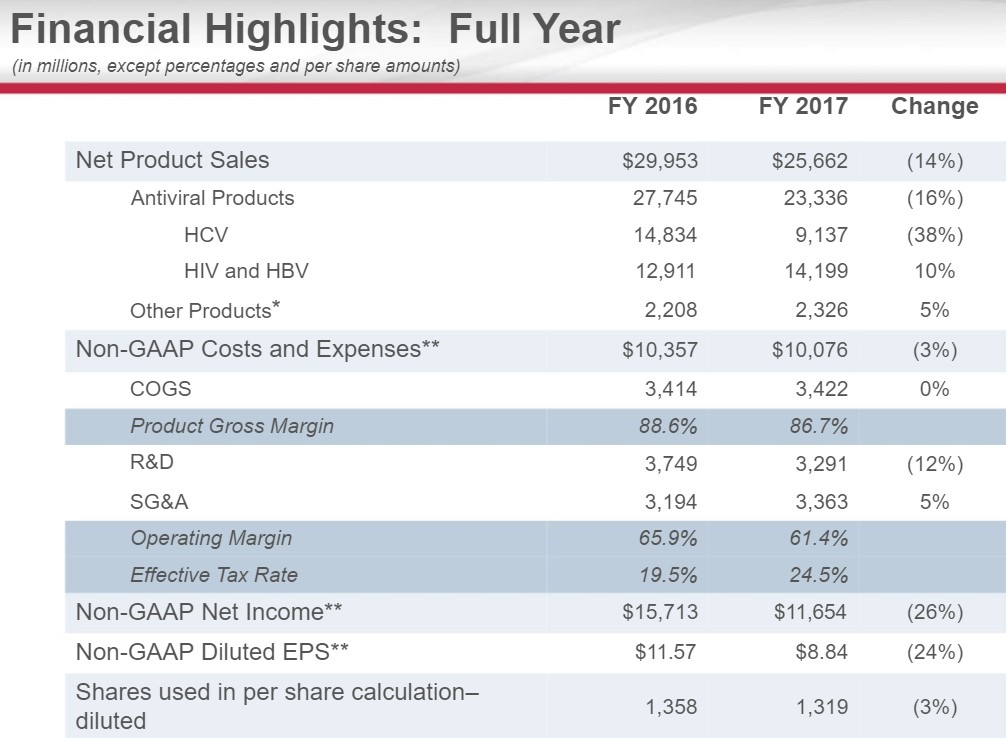

Lost in the cacophony of opinions on Gilead (GILD), we are amazed at the intense focus on the Hepatitis C franchise by the investment community. In our opinion, the HCV franchise remains the least mportant portion of the story as the franchise remains in terminal decline. As a brief primer, the product suite brought to market by Gilead and its competitors offers a functional cure for HCV in less than 12 weeks.

Just based on the dynamics of the treatment, each patient that begins the regime would inevitably cease to become a “customer” as the treatment would fix the ailment. Extrapolating this concept further, as the regime begins to work its way through the affected patient population, a dramatic decrease in overall numbers would begin. Thus, with a clear understanding of the dynamics at play, we feel the decline is to be expected.

Where opinions dramatically detour is over the very nature of the pharma/biotech complex. The entire complex is a creative one, similar in scale to the tech sector where constant innovation is needed. To allow research to thrive, a patent system is set where a quasi-legal monopoly is bestowed to the company that is willing to undertake the risk in funding the trials to prove the prospective compound works as intended with an acceptable side-effect profile. The industry remains fiercely competitive—using the HCV market as an example, AbbVie (ABBV) and Merck (MRK) have both attempted to disrupt Gilead’s lead in the HCV marketplace.

We are not-at-all-surprised that competition has entered the marketplace. Our opinion from the beginning remains that Gilead’s significant first-mover advantage would allow it to generate an enormous amount of free cash flow that would then be deployed into additional therapies (the Kite acquisition which bestowed in Gilead first-mover advantage in CAR-T therapies).

