Understanding Share Buybacks

Image Source: Mike Mozart

This article is for educational purposes only and may not reflect our updated opinion on any companies mentioned.

Rule of Thumb: If share buybacks are completed at a price level that is under a firm’s fair value estimate, the activity can be considered value-creating. If share buybacks are completed at a price level that is above a firm’s fair value estimate, they can be considered value-destroying.

By Brian Nelson, CFA

Share buybacks are not always a "good thing."

The general rule of thumb may be that share buybacks reveal that management believes its stock is underpriced and that the executive team thinks there may be no better investment opportunities out there with firm money than its very own company stock, but while this sounds good, it doesn't always mean that share repurchases will benefit stockholders, or even create value in the long run. The reality is that management teams seemingly almost always think their company's stock is undervalued (except maybe Netflix’s Reed Hastings?), and internal company projections that may estimate intrinsic value are subject to as much forecasting error and potential bias as any outside assessment.

A recent example of "stock buybacks gone wrong" is RadioShack (RSH), which in August 2010 went on a buying spree for its own shares, specifically announcing an accelerated share repurchase program August 23, 2010. The image below shows when the buybacks were announced at RadioShack, the red circle on the chart, and the subsequent stock performance though late 2013. RadioShack ended up filing for bankruptcy February 5, 2015, and then again in 2017. By most assessments, the company failed to reconnect with its customer base in the midst of increasing competition from more innovative and forward-leaning enterprises. In hindsight, it is clear RadioShack would have been better off keeping the money it spent on buybacks, and that is the point: not all buybacks are a positive sign and not all buybacks will generate value for shareholders (IBM is another example).

Image shown: Buybacks aren't always positive for shareholders. An image showing when RadioShack bought back its own stock, just a few short years prior to filing for bankruptcy.

With the idea that share buybacks are not always the best use of shareholder cash firmly established, let's address situations where management teams may get into trouble with traditional buyback analysis. Many market participants, for example, may believe that a stock will automatically be re-capitalized at a certain earnings multiple based on its forward earnings per share, which all else equal, will be enhanced as share buybacks are implemented. The thinking goes that a higher earnings per share number times (multiplied by) the same P/E multiple as before will equal a higher stock price than before. Unfortunately, this is generally not how value is created, and again, IBM (IBM) is yet another good example of this. IBM, for example, became so focused on achieving lofty operating earnings per share forecasts, augmented by share buybacks, that it lost sight of value-generation (the pursuit of high-ROIC projects relative to an estimated cost of capital).

Though there may be myriad reasons why market participants believe buybacks are generally always positive, such a view often comes down to investors overlooking one important source of value: the balance sheet. An understanding of the fundamental components of equity value, however, can help market participants determine whether share buybacks are value-creating (they add to the fair value of a company) or if they are value-destructive (they detract from the fair value of a company). Talking about the balance sheet with respect to buybacks, which seemingly only serve to enhance the earnings per share on the income statement, seems a bit off topic, but the balance sheet is a source of firm value, too, and that's where share buybacks are financed (either through cash already on the books, newly-issued debt, or internally-generated free cash flows). All else equal, a company with $100 billion in net cash is worth more than a company with $1 million in net cash. The takeaway is that not all components of intrinsic value rest on the income statement and can be appropriately captured by earnings per share.

If interested, please read more on how earnings per share, via the price-to-earnings ratio, is tied to enterprise free cash flow valuation, which considers a balance-sheet assessment here.

Understanding the Components of Equity Value

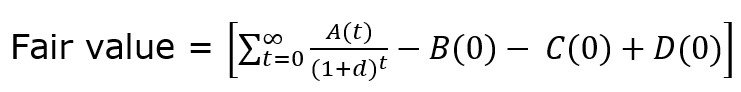

where A (t) is an Enterprise Free Cash Flow (1) at year t,

B (0) is a Total Debt at time 0,

C (0) is a Preferred Stock at time 0,

D (0) is a Total Cash at time 0,

d is Weighted Average Cost of Capital (WACC).

