The Quiet Analyst Speaks

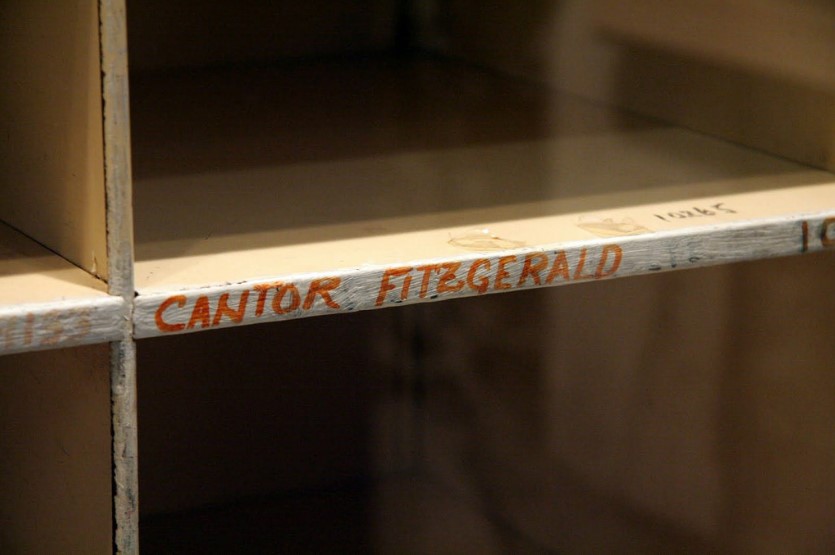

Image Description and Source: Mailslot for Cantor Fitzgerald, on the top floors of the WTC. The mailslot was located in a post office near the WTC site. The mailslots are with the Smithsonian Institution. Travis Wise.

It’s 9pm Sunday, September 11, 2016. The day is a somber one. The 15th year passing of the tragic events of 9/11 were on everyone’s minds, and I can’t help but think specifically of Cantor Fitzgerald.

The financial services company’s headquarters were on the 101st-105th floors of One World Trade Center, just a few floors above the impact zone of one of the hijacked airplanes. The firm lost 658 employees, over two thirds of its workforce, more than “any of the other World Trade Center tenants or the New York City Police Department, the Port Authority of New York and New Jersey Police Department, the New York City Fire Department, and the United States Department of Defense.” It’s possible that you never knew this – or perhaps you never heard of Cantor Fitzgerald. The company lives on though. I hope that you’ll never forget.

Though I am not your personal advisor, those that read our work know that I am quite personal and wear my heart on my sleeve. We’re a publishing company, but we don’t just publish anything. You know what I mean. How many times have you read somewhere else – “5 Reasons to Buy XYZ company” only to find another article shortly thereafter “5 Reasons to Sell XYZ company.” There is certainly something to be said about hearing both “sides of the story,” but the true value of investment research and analysis rests in the judgment behind the assessment. Media firms and content farms publish for the sake of publishing—they are after your eyeballs, not really helping you. They don’t know you.

I think our firm is different. When or if you decide to cancel your membership, it hurts. I care. I wonder what I could have done better, where our firm can improve, how I can better show the value we provide. When you ask us a question, we think about it, ponder and then respond. You get a response from an investment analyst, not a sales person or a news author, but someone schooled in financial statement analysis, investment research and beyond. When you have time, please look up what goes into attaining the chartered financial analyst (CFA) designation. Once you do, you’ll make this the bottom line requirement. Why not? The designation may reveal more about a commitment to excellence than anything else, and that’s incredibly important. It matters.

This is as difficult time as ever to be in the markets, and it’s even harder to be a financial professional. To me, the approach is always simple, but the aftermath isn’t always as welcome. If there is one thing that I stand for, it’s integrity. I won’t go over the tried-and-true investment picks we’ve made over the past few years that have saved investors big from Kinder Morgan (KMI) and beyond, but those that know me know that I say what I really think even if I know it’s going to hurt. Do I think I will sell more subscriptions by warning about a dividend growth bubble (the most popular investment strategy today), or talking about how consumer staples equities are trading at nosebleed levels (the most well-known stocks), or how the master limited partnership business model is incredibly vulnerable in the event of tightening credit (among the highest-yielding companies)? Of course not. Helping sometimes is painful. Very painful. But I’m no salesman. I’m here to provide you with the most valuable asset out there: independent, insightful, objective, informed opinion.

We don’t bat 1.000, but nobody does. Other content farms need thousands of contributors to cover the ground we do—and what good is it to have thoughts from thousands when they all have different processes and experience levels? You don’t know what you’re getting. There’s no consistency of quality – and what about the editors? Are they charter holders? How do they decide what’s good and what’s not and why? The Valuentum approach is systematic and grounded in financial theory (and not just the P/E ratio). It’s hard to explain, but we’re working to find the right answer--not just publish “everything.” It’s probably no wonder now why you don’t see rapid fire content on our website. It takes time to generate fantastic analytical content. On the other hand, it takes a couple hours to write a news story.

My goodness -- aren’t you tired of the headlines elsewhere, “50 Dividend Stocks Yielding Over 15%.” Or “The Best Stock in the World.” Or “The Best Investment Strategy Ever.” Or “Will the Stock Market Crash 50% or More?” It’s sad. Ugh. People actually click on these articles? And how about the financial professional that spends all of his or her time on Twitter? How can that be? Are they doing any research or analysis, or just parking their clients’ money in managed accounts and reaping the management fee, while prospecting for more elephants on social media platforms? This can't be what the financial industry is about...I hope it's not.

