Member LoginDividend CushionValue Trap |

Keeping the Horse Before the Cart: Valuentum’s Economic Castle™ Rating

publication date: Jan 5, 2025

|

author/source: Brian Nelson, CFA

Image Source: Ian By Brian Nelson, CFA “In business, I look for economic castles protected by unbreachable moats.” – Warren Buffett In the world of investing, no other saying may be more widespread. The teachings of Berkshire Hathaway’s (BRK.A, BRK.B) Warren Buffett have become a favorite among individual investors, having been adopted by money-management firms and sell-side firms alike in order to better connect with their clients and readers who have been ‘under siege’ by the topic in recent years. The phrase ‘economic moat’ – or sustainable competitive advantage – has simply become ubiquitous in the investment world and perhaps has lost much of its significance and meaning along the way. Most management teams across the globe are now eager to tell you about their very own ‘economic moat,’ while almost every sell-side research firm will mention the moaty characteristics of a company’s division or the moaty characteristics of a firm’s enterprise. Flipping on CNBC for a couple hours will have a guest or two that says that his/her favorite idea “has a nice moat.” I, for one, love talking about Valuentum’s economic moat, too! Our firm has a variety of sustainable advantages, but we know that the real value of the firm is based on its future free cash flow stream and its net balance sheet (net cash position), and not based on my qualitative opinion of competitive advantages. The meaning behind the concept of an ‘economic moat’ has, for the lack of a better word, become meaningless. Until the time where stocks are priced by the size of their moat or in ‘number of moats,’ and not by the size of their future free cash flow stream or in a specific currency, an ‘economic moat’ assessment will never trump that of an in-depth cash-flow-derived valuation process. One of the early pioneers of the ‘economic moat’ concept is Michael Mauboussin, and his work at Credit Suisse in 2002 (1) has paved the way for widespread application of the medieval nomenclature across a broad swath of investment frameworks. Mauboussin states that sustainable value creation is rare and sustainable competitive advantages are even ‘more rare’ (given that a firm must perform not only better than its cost of capital but also better than its peer group to achieve both). The widely accepted view within the investment community is that at some point in the future, competitive forces will erode a firm’s competitive advantages and drive return on new invested capital (RONIC) to a company’s cost of capital (WACC). This very dynamic is embedded within the framework of the three-stage discounted cash-flow model we use at Valuentum, where we fade a company’s RONIC at the end of Stage I to its WACC at the end of Stage II. The concept of an economic moat – or sustainable competitive advantages – generally focuses purely on the sustainability and the duration of the competitive advantages that a firm possesses. The concept of an economic moat generally does not consider the cumulative sum of a firm’s potential future economic profit creation, but only that at some point in time in the future, a moaty company will continue to have an economic profit spread and a no-moat firm will not. Let’s examine the potential problem that might arise if one focuses only on companies that have economic moats, or sustainable and durable competitive advantages, and overlooks those with shorter-duration, high-magnitude economic profit spreads.