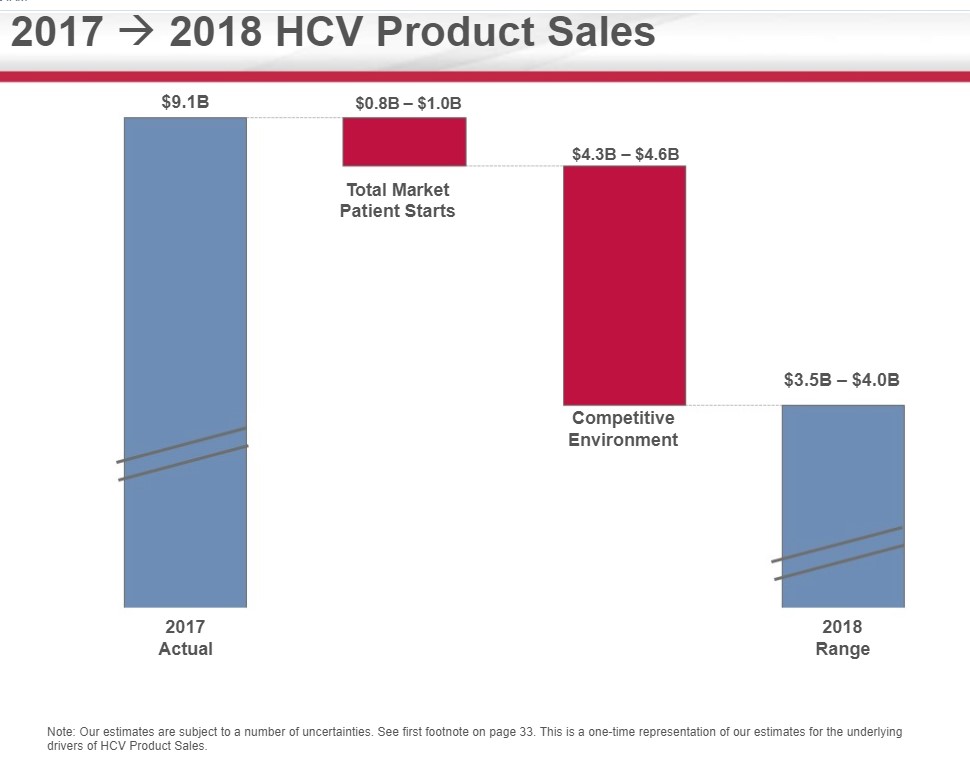

We highlighted in a very recent piece titled “Gilead Sciences HCV Revenue Guidance is the Star of the Show" the concept of a stable duopoly with the HCV franchise serving as an abundant source of free cash flow with minimal additional resources needed to sustain the franchise. The following quote from CEO John Milligan eloquently sums it up.

But as we enter 2018, we consider that the marketing -- the pricing has become stable. So for 2018 and beyond, we think the market prices will be stable. We think that the market share will be split between 2 companies, and we'll see how we battle out between ourselves and our competitor, AbbVie. And a more predictable but slightly declining patient flow into the future. So what this means for Gilead is HCV will be an important component of what we do. It will be a smaller component of what we do, and we think that the growth in our HIV and other businesses will be the main driver of what you'll see for Gilead going into the future.

Source: JP Morgan Jan 8th, 2018 conference

Gilead is issuing initial HCV guidance of $3.5 to $4 billion is sales for 2018, a sharp deceleration from 2017. The guidance is in line with Milligan’s statement of a competitive, but stable environment with the expectation that Gilead will cede market share to AbbVie. Gilead has issued overall revenue expectations in 2018 of between $20-$21 billion hence the HCV franchise is now directly responsible for less than 20% of overall revenues.