But what is going on in this business? Have dividend growth and loose monetary policy finally killed the equity analyst? If entities like Energy Transfer Equity (ETE), for example, can lever up 5, 6, 7 times and still have access to capital while paying a distribution, do fundamentals matter anymore? The answer...well...is “not really” – at least not in today’s market. With infinite access to capital at practically zero cost, companies can do whatever they want -- pay a dividend, raise it 10%, 20%, 50% -- what's to stop them? With infinite access to capital, there's no anchor to fundamentals. If you haven't already, you have to read the article we published, “Just How ‘Messed Up’ Is the MLP Structure” on our website when you have a chance. I show you how a company can generate billions in market capitalization via the MLP structure with nothing. Yes, that’s correct - nothing. Are MLPs dangerous? Do investors care? Well, only when the next fall out comes.

Let’s get up to date with a few things. The sell-side analysts covering MLPs are just drinking the Kool-Aid. They know how to calculate free cash flow -- they have to. After all, Exxon Mobil (XOM), ConocoPhillips (COP), and Chevron (CVX) all calculate free cash flow as some variant of cash flow from operations less all capital spending. But somehow analysts don't use this definition in the master limited partnership space? Look – just because you call something by a different name (an MLP) doesn’t make its economics any different. Its value is calculated the same way, as a function of the free cash flows accruing to shareholders. It’s laughable what’s going on in this business to make the yield merry-go-round continue. M&A is heating up in the energy MLP space now, too, with news of the Enbridge (ENB) and Spectra (SE) merger followed by rumors that Enterprise Partners (EPD) had been looking at Williams (WMB). The MLP business model will work until the credit markets no longer allow it to – that’s a difficult thing to handicap.

Let’s talk about Apple. You know the story well – the fantastic cash balance on the books, its huge free-cash-flow generating capacity, and lofty dividend, but are you focusing on the right things? I read a quick blurb from Wells Fargo that said that “while the iPhone 8 has potential to be a big cycle...it’s too early to invest.” Wait...what? It really doesn’t matter if this analyst is right or wrong, the framework is puzzling, and I'll just call it wrong. Are investors really trying to trade future product cycles? Don’t investors know that expectations about the future are already embedded in TODAY’s stock price? Don’t investors know that the present value of future free cash flows, which include future iterations of the iPhone, form the current fair value estimate of any company? There is nothing that is more hazardous than not having the right framework. Without the right framework, one can’t ask the “right” questions. You need to ask the right questions.

What about Priceline (PCLN)? The company is right back near a 52-week high. I can’t tell you how many questions I fielded on that stock when it fell below $1,000, and I kept saying that it was one of our best ideas. Oh – Intel (INTC) is in the new Apple iPhone 7 and 7 Plus – didn’t we tell you that many moons ago? The stock is bumping up against its 52-week high, too, even after a rough start to 2016. We’re watching General Motors (GM) after it was added to the Best Ideas Newsletter portfolio, and we may add to the position if it heads materially lower. Remember – we only inched into it. We consider a full position 5% at cost. Shares are trading at ~5 times forward earnings and yield ~5%. That’s an incredible bargain, especially in this frothy market.

Do you remember how many people were upset when we pulled out of Gilead (GILD) several months ago? It was our miscue to get involved in the first place, but swapping it out in favor of Johnson & Johnson (JNJ) was one of our best moves in the Best Ideas Newsletter portfolio. Gilead is now at ~$78 per share, and J&J is well above cost. How about shares of Alibaba (BABA)? The one-time favorite of ours is now ~$100 per share. We simply lost our stomach to hold it, and how can we possibly be upset? The Best Ideas Newsletter portfolio is at all-time highs? It's at all-time highs -- sorry, I had to say it again. But wow – Alibaba’s shares have been on fire as of late! We don’t pretend to get everything right, but we like social media darling Facebook (FB) in its place. Shares are now approaching ~$130 each, and we think the company is in all of the right places.

It’s hard to know what each and every one of you are thinking, what’s important to you, or how you interpret my thoughts and writing. I think you know that our newsletter portfolios house our best ideas – the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. But do you know that the screens on our website are just screens? They combine data – that’s it. They are not signed off by our analyst team as our ideas in the newsletter portfolios. In a great many cases, undervalued stocks may not be our best ideas for a number of reasons--business model risk, cash flow uncertainty, and the list could go on and on. You shouldn't be viewing our newsletter portfolios on an equal plane as that of our stock screens. One is for idea generation, while the other provides a grouping of stocks with similar characteristics.

Every single day our team works to earn your business. I value you. Please don’t treat us like a Netflix (NFLX) subscription. All of the content we publish is generated personally and passionately by our team – we’re not a content farm aggregating others’ content and generating a spread. One last thing -- I remember the dot-com bubble when everyone was saying the sky was the limit and threw caution to the wind. The sell-side got that one wrong, and the Global Settlement ensued. Don't get (too) caught up in the hoopla...valuations are stretched. But that doesn't mean our newsletter portfolios won't continue to outperform or that our next idea won't generate alpha. Always available for questions.

Kind regards,

Brian Nelson, CFA

President, Investment Research & Analysis