Member LoginDividend CushionValue Trap |

How Do We Use the Valuentum Buying Index?

publication date: Nov 27, 2023

|

author/source: Valuentum Editorial Staff

By Brian Nelson, CFA

Hi everyone,

Hope you are doing great!

We often receive questions about how we use the Valuentum Buying Index (VBI) rating system, one of the key metrics we use to source ideas for our members, but we think it is equally important to mention up front that the VBI is only one of the many facets of our website and services. For example, if you haven't checked out the Dividend Cushion ratios on the stocks in your portfolio or the dividend growth product (from individual reports to the newsletter and beyond), surely you are not maximizing your membership! Don't forget about the Economic Castle rating, High Yield Dividend Newsletter, and the Valuentum Exclusive publication, too. ---

No matter your strategy or process though (it is not for us to say what is best for you), the Valuentum Buying Index rating system is still a helpful tool to have at your disposal given all of the important information that is embedded within it. We'll talk more about the bells and whistles of the VBI later in this article. It's also worth noting that the VBI, as we call it, is not as easy to interpret as other processes because it is not designed as a stair-step methodology (e.g. 1, 2, 3). In fact, VBI ratings can move around quite a bit upon each report update.

---

The VBI is also not as simple as "buying" 9s and 10s and "selling" 1s and 2s because the VBI is used in conjunction with a variety of other considerations (e.g. portfolio diversification, sector tilts, business model evaluations, balance sheet assessments) to build the newsletter portfolios. Readers shouldn't view the VBI in isolation on any individual company either, but rather assess the application of the VBI methodology and our processes holistically within the simulated newsletter portfolios.

---

For example, during 2022, Meta Platforms (META) and PayPal (PYPL) were two calls that didn't work out well during 2022, but the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio still carved out relative outperformance during the year. We credit this relative outperformance during challenging times to the VBI methodology, but also to other tenets, not the least of which is the importance of diversification and generally holding no less than 15-20 securities in the simulated newsletter portfolios.

---

Stock selection, however, will always remain critical to relative outperformance, in our view.

---

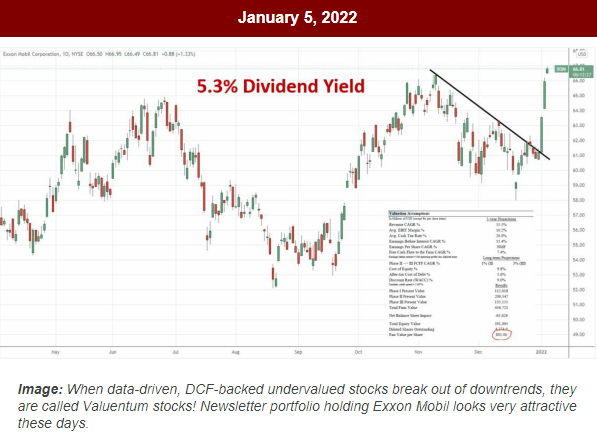

Exxon Mobil (XOM), for example, became the quintessential Valuentum stock during 2022--and this call was huge because we have traditionally steered clear of energy equities given their ties to volatile and largely unpredictable commodity prices. At the close on January 5, 2022 (the time of our email to members), Exxon Mobil was trading at ~$67 per share, and by the time it was removed from the newsletter portfolios on March 13, 2023, shares were trading at ~$106 each. The following link is the email notification we sent to members about Exxon Mobil on January 5, 2022, a view that was informed by the tenets of the VBI: "ALERT: XOM Is A Valuentum Stock with A Hefty Dividend Yield!"

----

We absolutely pounded the table on this Valuentum stock, and it soared during 2022!

Image: We highlighted Exxon Mobil to start 2022, and the stock was one of the best performers in the S&P 500 last year. Exxon Mobil became a “Valuentum” stock last year, with shares being undervalued, exhibiting a strong technical breakout, and sporting an attractive dividend yield to boot. The stock became a huge winner. Note: Exxon is no longer included in the simulated newsletter portfolios. The image is an excerpt from an email sent to members January 5, 2022.

---

The Valuentum Buying Index Has Checks and Balances

---

With prudence and care, the Valuentum Buying Index process and its components are carried out. Our analyst team spends most of its time thinking about the intrinsic value of companies within the context of a discounted cash-flow model and evaluating the risk profile of a company's revenue model. We have checks and balances, too. First, we use a fair value range in our valuation approach as we embrace the very important concept that value is a range and not a point estimate. A relative value overlay as the second pillar helps to add conviction in the discounted cash-flow process, while a technical and momentum overlay seeks to provide confirmation in all of the valuation work. There's a lot happening behind the scenes even before a VBI rating is published, but it will always be just one factor to consider.