Image Source: Gilead Sciences

HIV Remains the Star of the Show

The core HIV franchise has now emerged from the shadow of HCV into the rightly deserved spotlight as the engine that powers Gilead forward. We remain in awe of the scientific talent directly involved in the HIV space. Gilead has constantly demonstrated its superior grasp of the subject matter by initially displacing far deeper-pocketed rivals by providing once-a- day dosing regiments into what was once one of the most complex dosing regiments around.

As an aside, compliance remains critical in maintaining a low to non-existent viral load, hence a confusing or demanding dosing regimen will often lead to missed doses and possible drug resistance developing. Gilead was at the vanguard of the industry by deploying once-a-day combination tablets, thus winning the hearts of patients by relieving them of the stress of managing the dosing regiment in addition to the wallets of payers who wisely viewed the simplification offers by one a day dosing would lead to superior clinical outcomes (it has).

The research-based field remains fiercely competitive with numerous entities vying to steal market share. Thus, Gilead cannot sit idly by basking in the glory of past accomplishments. Further innovation is needed to maintain and expand markets share, a task the team was up for by developing Tenofovir Alafenamide (TAF) to replace tenofovir disoproxil fumarate, which served as the original formulation of the product in its first-generation products. The clinical profile of TAF is intriguing as TAF is a prodrug which is far gentler on the kidneys while improving bone health. With the average of an HIV infected patient approaching 60, kidney function naturally begins to decline hence the need to develop treatments that would reduce the concentration of tenofovir in the plasma while maintaining clinical efficiency.

By introducing TAF into the marketplace, an ingenious segue is offered where new formulations of existing therapies can be concocted, thus maintaining and expanding the patent life of the overall HIV franchise. The results are evident as HIV sales grew at a 10% clip despite a new entrant by ViiV Health.

Not to be outdone, Gilead has won approval of a new triple-therapy that is poised to steal share from ViiV upstart challenge, thus strengthening Gilead’s dominance in HIV. The FDA has granted Biktarvy which is a combination of Bictegavir a novel integrase inhibitor along with therapy mainstays Descovy to form a powerful new approach to treat HIV. We suspect the triple therapy will prove to be better than the doublet provided by Viiv as many key opinion leaders have voiced concerns about the potential for resistance to form. We remain confident Gilead will maintain the upper hand in the HIV market for the foreseeable future, thus setting up a nice base of revenue. As promising as Gilead's position in HIV is, continued growth in this area may not be enough for the market to get excited.

For this, a new source of revenue may need to be brought forward.

Car-T

We feel the CAR-T therapies brought forth by Novartis (NVS) and Gilead Sciences are at the forefront of a new paradigm in treating oncology. The results posted thus far by the pair is far and away better than other conventional treatments that the FDA very wisely fast-tracked the process for approval. The promise of this unique therapy coupled with the deep-pockets of Novartis and Gilead is one of the primary reasons why both reside in the simulated newsletter portfolios. We feel it’s a true game changer.

However, progress will be slow as the process will need time for the infrastructure to develop and to be brought in-line. We are not focused on this year’s growth. Instead, we are more interested in additional data reads for label expansion in addition to more care centers being brought into the treatment network. We feel Gilead is in the pole position based on the initial label for its Car-T therapy (Yescarta) yet additional resources will need to be devoted to ensuring it stays this way.

Oncology powerhouse Celgene (CELG) has made an audacious (yet very late) splash by acquiring the remaining portion of Juno Therapeutics it did not own for $9 billion. We feel first mover advantage in this space is huge with high barriers to entry as switching costs will outway the meager cost savings expected to arise. We will continue to monitor events closely as Yescarta is a key portion of our bullish stance on Gilead.

Conclusion

Our initial attraction to Gilead Sciences remains the copious amounts of cash flow that Gilead continues to generate. As we enter 2018, we may be entering a key positive inflection point. There are always risk to the long term, but we think Gilead has a lot of things going for it. We still like it as an idea, but we're monitoring things closely.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent healthcare and biotech contributor Alexander J. Poulos is long Gilead Sciences and Merck. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.