Notes: There are generally three primary sources of intrinsic value of a company. First, the company’s operating activities have value, as measured by the present value of all future enterprise free cash flows that are generated for all stakeholders of the business (debt holders, equity holders, etc), to the entire enterprise (A). Second, the company’s balance sheet can have value (D - B - C, in image above). For example, if a company has $1 billion in total cash and $500 million in total debt and no preferred stock outstanding, if the board should decide to shut down today, shareholders would be entitled to the net cash position, or $500 million ($1 billion less $500 million), adjusted for closing/unwinding expenses. Third, a company’s “hidden” assets such as an overfunded pension or an equity stake in another company that may not be accurately reflected in GAAP accounting statements can have value (this aspect is not included in formula above, but an expanded definition might include it).

An intrinsic value estimate of any non-financial equity (stock) is generally calculated as follows: the discounted future enterprise free cash flows to the firm (enterprise cash flow) are added to the company’s current balance-sheet net cash position, and that sum is divided by current shares outstanding. The result is an estimate of the firm’s fair value per share. Share buybacks influence the value equation as follows: shares are reduced by the number of shares repurchased and cash on the balance sheet is reduced by the cost of the share repurchase program (price paid per share multiplied by number of shares outstanding).

Shown below is Oracle’s (ORCL) equity value make-up as an example. Future free cash flows are calculated by our analysts. A look on page 84 of Oracle’s 10-K, in fiscal 2012, shows the company’s cash and cash equivalents ($14.96 billion) plus marketable securities ($15.72 billion) less its current notes payable ($2.95 billion) less its long-term notes payable ($13.52 billion), which equals the net balance sheet impact of $14.2 billion (fourth bar from the left). You’ll find Oracle’s shares outstanding in that same 10-k on page 85 (5.12 billion), which we use to arrive at the company’s fair value estimate per share.

Image Source: Valuentum

You’ll notice that we didn’t say future shares outstanding or future earnings per share in this case. Generally speaking, an intrinsic value estimate of a company considers its current net balance-sheet position and current shares outstanding. Within enterprise valuation, the company’s future outlook is captured via the entity’s discounted future enterprise free cash flows. In the valuation context, we therefore focus on evaluating the operating and investing dynamics (capex) of the company--share buybacks (and dividends) are financing activities--and spend most of our time thinking about the nature of a company’s future enterprise free cash flow stream (revenue, operating earnings, net income, working capital movements, capital expenditures). A company’s future earnings per share changes that are exclusively driven by future share buybacks (made at the fair value price) are theoretically already captured in the intrinsic value equation either with 1) today’s current balance-sheet net cash position or 2) future free cash flows to the firm. Only when share buybacks are completed at a price that differs from our estimate of the company’s intrinsic value would value-creation or value-destruction occur.

A modeling note: We view today’s cash on the balance sheet or future free cash flows to the firm as the only two sources of cash that can be used for future buybacks. Issuing debt in the future may be used for buybacks but that action alone is value-neutral: debt is increased by the amount cash is increased – therefore the net cash position on the balance sheet is unchanged. The subsequent share buybacks financed by newly-issued debt at a future date are assumed to be made at the fair value price – no change in value. Predicting when companies will issue new debt and at what price they may or may not buy back shares tends to be a highly speculative and aggressive valuation procedure, in our view, and we tend to avoid making such forecasts. That said, with newly-issued debt at a future date, there may be a change in the discount rate as a result of the new capital structure, but we typically reset our valuation with the new capital structure at that time, and only in material, transformative instances. We do not build in material capital structure changes in the model in future years as we again would view this as speculative and aggressive valuation procedure.

