Order The Exclusive Today!

Already a member to the Exclusive publication? View the Exclusive website here.

Already a member to the Exclusive publication? View the Exclusive website here.

You Asked, We Answered: The Exclusive

From the Valuentum Team each month, receive three investing ideas for consideration (one for income, one for capital appreciation, and a "short" idea consideration), fully-laid out in thesis form.

Offer is limited to the first 1,000 Valuentum members. Reserve your spot today.

“The stock market is a no-called-strike game. You don’t have to swing at everything—you can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling, “Swing, you bum!” -- Warren Buffett

Hi everyone,

We can’t be more pleased with the reception we have received from the investment community the past 10+ years, and we continue to create products to meet various needs and requests.

What we have rolled out in The Exclusive publication may be one of our best features yet, and it’s purely incremental to your Silver or Gold membership. We understand some members may not find the newsletter portfolios helpful, and we know that the Valuentum Buying Index may not be their cup of tea either.

Warren Buffett is famous for saying, “The stock market is a no-called-strike game. You don’t have to swing at everything—you can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling, “Swing, you bum!” We’re never going to jeopardize our laser-focus on achieving the newsletter goals by adding idea after idea (just for the sake of doing so), but we know members still want new ideas – and they want the very best ones we can find at that! But we can't force ideas into a newsletter portfolio just for the sake of doing so.

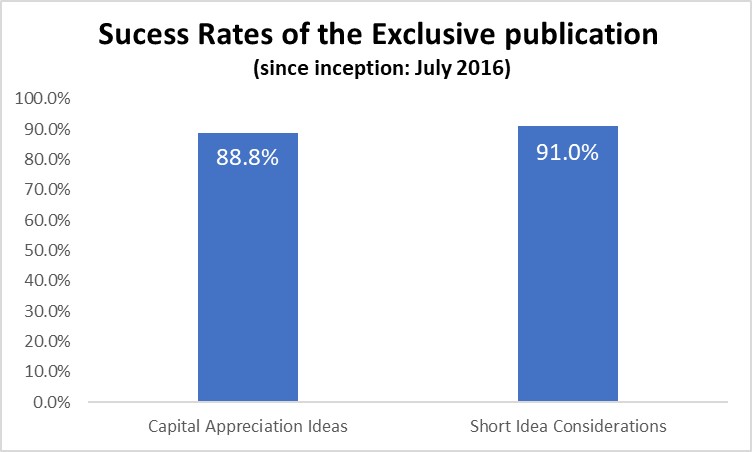

Image: The percentage of ideas highlighted in the Exclusive that have moved in the direction of our thesis (i.e. up for capital appreciation ideas and down for short idea considerations) through the current price or closed price, with consideration of cash and stock dividends. Success rates do not consider trading costs or tax implications. Data through December 8, 2023. Past results are not a guarantee of future performance.

So we're going to do one better. Having managed the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio to continued strong hypothetical returns* during the past decade or so, the Valuentum Team highlights in the monthly publication The Exclusive three new ideas each month to consider, one for income, one for capital appreciation, and a "short" idea consideration. Fresh, underfollowed and new ideas every month! Nothing will be held back.

$1,295/year. No refunds offered. Product will close after the first 1,000 members, so reserve your spot today. This is a recurring membership. Cancel anytime.

The Valuentum Team is available for any questions about this product and its features at info@valuentum.com. Thank you for your continued interest!

Key Features:

- Released monthly when the market is closed -- everyone is on an equal playing field. You'll have time to consider.

- Ideas are delivered to your inbox. Members for this publication are limited to 1,000. It's as exclusive as it gets.

- Time horizons are published for highlighted ideas. Follow ups of previous 'open' ideas in subsequent editions. Ideas are 'closed' within newsletter editions or by email notification. Performance tracked when ideas are 'closed,' and theses updated periodically on 'open' ideas, when deemed appropriate.

- Only "investable" ideas -- meaning no thinly-traded issues. Includes small caps and non-US/ADRs at times -- generally under-followed and overlooked investment opportunities!

- Only stocks outside Valuentum's existing coverage universe viewed outside the newsletter portfolio context. Product helps members sort through the thousands of other stocks not in Valuentum's existing coverage universe!

- Purely incremental to a Silver or Gold membership. No change to the high quality of service and analysis you've grown accustomed to. Independence and integrity remain our core. Investors first.

* The High Yield Dividend Newsletter, Best Ideas Newsletter portfolio, ESG Newsletter portfolio, and Dividend Growth Newsletter portfolio are not real money portfolios. Results are hypothetical and do not represent actual trading. The Valuentum Exclusive publication does not reflect real performance. Any performance is hypothetical, simulated, and does not represent actual trading.

--------------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.