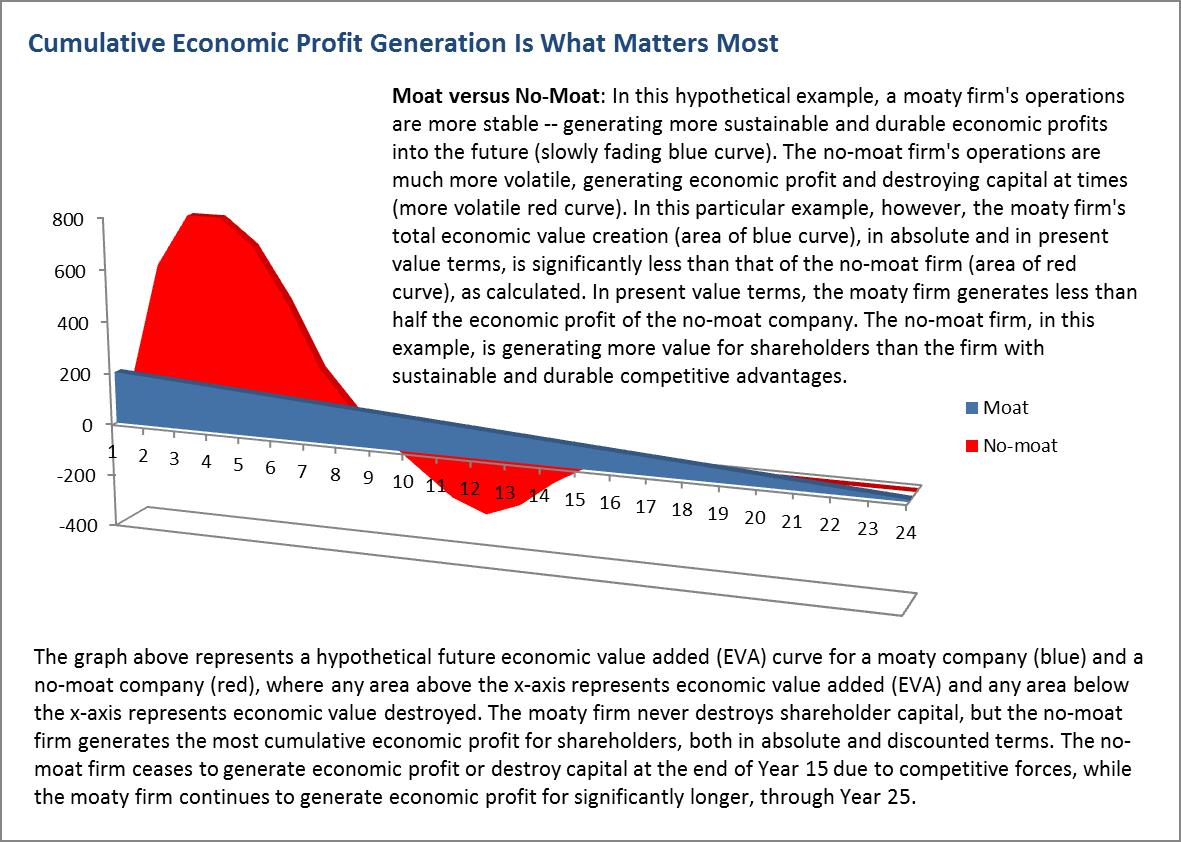

Image Source: Valuentum; EVA is trademarked by Stern Stewart & Co << Please take few moments to read through the information in the graph above. The notes have been reproduced in italics below. >> Moat versus No-Moat: In this hypothetical example, a moaty firm's operations are more stable -- generating more sustainable and durable economic profits into the future (slowly fading blue curve). The no-moat firm's operations are much more volatile, generating economic profit and destroying capital at times (more volatile red curve). In this particular example, however, the moaty firm's total economic value creation (area of blue curve), in absolute and in present value terms, is significantly less than that of the no-moat firm (area of red curve), as calculated. In present value terms, the moaty firm generates less than half the economic profit of the no-moat company. The no-moat firm, in this example, is generating more value for shareholders than the firm with sustainable and durable competitive advantages. The graph above represents a hypothetical future economic value added curve for a moaty company (blue) and a no-moat company (red), where any area above the x-axis represents economic value added and any area below the x-axis represents economic value destroyed. The moaty firm never destroys shareholder capital, but the no-moat firm generates the most cumulative economic profit for shareholders, both in absolute and discounted terms. The no-moat firm ceases to generate economic profit or destroy capital at the end of Year 15 due to competitive forces, while the moaty firm continues to generate economic profit for significantly longer, through Year 25. The potential problem with using solely an economic moat framework to assess businesses becomes readily apparent in the above example. Though moaty firms are durable and sustainable businesses, they may not be the best value-generators for shareholders. To business owners, this issue is very clear. Business owners want to maximize shareholder value – and a firm’s competitive advantage assessment at times may be independent of that view. Business owners want to generate the most economic value. The trajectory of a company’s economic value creation (or the blue and red areas in the graph above) is not equivalent to the trajectory of a firm’s stock price. A firm’s valuation, which is used to identify stock mispricings, already embeds the future economic value creation, as it is a function of ‘earnings before interest,’ which itself is the primary driver behind future free cash flows to the firm (enterprise cash flows) – or that which we use in our valuation framework at Valuentum. Said differently, the above graph shows pure economic value-creation, or in other words, the spread between a firm’s return on invested capital and its cost of capital. It’s possible, though unlikely, that the stock price volatility of the no-moat stock above can be less than that of the moaty stock. I say this to drive home the differences between stock price volatility, which is based on expectations revisions, and economic profit volatility, which is based on fundamental business dynamics. Regarding a moaty firm’s or a no-moat firm’s stock price, if the firm is fairly valued, the stock may already reflect its respective forecasted economic profit trajectory. As Moubaussin puts it in his paper, under a scenario where the equity is fairly priced, investors should expect a risk-adjusted market return. The value of fairly-priced moaty stocks, which tend to be less risky, may advance at a lower annual pace than the value of fairly-priced no-moat stocks due in part to the lower risk-adjusted discount rate applied to their respective future free cash flow stream. Generally speaking, a firm’s intrinsic value may advance at the annual