How Share Buybacks Impact Intrinsic Value

As you have read thus far, we’re generally not concerned with earnings per share in the out-years of our valuation approach as a result of a share buyback program. Instead, we focus on future operating earnings (or net income, or more specifically, earnings before interest) and the capital requirements of the entity (i.e. net new investment in arriving at an estimate of future free cash flows to the firm). We generally assume that future share buybacks to be completed at an unknown price in the future are fair-value neutral, what we consider to be a reasonable expectation, until the buybacks are completed. Key concepts thus far:

1) An intrinsic value estimate considers the balance sheet

2) Share buybacks impact earnings per share and the cash on the balance sheet

3) We assume future share buybacks are made at the fair-value price until they are completed

In the case where share buybacks are completed, there are a few things that happen:

--> Shares are reduced by the number of shares bought back

--> The amount of cash on the balance sheet is reduced by the number of shares bought back multiplied by the price per share

--> The resulting addition to the fair value estimate or detraction from the fair value estimate rests on which change is more powerful. Either:

a. the impact of the reduction of the number of shares has a smaller impact on the fair value estimate than the reduction in cash on the balance sheet

b. the impact of the reduction of the number of shares has a greater impact on the fair value estimate than the reduction in cash on the balance sheet

Let’s use a couple hypothetical examples to illustrate a value-creating buyback and a value-destroying buyback.

Hypothetical Value-Creating Buyback Scenario*

Per Oracle, above:

Sum of Discounted Future Free Cash Flows: 58,669 + 89,993 + 48,197 = $196.86 billion

Net Balance Sheet Impact: $14.2 billion

Total Equity Value: $211.06 billion

Shares Outstanding: 5.1 billion

Fair Value Estimate: $41.38 per share.

At the time of this original publishing, Oracle’s shares were trading at $33.15 per share. Let’s say, for illustration purposes, Oracle decides to use all of its net cash of $14.2 billion to buy back 0.428 billion shares. Here’s the new equity value make-up:

Sum of Discounted Future Free Cash Flows: 58,669 + 89,993 + 48,197 = $196.86 billion

Net Balance Sheet Impact: $0 billion

Total Equity Value: $196.86 billion

Shares Outstanding: 4.67 billion

Fair Value Estimate: $42.15 per share.

By buying back stock at the price levels outlined in this example, Oracle has theoretically created value. The company’s new fair value estimate is $42.15 (was $41.38). Though there is always the risk of fair-value estimation error, buying back stock would make sense in this situation.

Hypothetical Value-Destroying Buyback Scenario*

Let’s use Home Depot (HD) in this hypothetical example. Here’s the equity value make-up for the home improvement powerhouse:

Sum of Discounted Future Free Cash Flows: 28,121 + 49,482 + 28,513 = $106.1 billion

Net Balance Sheet Impact: -$8.3 billion

Total Equity Value: $97.81 billion

Shares Outstanding: 1.51 billion

Fair Value Estimate: $64.73 per share.

Let’s assume that Home Depot buys back $10 billion worth of stock at the price at the time of original publishing, at $76.14 per share. This action would reduce shares outstanding by 0.131. Here’s the new equity value make-up:

Sum of Discounted Future Free Cash Flows: 28,121 + 49,482 + 28,513 = $106.1 billion

Net Balance Sheet Impact: -$18.3 billion

Total Equity Value: $87.81 billion

Shares Outstanding: 1.379 billion

Fair Value Estimate: $63.67 per share.

In this case, by buying back stock at the price levels outlined in this example, Home Depot has theoretically destroyed value. The company’s new fair value estimate is $63.67 per share (was $64.73). Buying back stock, in this case, may not make much sense even though future earnings per share will increase, all else equal and assuming our fair value estimate is "correct."

* Both scenarios assume no change in a company’s weighted average cost of capital.

Valuentum’s Take

All told, we hope that we've explained why share buybacks may not always a good thing, and why only through a focus on the entire value composition can investors estimate whether share buybacks theoretically can create or destroy economic value. Rule of Thumb: If share buybacks are completed at a price level that is under a firm’s fair value estimate, the activity can be considered value-creating. If share buybacks are completed at a price level that is above a firm’s fair value estimate, they can be considered value-destroying. All of this comes with one big caveat, however: the estimate of the fair value relative to the price at which buybacks are completed must be directionally "correct."

We hope you enjoyed this piece!

<< What are the sources of cash from financing on the cash flow statement?

A version of this article appeared on our website October 28, 2013. This article is for educational purposes only and may not reflect our updated opinion on any companies mentioned. Please access the updated research for any company of interest.

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.