---

Within any process, of course, we value the human, qualitative overlay, which captures a wealth of experience and common sense. We strive to surface our best ideas for members, and flying blind is never a good strategy, in our opinion. In probably one of the most obvious cases, for example, an experienced investor knows when a price-to-earnings (P/E) ratio isn't informative (as in the case of negative or negligible earnings), but a quantitative rating system that uses a P/E ratio may not know any better. That's why the VBI has checks and balances and focuses on the discounted cash-flow process first and foremost, but the human, qualitative overlay is still extremely important, especially when considering various business models and unique "un-modelable" risks (e.g. a run on the bank). In our opinion, a golf club is only as good as the player that uses it, and in a similar light, a financial model or a rating system is only as good as the user that applies it.

---

To assess the effectiveness of our methodological processes, we periodically measure the simulated newsletter portfolio returns over time, which represent important data points that shed light on the efficacy of all the work we do on the website and beyond. The ideas in the portfolios in the Best Ideas Newsletter and Dividend Growth Newsletter, for example, are among some of our best ideas and have been selected by our analyst team for consideration in such newsletter portfolios. The thoughts behind the weighting of each idea and the portfolio management process revealed in full transparency on a month to month basis is a very important part of our processes, too. It is far more important to us to have pounded the table on then-newsletter portfolio idea Exxon Mobil in early 2022, for example, than nail the VBI performance on a name that is not included in any of the newsletter portfolios.

---

The Valuentum Buying Index Is One of Many Important Factors to Consider

---

Let's talk about how the VBI helps to inform which ideas we include in one of the newsletter portfolios, the Best Ideas Newsletter portfolio. This is where some clarification is probably important for new members. For one, the word choice is critical, "inform," because the VBI is generally just one of many factors that go into whether we add a company to the Best Ideas Newsletter portfolio, even as we say that the VBI is one of the most important factors. Including at least 15-20+ securities in any newsletter portfolio, and seeking out ideas that have strong cash-based sources of intrinsic value (e.g. net cash on the balance sheet and future expected free cash flow) are two other very important considerations, for example.

---

Second, the timing element or duration concept is a key consideration in our processes, too. We've noticed via our studies that momentum can be much more pronounced (powerful) over longer periods of time. This was one of the interesting findings of our academic white paper study (2012). We try to consider this dynamic with the update cycle of our reports (and the time horizon for ideas to work out). That's why our reports are updated regularly (every 3-12+ months) or after material events and not daily, weekly, or even monthly. Perhaps most practically though, we don't think portfolio churn is the way to generate relative outperformance. Momentum may be high turnover, but Valuentum is low turnover. We don't want to interrupt compounding, unnecessarily, either.

---

Though the time frame varies depending on each idea that we consider for the Best Ideas Newsletter portfolio, we would expect many of our best ideas to generally work out over a 12-24+ month time horizon (on average). Not all ideas will be successful, however. Our "holding period" is targeted to be much, much longer for some ideas in the Dividend Growth Newsletter portfolio, as income and dividend growth are other key factors (in addition to the Valuentum Buying Index and capital appreciation potential). Typically, income is needed consistently over time, while dividend growth often takes years to build.

---

The time horizon or duration concept is where the Valuentum Buying Index rating system becomes more complicated than a simple 1, 2, 3 process. For example, we tend to "add" stocks to the Best Ideas Newsletter portfolio when they register a 9 or 10 on the Valuentum Buying Index (VBI), "hold" them for some time depending on a number of variables (the VBI, market conditions, sector weightings within the portfolio itself), and then we tend to "remove" stocks from our Best Ideas Newsletter portfolio when they register a 1 or 2 on the VBI.

---

It's important to reiterate that we have a qualitative overlay for the Best Ideas Newsletter portfolio (and one for the Dividend Growth Newsletter portfolio, too, based on dividend-related considerations). For example, we generally shy away from banking entities and other capital-market dependent stocks that require external funding to sustain their businesses as well as any payouts to their investors.

---

Image shown for informational/illustration purposes only. Valuentum is an investment research publishing company. --- But why don't we update the same report every day and make a lot of small, frequent changes to the newsletter portfolios? Well, discounted cash-flow-derived fair value estimates shouldn't change that frequently, for one, and obviously, we don't think lots of turnover is the secret to investment success either. In quite the opposite approach, we strive to maximize profits on every idea in the newsletter portfolios that we pursue, with the understanding that momentum does exist and that prices over and under shoot intrinsic value all of the time. ---

For example, as shown in the image above, a value strategy (10 --> 5) truncates potential profits, while a momentum strategy (4 --> 1) ignores profits generated via value assessments. At Valuentum, we're after the entire profit potential of each idea. So, for example, if an idea is added to the Best Ideas Newsletter portfolio as a 10 and is removed as a 5, we would have truncated profit potential by not letting it run to lower ratings.

---

Most of the highly-rated Valuentum Buying Index rated stocks have generated a large portion of the strength of the Best Ideas Newsletter portfolio since its inception, but these stocks' ratings have also declined over time as they were held in the newsletter portfolio (a good thing -- a declining VBI rating generally means the share price has advanced, assuming all else is well).

---

Image shown for informational/illustration purposes only. Valuentum is an investment research publishing company. --- Not All Highly-Rated Stocks Are Added to the Newsletter Portfolios

---

Regarding the Valuentum process, as it is executed in the Best Ideas Newsletter portfolio, we do not "add" all stocks that register a 9 or 10, nor do we add the ones we do immediately thereafter. For example, when Google (GOOG, GOOGL), now Alphabet, a current Best Ideas Newsletter portfolio "holding," registered a 10 on the Valuentum Buying Index, we remained patient and didn't "add" the company to our portfolio until after it reported earnings at the time, providing us with an even better "entry point" (as new information came to light).

---

There are more "structural/timing" instances like the one with Alphabet, for example, that are extremely difficult to capture in any model, and understandably aren't as obvious to those outside looking in. Macroeconomic, broader market valuation, exogenous risks such as geopoitical dynamics, and sector weighting considerations are other factors that impact the qualitative portfolio management process. There are also certain stocks such as airlines and mortgage REITs that we'll never be interested in and won't ever find their way into the newsletter portfolios. Another recent example is Alibaba (BABA), which registered a 9 on the VBI, but we didn't add it to any newsletter portfolio given the heightened geopolitical tensions between the U.S. and China, among other risks.

---

But why not add every highly-rated stock on the Valuentum Buying Index to the Best Ideas Newsletter portfolio? Well, think of it as if you were to imagine a value investor not adding and holding every low P/E stock to his/her portfolio. They want the very best "value" stocks, in their opinion. That means having to leave some good ideas behind. Then, of course, there are always tactical and sector weighting considerations in any portfolio construction, yet another reason why the human touch remains a vital aspect of the Valuentum process.

---

At the core of how we use the VBI in the Best Ideas Newsletter portfolio is a qualitative portfolio management overlay. The VBI rating helps to inform the process, but the Valuentum team makes the allocation decisions of the newsletter portfolios on the basis of a number of other firm-specific and portfolio criteria. Sometimes, under certain market conditions, we may even have to relax the VBI criteria entirely in order to do what we think is required to achieve newsletter portfolio goals.

---

Some Examples of the Valuentum Buying Index In Action

---

Some straightforward opportunities in the Best Ideas Newsletter portfolio during the past decade or so were EDAC Tech, which tripled since it was added to the newsletter portfolio (never registering below a 9 along the way), and then of course, there have been Apple (APPL) and Visa (V), which have been great performers, among others.

---

Not to be overlooked either, the Valuentum Buying Index rating also informs us when we may consider "removing" an idea from the newsletter portfolios. Kinder Morgan (KMI), for example, registered a 1 on the Valuentum Buying Index just prior to its notorious fall and dividend cut. The VBI ratings on each stock's most recent 16-page report, downloadable directly from the website at www.valuentum.com, reflect our current opinion on the company.

---

In all, the Valuentum Buying Index rating system, as with all methodologies, helps to inform the investment decision process, but in constructing the simulated newsletter portfolios, a qualitative overlay is not only necessary, in our view, but has helped to optimize performance. We hope you learn more about Valuentum's processes in this article, and of course, please always contact your personal financial advisor to determine if any idea or strategy may be right for you.

---

Thank you so much for reading!

---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Tickerized for various high-profile companies and securities. A version of this article was originally published in August 2012. Actual results may differ from simulated information being presented. The High Yield Dividend Newsletter portfolio, Best Ideas Newsletter portfolio, ESG Newsletter portfolio, and Dividend Growth Newsletter portfolio are not real money portfolios. Results, including those in the Exclusive publication and our additional options commentary, are hypothetical and do not represent actual trading. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

How Do We Use the Valuentum Buying Index (VBI)?

How Do We Use the Valuentum Buying Index (VBI)?