pace of its corresponding discount rate less its dividend yield. Since moaty firms generally have lower discount rates and pay dividends, the pace at which their fair values increase in any given year will trail that of a no-moat firm, assuming the future forecasts are accurate. Intrinsic value estimates are never static. What we are after as investors, as Moubassin states in his paper, is anticipating revisions in expectations of financial performance. Is a no-moat’s economic value trajectory correctly priced in? Is a wide moat’s economic value trajectory overvalued? Is a no-moat firm’s economic value trajectory undervalued? The economic moat concept is less important to the valuation and global investment framework than the actual future economic value stream of each individual company. In Valuentum parlance, this means that we’re looking for companies in the global investment universe that have mispriced future economic value streams (i.e. stocks that are underpriced relative to their discounted future free cash flows and net balance sheet impacts) and are just starting to have their ‘expectations revised’ by market participants (i.e. their equities are just starting to be purchased). We call these stocks Valuentum stocks – underpriced stocks that are just starting to go up. Let’s take a look at a few examples to further illustrate the importance of cumulative economic value versus the sustainability and duration of economic value. Without question, railroads are fantastic businesses. North American railroads operate as an oligopoly, benefit from substantial barriers to entry, and boast significant pricing power – all good things. The group’s returns on invested capital won’t be but a few percentage points greater than their cost of capital at any point in time, but absent any abnormal shocks to the business, the railroad group will likely add a modest amount of economic value year after year – also a good thing. The economic value in this case represents the value the business generates via its economic profit spread (ROIC less WACC) and differs from the pace at which a company’s fair value will increase, which on an annual basis is a function of its discount rate less its dividend yield. Let’s use the ‘Return on Invested Capital’ graph from Union Pacific’s (UNP) 16-page research report (page 2) to illustrate the concept of sustainability and duration of future economic value creation:

Image Source: Union Pacific’s 16-page report (archived) As the chart above shows, we expect Union Pacific to continue generating economic value (ROIC less WACC) for shareholders for the foreseeable future. In fact, if we were to extend this chart over the next couple decades, the railroad’s economic value trajectory may look a lot like the hypothetical example we used previously (the steadily declining blue line). Union Pacific is a strong company – it had been a Best Ideas Newsletter portfolio holding – but will such a moaty railroad ever generate as much value as another firm like Apple (AAPL), for example? The answer to us is clearly ‘no.’ Apple’s ‘Return on Invested Capital’ graph from its 16-page report (page 2) shows a significantly larger economic value spread. It can be reasonably argued that Apple will generate more economic value for shareholders in the next 5 years than Union Pacific will for the remainder of its corporate life. This is a key concept to understand. The magnitude of Apple’s economic profit spread over the next five years alone may be a few hundred times that which Union Pacific will ever generate, and this excludes a time value of money adjustment. The sustainability and duration of Apple’s and Union Pacific’s future economic profit spread is less important than the cumulative economic value that each firm delivers to shareholders. Business owners want the most economic value.

Image Source: Apple’s 16-page report (archived) Enter Valuentum’s Economic Castle™ Rating The sustainability and duration of a firm’s economic value creation – or its competitive advantage period – tells us little about a company’s economic castle, or the magnitude of the value creation that it is expected to deliver to shareholders. Though a focus on economic moats is important to Warren Buffett’s process, identifying “economic castles,” or those that will deliver the most value to shareholders may be equally, if not, more important to an investor’s process. We are keeping the horse before the cart. Valuentum’s Economic Castle™ rating assumes that ‘economic profit’ (as measured by ROIC less WACC) is the primary factor in assessing the value that a company generates for shareholders. Whereas an economic moat assessment evaluates a firm on the basis of the sustainability and durability of its economic value creation stream, Valuentum’s Economic Castle™ rating evaluates a firm on the basis of the magnitude of the economic profit that it will deliver to shareholders (as measured by its ROIC-less-WACC spread). Firms with the best Valuentum Economic Castle™ ratings are poised to generate the most economic value for shareholders, regardless of their competitive positions. Valuentum’s Economic Castle™ rating is based on two considerations: 1) the framework behind Valuentum’s proprietary ValueCreation™ rating: ValueCreation indicates the firm's historical track record in creating economic value for shareholders, taking the average difference between ROIC (without goodwill) and the firm's estimated WACC during the past three years. The firm's performance is measured along the scale of EXCELLENT, GOOD, POOR, and VERY POOR. Those firms with EXCELLENT ratings have a demonstrated track record of creating economic value, while those that register a VERY POOR mark have been destroying economic value. The ValueCreation rating can be found on the second page of each company’s 16-page report. 2) a forward-looking assessment of a firm’s expected economic returns over the immediate five-year period. Our view is that the most economic value for the largest value-contributors will be generated over the immediate forward five-year period. These returns are not weighed down by the compounding dynamics of a discount rate and are not nearly as exposed to the forecasting error that occurs in later stages within any modeling framework. A firm that is generating an economic profit spread of 100 or so percentage points may generate more value for shareholders over a shorter time period than one that generates 1 or 2 percentage points each year for decades into the future. Examples of Highly-Rated Economic Castles™ Highly-rated Economic Castles™ can be underpriced, fairly-priced, or overpriced. Though the economic value framework and the discounted cash-flow framework are interdependent and correlated, the Valuentum Economic Castle™ rating is independent of a firm’s price-to-fair value assessment. The rating considers the magnitude of the economic value that a firm will generate for shareholders (as measured by the ROIC-less-WACC spread), in the same light that the concept of an economic moat considers only the sustainability and durability of a firm’s economic profit spread. Here are a few examples, with data as of the original publishing of this article. Apple (AAPL) – ValueCreation rating: EXCELLENT – Economic Profit Spread, 5-year projected average: 192.6 percentage points. Domino’s Pizza (DPZ) – ValueCreation rating: EXCELLENT – Economic Profit Spread, 5-year projected average: 260.3 percentage points. Microsoft (MSFT) – ValueCreation rating: EXCELLENT – Economic Profit Spread, 5-year projected average: 79.8 percentage points. MasterCard (MA) – ValueCreation rating: EXCELLENT – Economic Profit Spread, 5-year projected average: 73.1 percentage points. Google (GOOG) – ValueCreation rating: EXCELLENT – Economic Profit Spread, 5-year projected average: 69.4 percentage points. We think the Economic Castle™ rating is a valuable tool for the individual investor and financial advisor. We plan to use the Economic Castle™ rating as a core component of our equity research methodology. Members may see it in articles about firms, and we plan to release a periodic publication that covers firms that generate the highest Economic Castle™ ratings in our coverage universe. (1) Measuring the Moat, CSFB, Michael J Mauboussin, Kristen Bartholdson EVA is trademarked by Stern Stewart & Co. ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

This article first appeared on our website May 7, 2014. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |